Market Overview:

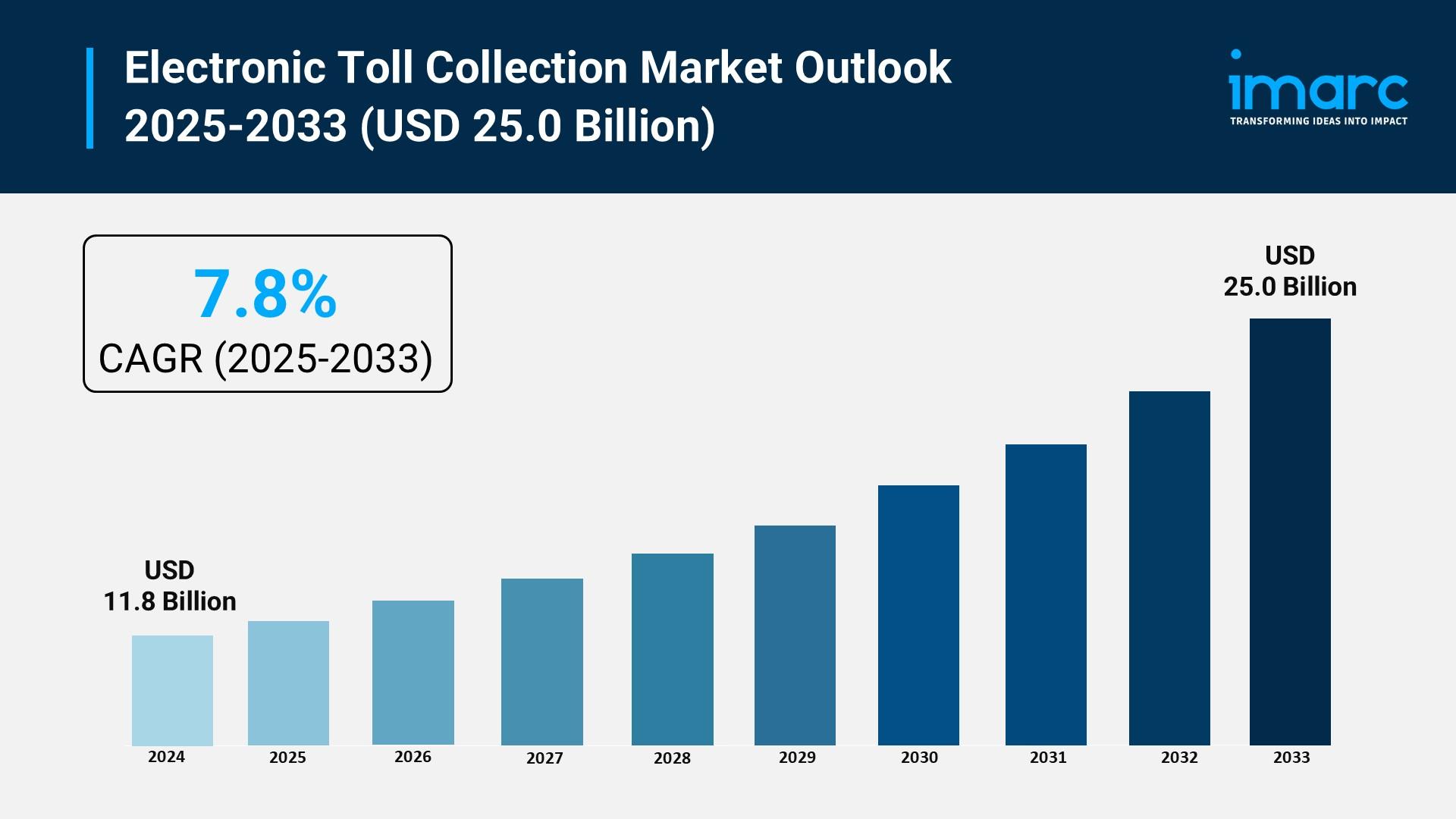

The electronic toll collection market is experiencing rapid growth, driven by government infrastructure modernization programs, rising demand for urban congestion management, and technological advancements in contactless payments. According to IMARC Group's latest research publication, "Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Region, 2025-2033", The global electronic toll collection market size was valued at USD 11.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.0 Billion by 2033, exhibiting a CAGR of 7.8% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/electronic-toll-collection-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Electronic Toll Collection Market

- Government Infrastructure Modernization Programs

National governments are increasingly prioritizing the digitalization of transport networks to bolster economic productivity and streamline interstate commerce. In 2026, the Indian government has committed to a nationwide rollout of satellite-based tolling, aiming to eliminate physical barriers across over 1,000 toll plazas. This initiative is projected to save approximately 15 billion rupees in fuel costs annually by preventing vehicle idling. Similarly, the United States continues to expand its "All-Electronic Tolling" (AET) footprint, with significant federal funding directed toward the National Highway System to replace aging manual infrastructure. These modernization efforts are not merely about convenience; they are strategic fiscal moves. In India alone, the transition to AI-supported barrier-free systems is expected to boost annual toll revenue by 60 billion rupees through the reduction of leakage and unauthorized bypasses. Such massive public investment ensures a steady demand for high-precision transponders and automated vehicle identification systems.

- Rising Demand for Urban Congestion Management

Rapid urbanization has forced municipal authorities to adopt electronic tolling as a critical tool for managing city-wide traffic flow and reducing carbon emissions. Major global hubs are implementing "Congestion Pricing" zones, where ETC systems monitor vehicle entry into high-traffic districts during peak hours. For example, North America currently holds a dominant market share of over 31% in the tolling sector, largely driven by the deployment of express lanes and managed lanes in metropolitan areas to curb gridlock. These systems utilize Radio Frequency Identification (RFID) and Video Analytics to charge drivers dynamically, encouraging a shift toward public transit. Public-private partnerships are also surging, with private entities investing in urban road infrastructure in exchange for long-term tolling rights. By integrating tolling with smart city frameworks, authorities can reduce urban violation rates by more than 10%, ensuring that city roads remain navigable while generating necessary funds for local infrastructure maintenance.

- Technological Advancements in Contactless Payments

The shift toward a cashless global economy has drastically accelerated the adoption of ETC hardware and software as consumers demand frictionless travel experiences. Modern tolling systems now leverage Dedicated Short-Range Communication (DSRC) and RFID technologies, which provide high reliability and low latency for vehicle-to-infrastructure communication. Since late 2025, India has issued over 4 million annual FASTag passes, illustrating a massive consumer pivot toward prepaid digital accounts. Companies like Kapsch TrafficCom and TransCore are leading this charge by developing interoperable back-office systems that allow a single transponder to function across different state and national borders. This interoperability is crucial for logistics and fleet management companies, which can now manage thousands of vehicle accounts through a centralized digital interface. As mobile wallet integration becomes standard, the ease of automatic top-ups and real-time transaction alerts continues to drive the replacement of manual cash-based systems with sophisticated, automated payment ecosystems.

Key Trends in the Electronic Toll Collection Market

- Implementation of Multi-Lane Free-Flow (MLFF) Systems

A primary trend reshaping the industry is the move toward Multi-Lane Free-Flow (MLFF) systems, which allow vehicles to maintain highway speeds of up to 80 km/h while passing through tolling points. Unlike traditional electronic lanes that require vehicles to slow down or navigate narrow gates, MLFF utilizes overhead gantries equipped with high-speed cameras and sensors. This "Open Road Tolling" environment is becoming the standard for new highway projects in Europe and Asia. For instance, recent developments in India’s national highways involve replacing physical booths with AI-driven MLFF gantries that read number plates and RFID tags simultaneously. This technology not only improves the travel experience by reducing wait times to zero but also significantly lowers the operational costs associated with maintaining physical plaza buildings and staffing. Real-world applications show that MLFF can increase vehicle throughput by five times compared to traditional gated electronic lanes.

- Integration of Satellite-Based Tolling (GNSS)

The industry is pivoting toward Global Navigation Satellite System (GNSS) based tolling, which eliminates the need for expensive roadside infrastructure entirely. This trend is particularly gainful for distance-based charging, where tolls are calculated based on the precise kilometers traveled rather than fixed points. In 2026, satellite-linked number plate identification is being integrated with existing RFID frameworks to create a hybrid, high-accuracy tracking system. This allows for dynamic pricing models where toll rates can be adjusted in real-time based on traffic density or vehicle weight. Germany and several other European nations have pioneered this for heavy goods vehicles, and the technology is now trickling down to passenger vehicle networks. By using GPS coordinates, operators can implement "virtual toll booths" anywhere on a map, providing unparalleled flexibility for state agencies to manage secondary roads and rural corridors without the capital expenditure of physical hardware.

- AI and Machine Learning for Fraud Detection

Artificial Intelligence (AI) is now being deeply integrated into the back-office operations of tolling agencies to enhance revenue assurance and combat toll evasion. Modern systems use machine learning algorithms to perform Automated Number Plate Recognition (ANPR) with extreme accuracy, even in poor weather or high-speed conditions. AI models can detect anomalies such as "tailgating" (where a vehicle follows another closely to avoid a sensor) or the use of fraudulent tags. In some regions, AI-based Violation Enforcement Systems (VES) are linked directly to national vehicle databases, ensuring that outstanding dues are settled during vehicle registration renewals or sales. For example, real-time video analytics can now identify vehicle make, model, and color to verify that the tag being used matches the registered vehicle. This technological layer is essential for the success of barrier-free tolling, as it ensures that the "honor system" of open-road travel is backed by a robust, automated enforcement mechanism.

Leading Companies Operating in the Global Electronic Toll Collection Industry:

- Conduent Incorporated

- EFKON GmbH

- International Road Dynamics Inc.

- Kapsch Trafficcom AG

- Mitsubishi Heavy Industries, Ltd.

- Q-Free

- Skytoll

- Thales Group

- The Revenue Markets Inc.

- Trans Core

Electronic Toll Collection Market Report Segmentation:

By Technology:

- RFID

- DSRC

- Others

RFID accounts for the majority of shares with 42.3% market share on account of its reliability, cost-effectiveness, and seamless toll collection capabilities.

By System:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

Transponder - or tag-based systems dominate the market with 82.5% share due to their user-friendly nature and hands-free transaction capabilities.

By Subsystem:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

Automated vehicle classification leads with 28.6% market share, utilizing sensors and AI for precise toll calculations.

By Offering

- Hardware

- Back Office and Other Services

Hardware dominates with 69.8% market share, encompassing RFID readers, transponders, cameras, and sensors essential for toll operations.

By Toll Charging:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

Distance based charging leads with 47.0% market share, offering fair and accurate toll assessment based on actual road usage.

By Application:

- Highways

- Urban Areas

Highways account for 71.1% market share, reflecting widespread adoption for funding road maintenance and expansion projects.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position with 31.0% market share, driven by infrastructure modernization initiatives and advanced ITS adoption.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302