Understanding US CPA course fees is crucial before you begin your CPA journey. Unlike traditional degree programs, the US CPA qualification involves multiple cost components such as exam fees, application charges, international testing fees, and study material costs. In this blog, we provide a transparent, updated, and student-friendly breakdown of US CPA course fees so you can plan your budget confidently.

What Are US CPA Course Fees?

US CPA course fees refer to the total expenses incurred from registration to certification. These fees are regulated by US state boards and exam bodies and may vary depending on:

-

State board selected

-

Number of exam attempts

-

Coaching provider

-

Mode of preparation (self-study vs coaching)

US CPA Course Fees Structure (Detailed)

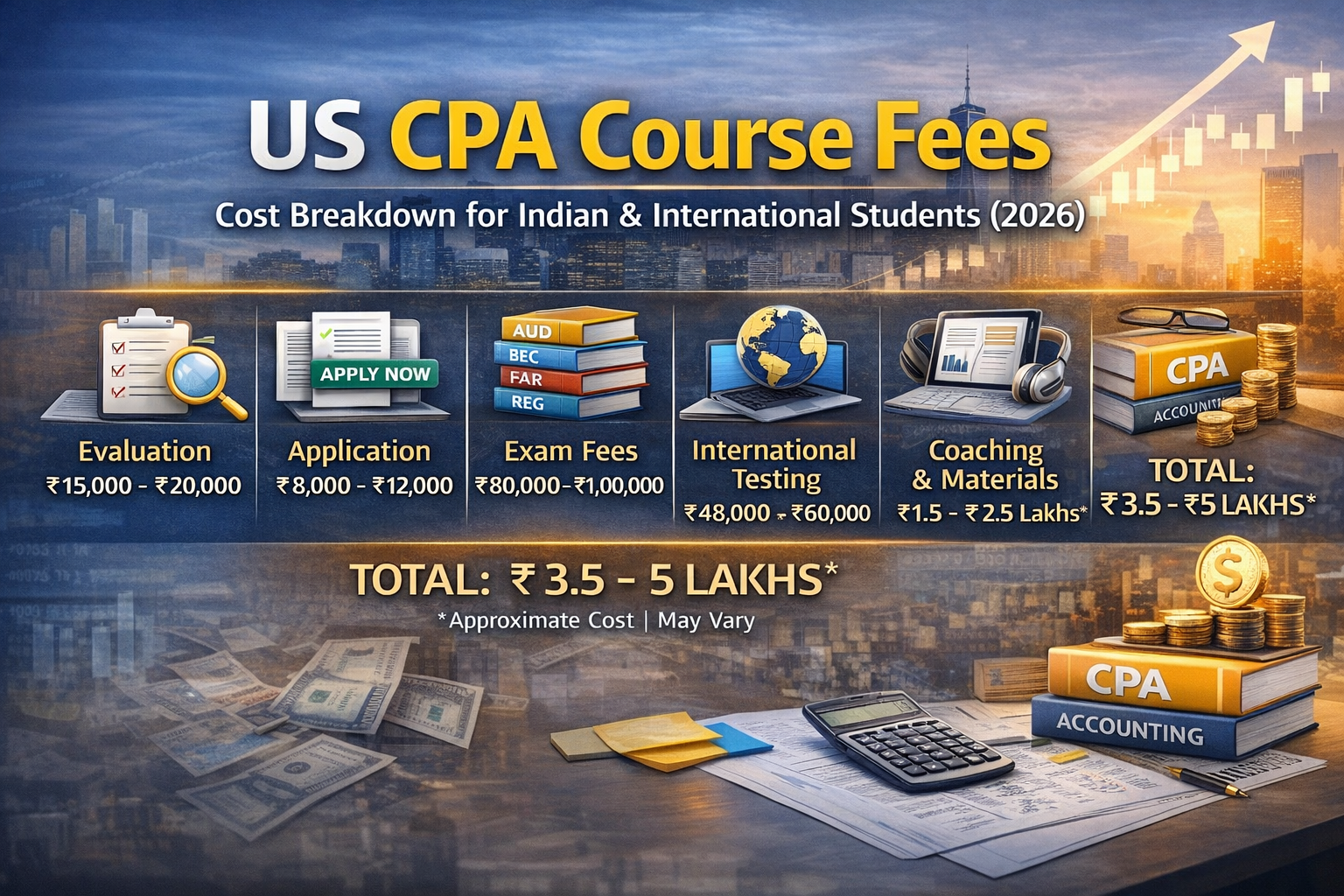

Below is a detailed breakdown of US CPA course fees:

1. Evaluation Fees

Before registering, Indian students must get their academic credentials evaluated.

-

Cost: ₹15,000 – ₹20,000

-

One-time fee

-

Mandatory for eligibility

2. Application Fees

Paid to the state board during initial registration.

-

Cost: ₹8,000 – ₹12,000

-

Varies by state

-

One-time or per application

3. Exam Fees (4 Papers)

Each CPA exam section requires a separate exam fee.

-

Per paper: ₹20,000 – ₹25,000

-

Total (4 papers): ₹80,000 – ₹1,00,000

This is a major component of US CPA course fees.

4. International Testing Fees

Applicable for candidates taking exams outside the US (including India).

-

Per paper: ₹12,000 – ₹15,000

-

Total: ₹48,000 – ₹60,000

5. CPA Registration & Licensing Fees

Paid after clearing all exams and completing experience requirements.

-

Cost: ₹5,000 – ₹10,000

US CPA Course Fees: Coaching & Study Material

Coaching is optional but highly recommended.

-

CPA coaching fees: ₹1.5 – ₹2.5 lakhs

-

Includes:

-

Video lectures

-

Notes & question banks

-

Mock tests & revision support

-

Study material cost depends on the provider and access duration.

Total US CPA Course Fees (Estimated)

| Component | Approx Cost |

|---|---|

| Evaluation + Application | ₹25,000 – ₹30,000 |

| Exam Fees (4 papers) | ₹80,000 – ₹1,00,000 |

| International Testing | ₹48,000 – ₹60,000 |

| Coaching & Study Material | ₹1.5 – ₹2.5 lakhs |

| Total US CPA Course Fees | ₹3.5 – ₹5 lakhs |

Note: Costs may increase if exams are retaken.

Are US CPA Course Fees Worth It?

Despite the investment, US CPA course fees offer strong ROI due to:

-

Global recognition

-

High demand for US GAAP professionals

-

Faster course completion (12–18 months)

-

Lucrative salary prospects

Salary vs US CPA Course Fees (ROI Perspective)

-

India: ₹7–15 LPA

-

International roles: USD 70,000+ annually

Most candidates recover US CPA course fees within the first 1–2 years of employment.

Tips to Reduce US CPA Course Fees

-

Clear exams in the first attempt

-

Choose the right state board

-

Opt for bundled coaching packages

-

Plan exam slots strategically

Smart planning can significantly reduce overall US CPA course fees.

Final Thoughts

The US CPA course fees may seem high initially, but the long-term career benefits, global mobility, and salary growth make it a highly rewarding investment. With the right preparation strategy and financial planning, the US CPA course can be both affordable and career-transforming.