If you are looking to build a specialized and globally respected career in taxation, becoming an IRS enrolled agent can be a smart and strategic choice. The IRS enrolled agent credential is awarded by the Internal Revenue Service and authorizes professionals to represent taxpayers before the IRS for audits, appeals, and collections.

In this blog, we will cover what an IRS enrolled agent is, eligibility, exam structure, career scope, and why this qualification is gaining popularity among commerce graduates and accounting professionals.

What Is an IRS Enrolled Agent?

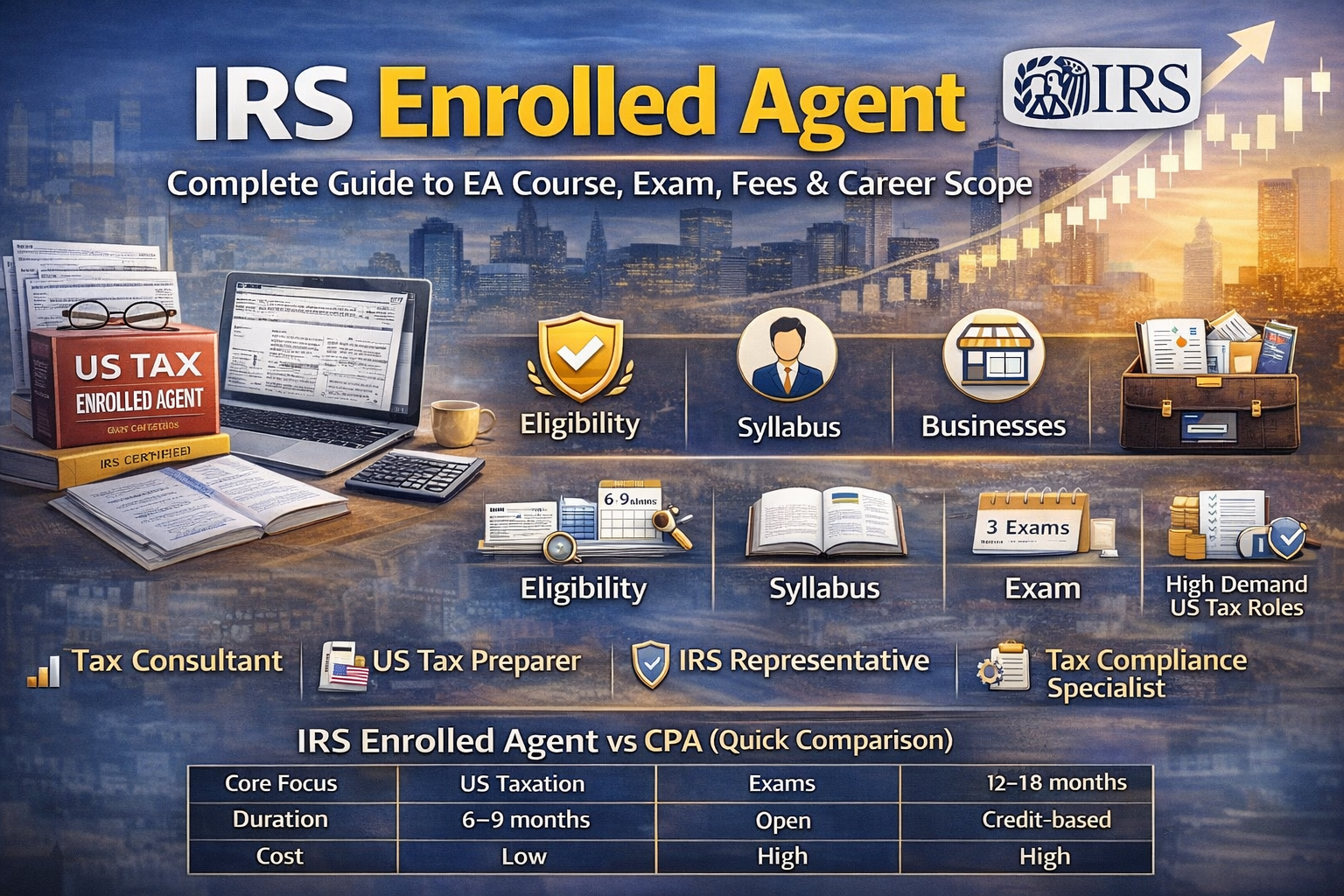

An IRS enrolled agent (EA) is a federally licensed tax practitioner who has unlimited rights to practice before the IRS. Unlike CPAs or attorneys, the enrolled agent designation is focused purely on US taxation.

Once certified, an IRS enrolled agent can:

-

Prepare and file US tax returns

-

Represent individuals and businesses before the IRS

-

Handle audits, appeals, and tax disputes

-

Provide advisory services on US tax compliance

This makes the IRS enrolled agent one of the most specialized and respected tax credentials in the world.

Why Choose the IRS Enrolled Agent Course?

The IRS enrolled agent credential is ideal for professionals who want a short-duration, high-skill qualification with strong global demand.

Key Benefits of Becoming an IRS Enrolled Agent

-

✅ Federal license issued directly by the US government

-

✅ No mandatory degree requirement

-

✅ Strong demand in US accounting & outsourcing firms

-

✅ Work opportunities with US clients from India

-

✅ Ideal for commerce graduates, CAs, CPAs, and tax professionals

Compared to longer courses, the IRS enrolled agent pathway is focused, practical, and career-oriented.

Eligibility for IRS Enrolled Agent

One of the biggest advantages of the IRS enrolled agent course is its open eligibility.

You can pursue IRS enrolled agent if you:

-

Have completed 12th / graduation (commerce background preferred)

-

Do not require prior US tax experience

-

Are willing to clear the IRS Special Enrollment Examination (SEE)

There is no age limit and no mandatory accounting license required.

IRS Enrolled Agent Exam Structure (SEE)

To become an IRS enrolled agent, candidates must pass the Special Enrollment Examination (SEE) conducted by the IRS.

Exam Parts

-

Part 1 – Individuals

-

Filing status & income

-

Deductions & credits

-

Capital gains & retirement income

-

-

Part 2 – Businesses

-

Business income & expenses

-

Partnerships & corporations

-

Depreciation and accounting methods

-

-

Part 3 – Representation, Practices & Procedures

-

Taxpayer rights

-

IRS audits & appeals

-

Professional ethics

-

Each part is tested separately, offering flexibility to candidates.

Career Scope After IRS Enrolled Agent

An IRS enrolled agent has strong career opportunities both in India and globally.

Job Roles

-

US Tax Analyst

-

Tax Consultant (US Taxation)

-

IRS Representation Specialist

-

Compliance & Advisory Professional

Employment Areas

-

US CPA firms

-

Big 4 & mid-size accounting firms

-

KPOs & outsourcing firms

-

Independent US tax practice

With increasing US compliance work being outsourced, the demand for IRS enrolled agent professionals continues to rise.

IRS Enrolled Agent Salary & Growth

An entry-level IRS enrolled agent can earn competitive salaries, especially in US tax firms and KPOs. With experience, professionals can move into senior advisory roles or even start their own US tax practice.

Career growth depends on:

-

Experience in US taxation

-

Client handling skills

-

IRS representation exposure

Who Should Pursue IRS Enrolled Agent?

The IRS enrolled agent course is best suited for:

-

Commerce graduates & postgraduates

-

Chartered Accountants looking to add US tax expertise

-

CPAs and ACCAs wanting tax specialization

-

Professionals working in US accounting & taxation domains

If your goal is to build a stable, niche, and internationally relevant tax career, the IRS enrolled agent credential is worth serious consideration.

Final Thoughts

The IRS enrolled agent qualification is one of the fastest ways to enter the world of US taxation with a government-authorized license. With growing global demand, flexible eligibility, and strong career prospects, the IRS enrolled agent course offers excellent value for professionals aiming to work in US tax compliance and representation.