The Aerostructures Market is characterized by complex supply chains, high entry barriers, and strong collaboration between aircraft manufacturers and component suppliers. Market Research Future (MRFR) indicates that the market continues to evolve as companies adapt to changing production volumes, material technologies, and global sourcing strategies. These factors significantly influence the Aerostructures Market size, share, and long-term industry growth.

Aerostructure manufacturing requires precision engineering, strict regulatory compliance, and long certification cycles. As a result, the industry structure is dominated by established players with deep technical expertise and long-standing relationships with original equipment manufacturers (OEMs). Tier-one suppliers play a critical role by delivering fully integrated structural assemblies, reducing complexity for aircraft manufacturers and strengthening supplier market share.

The industry analysis highlights that supply chain resilience has become a strategic priority in the aerostructures market. Aircraft programs rely on synchronized global production networks, making them sensitive to disruptions. In response, manufacturers are diversifying supplier bases, investing in localized production, and improving inventory management practices. These measures are shaping procurement strategies and influencing regional market dynamics.

Material sourcing is another key factor influencing market growth. The increasing use of composite materials has led to closer collaboration between aerostructure manufacturers and material suppliers. Advanced composites require specialized fabrication techniques and quality control processes, increasing the importance of vertically integrated capabilities within the industry.

A notable market trend is the growing emphasis on cost optimization without compromising structural integrity. Aircraft OEMs are under pressure to reduce program costs, leading to increased outsourcing and long-term supply agreements. Aerostructure suppliers are responding by investing in automation, lean manufacturing, and digital quality management systems to improve margins and competitiveness.

The commercial aviation segment continues to account for the largest share of aerostructures demand, supported by sustained aircraft backlogs. Narrow-body aircraft programs, in particular, drive high-volume production of wings, fuselage sections, and nacelles. Military and defense programs contribute stable demand, often with higher margins due to customization and advanced performance requirements.

Geographically, North America and Europe remain central to the global aerostructures industry due to established manufacturing infrastructure and skilled labor availability. However, Asia-Pacific is becoming an increasingly important production hub as global OEMs expand manufacturing footprints to support regional aircraft demand and cost efficiencies.

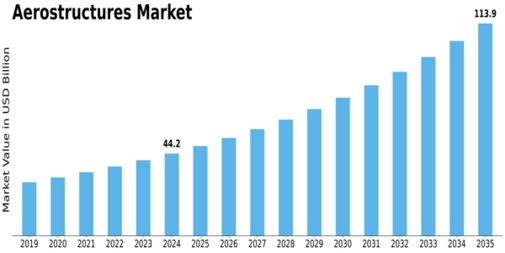

From a forecast perspective, the aerostructures market is expected to benefit from long-term aircraft fleet expansion and continued investment in aerospace manufacturing capabilities. Companies that successfully balance cost efficiency, quality, and innovation are likely to strengthen their market position and capture future growth opportunities.

Discover More Research Reports on Aerospace & Defense By Market Research Future: