According to the TechSci Research report, “Automotive Market - Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2030F,” the Global Automotive Market was valued at USD 3.11 trillion in 2024 and is projected to reach USD 3.82 trillion by 2030, expanding at a CAGR of 3.5% during the forecast period. The automotive industry—long regarded as a cornerstone of global economic activity—is now undergoing one of the most transformative periods in its history. Driven by digitalization, sustainability mandates, electrification, and evolving consumer expectations, the sector is transitioning from traditional manufacturing paradigms to a technology-driven mobility ecosystem.

The modern automotive landscape is no longer defined solely by horsepower, mechanical engineering, and affordability. Instead, vehicles are becoming intelligent, connected, and software-defined mobility platforms. Consumers demand seamless digital integration, advanced safety technologies, personalized in-car experiences, and environmentally responsible propulsion systems. Governments worldwide are accelerating this shift by introducing stringent emission regulations, EV incentives, and infrastructure investments designed to decarbonize transportation networks.

Despite this strong growth outlook, the industry faces structural and operational challenges. Semiconductor shortages, geopolitical uncertainties, fluctuating raw material costs, and rising R&D expenditures have created complexity in supply chains and strategic planning. However, resilience, innovation, and collaboration remain defining characteristics of the global automotive market. Companies that successfully balance technological advancement with operational efficiency will shape the future of mobility through 2030 and beyond.

Market Overview

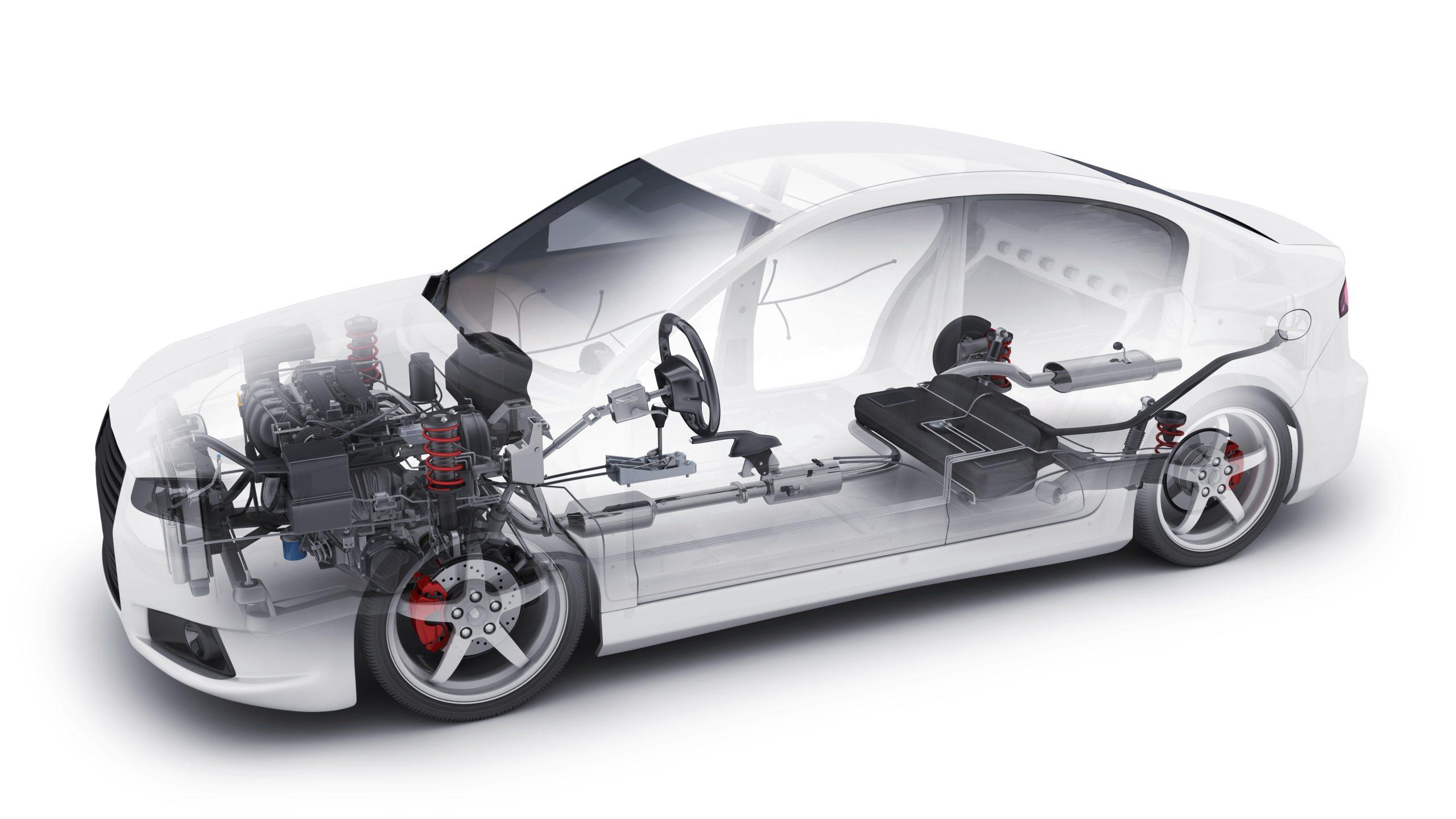

The automotive industry represents a complex ecosystem involving vehicle manufacturing, component suppliers, technology developers, energy providers, and digital service platforms. Historically rooted in internal combustion engine (ICE) technology, the sector is now transitioning toward electrified, connected, autonomous, and shared mobility solutions.

The global automotive market’s steady CAGR of 3.5% reflects stable demand across developed and emerging economies. Passenger vehicles remain the largest revenue contributor, while commercial vehicles support economic activity in logistics, infrastructure, and trade sectors. Electrification and digital connectivity are redefining vehicle architecture, introducing advanced electronics, software systems, and battery technologies that elevate the industry’s technological complexity.

As urban populations expand and megacities intensify mobility demands, automotive manufacturers are responding with innovative vehicle platforms that address congestion, sustainability, and user experience simultaneously. The rise of subscription-based vehicle ownership, ride-sharing services, and fleet electrification underscores the sector’s shift from product-centric to service-oriented business models.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=16833

Emerging Trends in the Global Automotive Market

1. Electrification at Scale

Electrification represents the most disruptive force in the automotive industry. Battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) are experiencing rapid adoption due to falling battery costs, government incentives, and improved charging infrastructure. Automakers are investing billions in dedicated EV platforms, battery gigafactories, and supply chain integration to accelerate production capacity.

Innovations in lithium-ion chemistry and solid-state battery research promise higher energy density, longer range, and faster charging times. As EVs achieve cost parity with ICE vehicles, mass-market adoption is expected to accelerate significantly.

2. Software-Defined Vehicles

Modern vehicles increasingly resemble rolling computers. Over-the-air (OTA) updates, cloud-based diagnostics, and AI-driven features allow manufacturers to continuously enhance performance, safety, and infotainment capabilities after purchase. Software-defined architectures enable customization and recurring revenue through digital services, transforming traditional revenue models.

3. Artificial Intelligence and Advanced HMI

Artificial intelligence (AI) is reshaping driver interaction and vehicle autonomy. Advanced human-machine interfaces (HMI) integrate voice recognition, gesture control, augmented reality dashboards, and eye-tracking systems to create intuitive driving experiences. AI enhances predictive maintenance, adaptive cruise control, automatic emergency braking, and fatigue detection—improving safety and operational efficiency.

4. Autonomous Driving Technologies

While full autonomy remains in development, advanced driver-assistance systems (ADAS) are increasingly standard across vehicle segments. Lane-keeping assist, automatic parking, collision avoidance, and real-time sensor analytics represent stepping stones toward higher levels of autonomy. Continuous data collection and machine learning models accelerate progress in this domain.

5. Sustainability and Circular Economy Integration

Environmental sustainability is central to automotive innovation. Manufacturers are adopting recycled materials, carbon-neutral manufacturing processes, and battery recycling programs to minimize environmental impact. Lifecycle assessment strategies are becoming essential components of corporate ESG commitments.

Market Drivers

Regulatory Support and Emission Mandates

Governments worldwide are implementing stringent emission standards and fuel economy regulations. Subsidies for EV purchases, tax exemptions, and infrastructure funding significantly stimulate adoption. Many nations have announced timelines to phase out fossil-fuel vehicle sales, accelerating electrification investments.

Consumer Preference for Connected Mobility

Consumers now prioritize connectivity, infotainment systems, and seamless smartphone integration. Demand for vehicles equipped with advanced safety systems, real-time navigation, and digital dashboards continues to rise. Personalization and digital ecosystem compatibility influence purchasing decisions.

Urbanization and Infrastructure Development

Rapid urbanization in emerging economies drives demand for passenger and commercial vehicles. Infrastructure projects, industrial growth, and economic recovery post-pandemic stimulate vehicle sales across multiple regions.

Fleet Electrification and Commercial Expansion

Logistics companies, ride-hailing platforms, and delivery fleets are transitioning toward electric vehicles to reduce operating costs and align with sustainability targets. Fleet electrification contributes significantly to EV volume growth.

Technological Innovation

Advancements in battery technology, lightweight materials, AI algorithms, and connectivity platforms enhance vehicle performance, efficiency, and safety—strengthening consumer confidence and accelerating market penetration.

Market Challenges

Semiconductor Shortages

Global chip shortages disrupted production schedules, highlighting vulnerabilities in automotive supply chains. Although gradual recovery is underway, long-term resilience requires diversified sourcing and vertical integration.

Raw Material Price Volatility

Lithium, cobalt, and nickel prices significantly impact EV battery production costs. Fluctuations create financial uncertainty for manufacturers.

Infrastructure Gaps

Charging infrastructure remains unevenly distributed across regions, limiting EV adoption in certain markets.

Rising R&D Investments

The shift toward electrification and digitalization demands substantial capital expenditure. Smaller manufacturers face financial strain in competing with established global players.

Segmentation Analysis

By Vehicle Type

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Medium & Heavy Commercial Vehicles (M&HCVs)

Passenger cars dominate revenue share, driven by consumer demand and urban mobility needs. Commercial vehicles support trade, logistics, and industrial growth.

By Propulsion Type

-

Electric Vehicle (EV)

-

Hybrid Electric Vehicle (HEV)

-

Natural Gas Vehicle (NGV)

-

Fuel Cell Electric Vehicle (FCEV)

-

Diesel Vehicle

-

Petrol Vehicle

Electric vehicles represent the fastest-growing segment. Hybrid vehicles serve as transitional solutions, while diesel and petrol continue to hold significant share in developing markets.

Regional Insights

South America: Fastest Growing Region

South America—particularly Brazil and Argentina—is emerging as the fastest-growing region in the automotive market. Economic recovery, domestic production growth, and increasing passenger vehicle demand drive expansion.

Brazil benefits from government support for ethanol-powered vehicles and gradual EV integration. Trade agreements under regional blocs enhance cross-border automotive collaboration. Although infrastructure challenges remain, rising manufacturing investments and affordable mobility demand position South America for sustained growth.

Competitive Analysis

The global automotive market is highly competitive, characterized by legacy manufacturers, emerging EV players, and technology-driven entrants. Key companies focus on electrification strategies, autonomous driving development, and digital ecosystem expansion.

Major market participants include:

-

Volkswagen AG

-

Toyota Motor Corporation

-

Mercedes-Benz Group AG

-

Ford Motor Company

-

Honda Motor Co., Ltd.

-

General Motors

-

Suzuki Motor Corporation

-

BMW AG

-

Nissan Motor Co., Ltd.

-

Hyundai Motor Company

These players compete through innovation, pricing strategies, sustainability initiatives, and global production capabilities. Strategic alliances with technology firms and battery suppliers enhance competitive positioning.

Industry Key Highlights

-

Market valued at USD 3.11 trillion in 2024.

-

Projected to reach USD 3.82 trillion by 2030.

-

CAGR of 3.5% during forecast period.

-

EV segment fastest growing propulsion category.

-

AI and advanced HMI technologies gaining prominence.

-

South America emerging as high-growth region.

-

Increased R&D investments in battery and autonomy.

-

Software-defined vehicle platforms expanding.

-

Sustainability integration across supply chains.

-

Fleet electrification accelerating global EV volumes.

Future Outlook

The global automotive industry is poised for transformative growth through 2030. Electrification will continue dominating strategic investments, supported by regulatory mandates and technological breakthroughs. Software integration and AI-powered mobility platforms will redefine vehicle functionality and user experience.

Autonomous driving capabilities will gradually mature, while smart city integration enhances vehicle connectivity. Emerging markets will play a critical role in sustaining demand growth, particularly in Asia-Pacific, Africa, and South America.

Manufacturers prioritizing innovation, vertical integration, and sustainability will gain competitive advantage. Digital ecosystems, recurring revenue models, and mobility-as-a-service platforms will reshape industry profitability structures.

10 Benefits of the Research Report

-

Comprehensive global market size and forecast analysis (2020–2030F).

-

Detailed segmentation by vehicle type and propulsion system.

-

Regional growth assessment and comparative benchmarking.

-

Competitive landscape profiling of leading global manufacturers.

-

Emerging technology trend identification (AI, EV, autonomy).

-

Strategic insights into regulatory and policy impacts.

-

Supply chain and raw material risk evaluation.

-

Investment opportunity mapping across regions and segments.

-

Sustainability and ESG strategy analysis.

-

Actionable recommendations for OEMs, suppliers, and investors.

Conclusion

The global automotive market stands at the intersection of technological evolution and sustainable transformation. Valued at USD 3.11 trillion in 2024 and projected to reach USD 3.82 trillion by 2030, the industry’s trajectory reflects both resilience and reinvention. Electrification, artificial intelligence, connectivity, and digital mobility ecosystems are redefining competitive dynamics.

While challenges such as semiconductor shortages and infrastructure gaps persist, the industry’s adaptive strategies—ranging from vertical integration to cross-sector partnerships—demonstrate strong growth potential. Companies that successfully integrate innovation with operational excellence will lead the next era of mobility, shaping a cleaner, smarter, and more connected automotive future.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: sales@techsciresearch.com

Website: www.techsciresearch.com