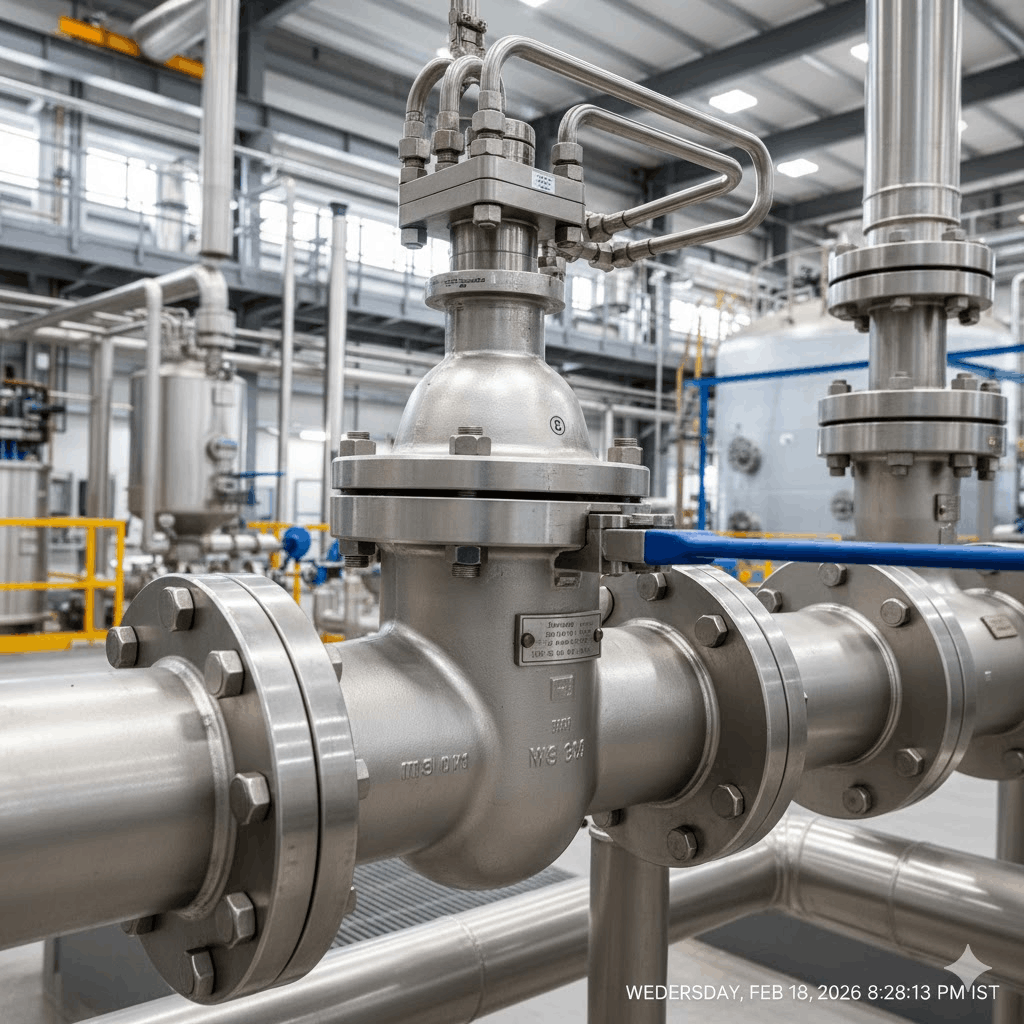

The Ball Valve Market is gaining significant momentum driven by advancements in valve design, materials, and automation technologies. As industrial operations evolve toward higher precision and safety standards, ball valves are widely adopted for their durability, ease of operation, and minimal maintenance requirements.

Key Market Drivers

The primary force behind ball valve market growth is the rising global focus on industrialization. As developing economies accelerate their industrial and infrastructure development — spanning oil and gas, water treatment, chemical processing, and power generation — the demand for effective flow control solutions has surged significantly.

In the oil and gas sector, ball valves are indispensable. They regulate fluid flow across upstream exploration, midstream transportation, and downstream refining operations, ensuring safe, efficient, and pressure-controlled processes. The continued expansion of pipeline networks, offshore platforms, and refinery infrastructure globally is directly fueling market demand.

Technological advancements in valve materials and design are also reshaping the competitive landscape. The development of high-performance materials such as stainless steel, specialized alloys, and cryogenic-grade metals has expanded ball valve applications into more demanding environments — including extreme temperatures, high-pressure systems, and exposure to corrosive chemicals. Furthermore, the growing adoption of smart valve systems integrated with SCADA and IoT monitoring is driving the next wave of innovation, enabling real-time flow management and predictive maintenance across industrial networks.

Market Segmentation Highlights

By material, stainless steel dominates the ball valve market, holding the largest share in 2023. Its superior corrosion resistance, durability, hygienic properties, and versatility make it the go-to material across oil and gas, pharmaceutical, and chemical processing industries. The alloy segment, however, is anticipated to register the highest CAGR during the forecast period, reflecting growing demand for specialty valves in high-temperature and high-corrosion environments.

By type, the market covers rising stem, floating, and trunnion-mounted ball valves. Trunnion-mounted valves are widely preferred in high-pressure, large-diameter pipeline applications, while floating ball valves are commonly used in lower-pressure systems. By end-use industry, oil and gas leads the application landscape, followed by water management, chemicals, pharmaceuticals, and energy and power.

Order a Copy of this Research Study @ https://www.theinsightpartners.com/buy/TIPTE100000555

Regional Insights

Asia-Pacific stands as the dominant regional market, valued at US$ 6.61 billion in 2023 and projected to reach US$ 9.54 billion by 2028 at a CAGR of 7.6% — the highest among all regions. Rapid industrialization across China, India, and Japan, combined with massive infrastructure investments in water supply, power generation, and manufacturing, has made Asia-Pacific the engine of global ball valve demand. The region also benefits from the presence of numerous local manufacturers offering competitive pricing across diverse valve specifications.

North America — led by the United States — holds a significant market share, driven by advanced process industries, aging infrastructure upgrades, and the early adoption of smart valve technologies. Europe maintains a solid position through its established chemical and pharmaceutical sectors, while the Middle East & Africa region is growing steadily, fueled by ongoing petrochemical expansion and energy infrastructure investment.

Competitive Landscape

The ball valve market features a moderately consolidated group of global leaders, including Flowserve Corp, Emerson Electric Co., Schlumberger NV (SLB), KITZ Corp, IMI Plc, Curtiss-Wright Corp, Crane Co., Velan Inc., Neway Valve Suzhou Co. Ltd., and Valvitalia SpA. Flowserve Corp and SLB lead the pack, owing to their diversified product portfolios and strong presence across multiple end-use industries. Strategic mergers and acquisitions continue to shape the competitive environment — recent moves include Emerson's acquisition of CIRCOR's steam system product lines and IMI Plc's purchase of specialty valve maker PBM, both aimed at broadening their industrial valve offerings.

Also Available in : Korean German Japanese French Chinese Italian Spanish

Frequently Asked Questions (FAQ)

Q: What is the size of the ball valve market? A: The ball valve market was valued at US$ 16.66 billion in 2023 and is projected to reach US$ 22.09 billion by 2028.

Q: What is the expected CAGR of the ball valve market? A: The market is anticipated to grow at a CAGR of 5.8% during the 2023–2028 forecast period.

Q: Who are the key players in the ball valve market? A: Major players include Flowserve Corp, Emerson Electric Co., SLB, KITZ Corp, IMI Plc, Curtiss-Wright Corp, and Crane Co., among others.

Q: What are the future trends in the ball valve market? A: The growing adoption of industrial automation is pushing manufacturers toward smart ball valves integrated with SCADA systems, enabling real-time pipeline monitoring, optimal pressure regulation, and predictive maintenance capabilities.