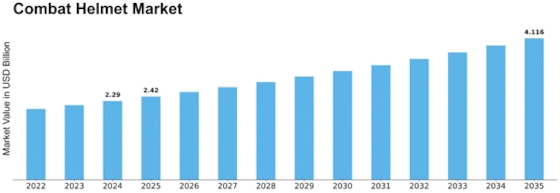

The Combat Helmet Market is characterized by diverse segmentation and evolving competitive dynamics that reflect changing defense priorities worldwide. Market Research Future (MRFR) estimates that The Combat Helmet industry is projected to grow from 2.414 USD Billion in 2025 to 4.116 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.48% during the forecast period 2025 - 2035.

The segmentation of the combat helmet market provides a detailed view of how different materials, product types, applications, and end-use categories influence overall demand and value creation. In terms of material, alternatives such as polycarbonate, aramid fiber, and carbon fiber dominate due to their high ballistic resistance and lightweight properties, while metal designs remain relevant for specific operational contexts requiring robust, all-weather protection.

When viewed by product type, the Combat Helmet Market includes ballistic helmets, bump helmets, flight helmets, and modular helmets. Ballistic helmets account for a significant share due to their widespread use in frontline combat operations and tactical deployments. Modular helmets are gaining traction as they allow additional accessories and attachments — such as night-vision mounts, communication systems, and ballistic visors — catering to specialized mission requirements.

From an application standpoint, combat helmets are primarily adopted by military forces, followed by law enforcement agencies and, to a lesser extent, civilian protective needs. Military demand remains the largest contributor to market size due to ongoing modernization programs, procurement cycles, and the integration of advanced features that enhance soldier survivability on the battlefield. Law enforcement agencies increasingly procure high-performance helmets to protect officers during urban operations, riot control, counter-terrorism actions, and other high-risk engagements.

End-use segmentation further delineates how helmets are deployed across combat, training, and rescue operations. Combat usage drives the majority of demand, especially as modern threats evolve and head protection becomes indispensable for both active duty and special forces. Training and rescue operations also contribute to market growth, though at a slower pace compared to frontline combat usage.

The competitive landscape of the combat helmet market features a mix of established global players and regional innovators. Major companies operating in this space include Gentex Corporation, Honeywell International Inc., 3M Company, Revision Military, MSA Safety Incorporated, Safariland Group, BAE Systems, Elbit Systems, United Shield International, and Zentek Ltd., among others. These players actively invest in research and development to deliver next-generation helmets that integrate advanced materials and smart technologies, reflecting a broader emphasis on innovation and performance enhancement.

Competitive strategies within the industry focus on product differentiation, strategic partnerships, and geographic expansion. Leading companies are expanding their portfolios to include helmets that support integrated communication systems, situational awareness sensors, and improved ergonomic designs. These value-added solutions not only reinforce protection levels but also address evolving battlefield needs, enhancing user comfort and functionality.

Supply chain optimization and strategic alliances are also shaping competitive dynamics. Collaborative efforts between defense contractors and material scientists are enabling the development of specialized composites that offer better protection and lower weight. Joint ventures and co-development agreements help companies penetrate new markets and tailor products to regional defense requirements.

Despite strong competition, smaller players and startups are emerging with focused expertise in niche material technologies or smart helmet accessories. By targeting specific operational needs — such as lightweight ballistic helmets for special operations forces or integrated systems for law enforcement — these innovators contribute to the competitive vibrancy and ongoing evolution of the market.

In summary, segmentation coupled with competitive strategy underscores the complexity and growth potential of the combat helmet market. The interplay between product innovation, application demands, and strategic positioning will remain central to how this market evolves through 2035.

Discover More Research Reports on Aerospace & Defense By Market Research Future: