In the era of multi-domain operations and digital warfare, the term Defense Logistic Market takes on fresh urgency. The market for military logistics support is evolving into a strategic capability rather than a back-office service. According to (MRFR), the global military logistics market (which overlaps significantly with the defence logistics market) was valued at USD 43.1 billion in 2022 and is projected to reach USD 60.64 billion by 2030, with a CAGR of 5.00 % between 2023 and 2030.

What’s Driving Innovation

-

Technological transformation: The logistics domain is moving beyond trucks and warehouses to include digital supply-chain management, unmanned logistics vehicles, real-time tracking, sensors and IoT. MRFR cites the use of GIS, RFID and connected systems as growth enablers.

-

Geopolitical shifts & deployments: With new bases, rapid reaction forces and expeditionary operations becoming more common, militaries need logistics systems that are agile, global and resilient. MRFR highlights geopolitical instability as a prime driver.

-

Disaster response and humanitarian operations: As militaries increasingly support non-combat missions, logistics capabilities developed for combat are increasingly repurposed for humanitarian relief, thus expanding the Military Logistics Market.

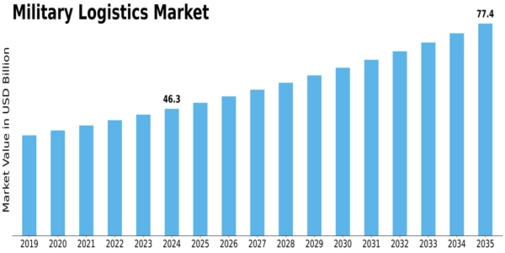

Market Size, Forecast & Key Stats

-

2022: USD 43.1 billion.

-

2023 (estimated): USD 45.255 billion.

-

2030 (forecast): USD 60.64 billion.

-

CAGR (2023-2030): ~5.00 %.

-

Dominant transportation mode: Roadways.

-

Key players: Among others, the MRFR list includes AECOM, Fluor Corporation, Thales Group, BAE Systems Plc, DynCorp International LLC and Honeywell International Inc..

Key Trends to Watch

-

Digital logistics platforms: Real-time asset tracking, analytics-driven supply-chain optimisation and autonomous delivery are becoming core capabilities.

-

Sustainability & resilience: Though military logistics is not traditionally associated with green logistics, the push for resilient supply chains means redundant modes and alternative transport routes are being considered.

-

Growing contract complexity: Logistics providers are increasingly expected to offer end-to-end services, from transport through maintenance to supply-chain visibility.

-

Regional expansion: While developed markets maintain high logistic standards, emerging regions (Asia-Pacific, Middle East) are expanding their logistics infrastructure, offering new growth opportunities.

Challenges & Risks

-

High capital investment for infrastructure, technology and training remains a barrier.

-

Supply-chain complexity, especially in conflict zones, increases risk and cost.

-

Rapid technological change means logistics providers must continuously adapt or risk obsolescence.

Implications for Stakeholders

For logistics providers and defence contractors:

-

Embrace integrated logistics solutions that combine transport, warehousing, maintenance and digital tracking.

-

Partner with technology firms to bring automation, IoT and AI into logistics operations.

-

Position capabilities for both conventional defence and humanitarian/disaster relief missions to broaden opportunity.

For defence forces and governments:

-

Prioritise logistics modernisation as a force-multiplier, not just a support service.

-

Invest in transport modes and supply-chain visibility for rapid deployment and sustainment.

-

Leverage partnerships with private logistics firms to achieve scale, flexibility and innovation.

In closing, the defence logistics market is transitioning. No longer simply about moving equipment, it is about enabling agile, resilient, and technology-driven supply chains that can support both warfighting and wider mission sets. With MRFR’s forecast of growth to USD 60.64 billion by 2030 at ~5 % CAGR, the time is ripe for logistics and defence players to align strategy and capability for the coming decade.