The global grey hydrogen market was valued at US$ 147.4 Bn in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2035, reaching approximately US$ 222.2 Bn by the end of 2035. Despite increasing attention on green and blue hydrogen, grey hydrogen continues to dominate global supply due to its cost advantages, mature infrastructure, and strong industrial demand.

Why Grey Hydrogen Still Matters

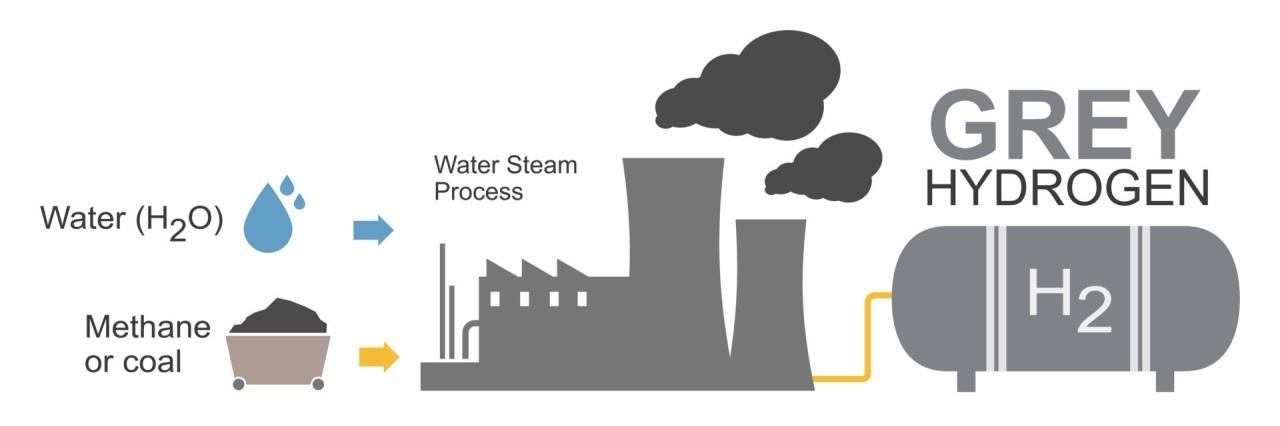

Grey hydrogen is produced primarily through steam methane reforming (SMR) or coal gasification. In this process, hydrogen is extracted from natural gas or coal, and carbon dioxide (CO₂) emissions are released into the atmosphere without capture. While carbon-intensive, grey hydrogen remains the most economical and scalable production pathway today.

Analysts suggest that market momentum is less about new plant construction and more about managing transitional dynamics. Established producers are optimizing existing SMR assets, signing long-term offtake agreements, and selectively investing in carbon capture retrofits to extend asset lifecycles. Grey hydrogen, therefore, acts as a cost anchor in the evolving hydrogen economy.

Market Drivers: Cost and Infrastructure Advantage

One of the primary drivers of the grey hydrogen market is its cost competitiveness. Natural gas-based SMR technology has been commercially deployed for decades and benefits from economies of scale. Feedstock availability, especially in gas-rich regions, ensures relatively low production costs compared to green hydrogen, which depends on renewable electricity and electrolysis.

Additionally, decades of infrastructure development—pipelines, storage facilities, refineries, and chemical plants—have embedded grey hydrogen deeply within industrial supply chains. Industries relying on hydrogen for continuous, high-volume operations prefer stable and predictable supply. Transitioning to alternative hydrogen sources would require substantial capital investment and operational restructuring, creating switching barriers.

In many developing economies, where renewable energy capacity and carbon capture systems are still limited, grey hydrogen offers an immediate and scalable solution to meet industrial hydrogen demand.

Download Sample PDF Copy Now: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85481

Industrial Dependency Sustains Demand

Industrial sectors remain the backbone of grey hydrogen consumption. The petroleum refining industry uses hydrogen in hydrotreating and hydrocracking to remove sulfur and produce cleaner fuels. The global fertilizer industry depends on hydrogen for ammonia production, which is critical for food security. Methanol manufacturing and steelmaking also require consistent hydrogen supply.

Asia Pacific leads global grey hydrogen demand, accounting for 46.5% of the market. Rapid industrialization in China, India, and Southeast Asia, coupled with coal gasification and natural gas-based production capacity, drives regional dominance. North America follows, supported by abundant shale gas resources and well-established SMR infrastructure.

Natural Gas: The Dominant Source

Among production pathways, natural gas-based SMR remains the most prominent source segment. Extensive natural gas reserves, competitive feedstock pricing, and vertically integrated supply chains strengthen this segment’s position. Industrial clusters in North America, Europe, and the Middle East benefit from efficient gas extraction, transportation, and hydrogen distribution networks.

Coal-based hydrogen production also plays a major role in China, where coal resources are abundant and integrated into industrial policy frameworks.

Strategic Shifts by Industry Leaders

Leading companies such as Air Liquide, Linde plc, Air Products and Chemicals, Inc., and Sinopec Corp operate large-scale SMR and coal gasification facilities globally.

These firms are increasingly adopting a dual strategy: monetizing existing grey hydrogen assets while investing in blue and green hydrogen projects. For example, Air Products has partnered with Exxon Mobil Corporation to develop blue hydrogen projects incorporating carbon capture technologies. Similarly, Linde has committed significant investments to supply hydrogen integrated with carbon sequestration for ammonia production projects.

Such developments highlight how incumbents are leveraging existing grey hydrogen infrastructure while aligning with long-term decarbonization goals.

Policy Signals and Market Outlook

Carbon pricing mechanisms, emissions standards, and national hydrogen strategies will significantly influence grey hydrogen’s future trajectory. If carbon costs rise substantially, blue and green hydrogen may gain stronger economic footing. However, given scalability constraints and high production costs associated with alternatives, grey hydrogen is expected to remain a substantial contributor to global hydrogen supply throughout the forecast period.

Ultimately, grey hydrogen will continue serving as a transitional pillar in the hydrogen economy. While environmental pressures intensify, its affordability, reliability, and entrenched industrial role ensure that it remains indispensable—at least in the medium term—until cleaner hydrogen technologies achieve full commercial parity.