North America Biostimulants Market Witnesses Robust Adoption Driven by Advanced Agricultural Practices

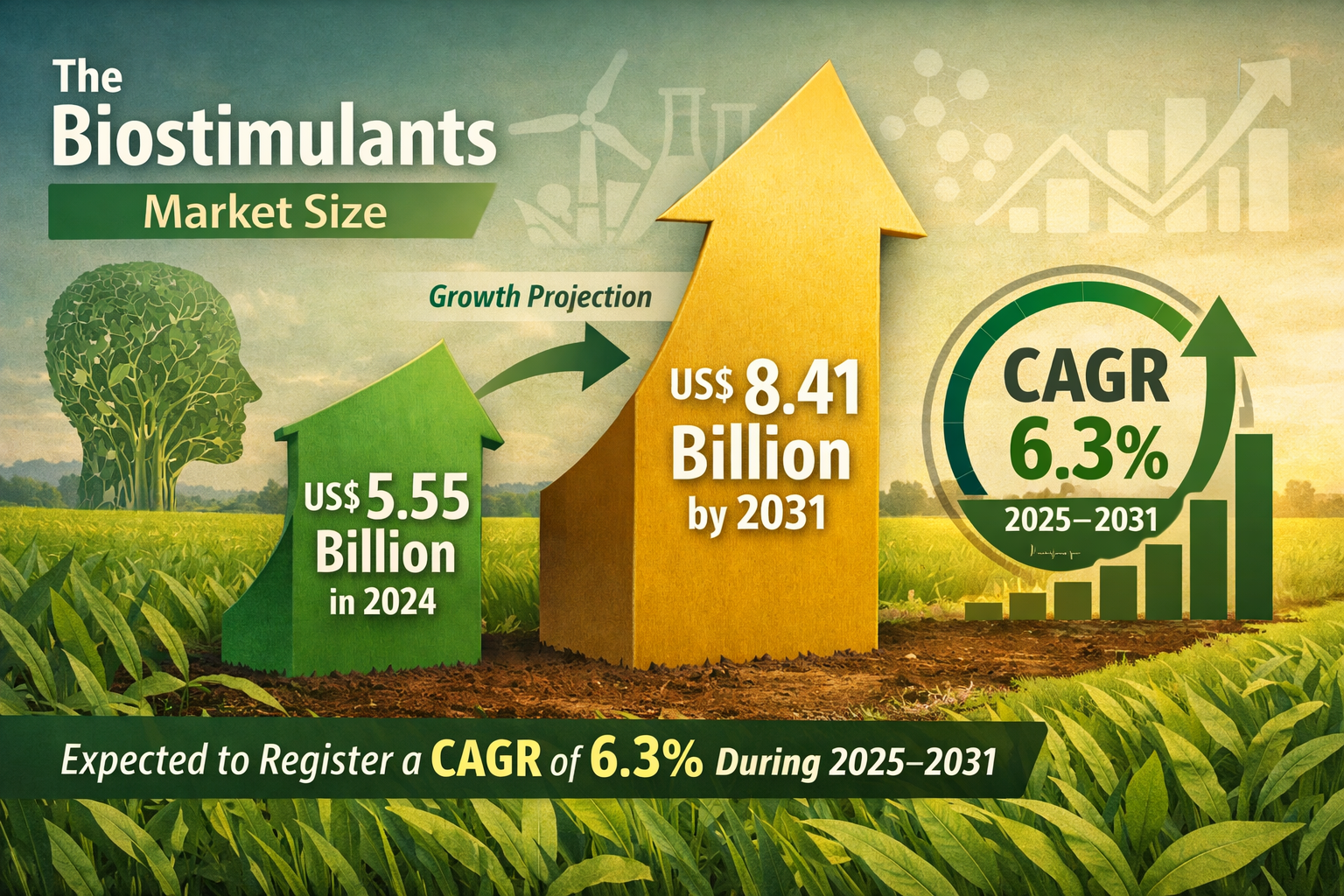

As the agricultural sector continues to evolve, the biostimulants market is emerging as a crucial player in enhancing crop productivity and sustainability. This press release aims to provide a comprehensive overview of the Biostimulants Market, highlighting key insights, emerging trends, and opportunities for growth through 2031.

Emerging Trends and Market Opportunities

The biostimulants market is witnessing several emerging trends that present unique opportunities for stakeholders:

Sustainability Focus: Increasing awareness of sustainable farming practices is driving demand for biostimulants as environmentally friendly alternatives to chemical fertilizers.

Technological Innovations: Advancements in biotechnology are leading to the development of more effective and targeted biostimulant products.

Consumer Preferences: Growing consumer preference for organic and sustainably grown produce is influencing market dynamics.

Access Report for More Info:

https://www.theinsightpartners.com/sample/TIPRE00003199/

Key Market Insights by 2031

Market Segments and Analysis:

Types of Biostimulants: Includes microbial, seaweed extracts, humic substances, and others.

Application Methods: Soil treatment, foliar application, and seed treatment are the primary methods driving market growth.

Crops: Major crops include cereals, fruits, vegetables, and turf and ornamentals.

Global and Regional Analysis:

North America: A leader in biostimulants adoption, driven by technological advancements and increasing organic farming practices.

Europe: Strong regulatory framework and consumer demand for sustainable agriculture practices.

Asia-Pacific: Rapidly growing market due to increasing agricultural activities and investments in modern farming techniques.

Market Players and Competitive Landscape:

Key players include major agricultural companies and innovative startups focused on biostimulant development. Competitive strategies include mergers and acquisitions, partnerships, and product innovations.

Recent Industry Developments

The biostimulants industry has seen significant developments in recent years, including:

Product Launches: Several companies have introduced new biostimulant products aimed at enhancing crop resilience and yield.

Regulatory Changes: Evolving regulations are shaping the biostimulants market, with increasing support for sustainable agricultural practices.

Collaborations: Partnerships between agricultural firms and research institutions are fostering innovation in biostimulant formulations.

Conclusion

The biostimulants market is poised for substantial growth by 2031, driven by increasing demand for sustainable agricultural practices and technological advancements. Stakeholders in the agricultural sector must stay informed about market trends and emerging opportunities to leverage the benefits of biostimulants effectively.

FAQ

What are biostimulants?

Biostimulants are natural substances or microorganisms that enhance plant growth and development by improving nutrient availability and stress tolerance.

How do biostimulants differ from fertilizers?

Unlike fertilizers that provide essential nutrients, biostimulants enhance the plant's natural processes, improving nutrient uptake and overall health.

What are the benefits of using biostimulants?

Biostimulants can lead to increased crop yield, improved soil health, and enhanced resistance to environmental stresses.

Are there any risks associated with biostimulant use?

Generally, biostimulants are considered safe; however, it is essential to use them as directed to avoid any adverse effects.

What is the future outlook for the biostimulants market?

The market is expected to grow significantly due to rising demand for sustainable agriculture and continuous innovations in product development.

Related Report:

1) Humic based Biostimulants Market

2) Central Nervous System Stimulant Drugs Market

About Us: -

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Devices, Technology, Media and Telecommunications, Chemicals and Materials.

Also Available in : Korean German Japanese French Chinese Italian Spanish

North America Biostimulants Market Witnesses Robust Adoption Driven by Advanced Agricultural Practices

As the agricultural sector continues to evolve, the biostimulants market is emerging as a crucial player in enhancing crop productivity and sustainability. This press release aims to provide a comprehensive overview of the Biostimulants Market, highlighting key insights, emerging trends, and opportunities for growth through 2031.

Emerging Trends and Market Opportunities

The biostimulants market is witnessing several emerging trends that present unique opportunities for stakeholders:

Sustainability Focus: Increasing awareness of sustainable farming practices is driving demand for biostimulants as environmentally friendly alternatives to chemical fertilizers.

Technological Innovations: Advancements in biotechnology are leading to the development of more effective and targeted biostimulant products.

Consumer Preferences: Growing consumer preference for organic and sustainably grown produce is influencing market dynamics.

👉 Access Report for More Info: https://www.theinsightpartners.com/sample/TIPRE00003199/

Key Market Insights by 2031

Market Segments and Analysis:

Types of Biostimulants: Includes microbial, seaweed extracts, humic substances, and others.

Application Methods: Soil treatment, foliar application, and seed treatment are the primary methods driving market growth.

Crops: Major crops include cereals, fruits, vegetables, and turf and ornamentals.

Global and Regional Analysis:

North America: A leader in biostimulants adoption, driven by technological advancements and increasing organic farming practices.

Europe: Strong regulatory framework and consumer demand for sustainable agriculture practices.

Asia-Pacific: Rapidly growing market due to increasing agricultural activities and investments in modern farming techniques.

Market Players and Competitive Landscape:

Key players include major agricultural companies and innovative startups focused on biostimulant development. Competitive strategies include mergers and acquisitions, partnerships, and product innovations.

Recent Industry Developments

The biostimulants industry has seen significant developments in recent years, including:

Product Launches: Several companies have introduced new biostimulant products aimed at enhancing crop resilience and yield.

Regulatory Changes: Evolving regulations are shaping the biostimulants market, with increasing support for sustainable agricultural practices.

Collaborations: Partnerships between agricultural firms and research institutions are fostering innovation in biostimulant formulations.

Conclusion

The biostimulants market is poised for substantial growth by 2031, driven by increasing demand for sustainable agricultural practices and technological advancements. Stakeholders in the agricultural sector must stay informed about market trends and emerging opportunities to leverage the benefits of biostimulants effectively.

FAQ

What are biostimulants?

Biostimulants are natural substances or microorganisms that enhance plant growth and development by improving nutrient availability and stress tolerance.

How do biostimulants differ from fertilizers?

Unlike fertilizers that provide essential nutrients, biostimulants enhance the plant's natural processes, improving nutrient uptake and overall health.

What are the benefits of using biostimulants?

Biostimulants can lead to increased crop yield, improved soil health, and enhanced resistance to environmental stresses.

Are there any risks associated with biostimulant use?

Generally, biostimulants are considered safe; however, it is essential to use them as directed to avoid any adverse effects.

What is the future outlook for the biostimulants market?

The market is expected to grow significantly due to rising demand for sustainable agriculture and continuous innovations in product development.

Related Report:

1) Humic based Biostimulants Market

2) Central Nervous System Stimulant Drugs Market

About Us: -

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Devices, Technology, Media and Telecommunications, Chemicals and Materials.

Also Available in : Korean German Japanese French Chinese Italian Spanish