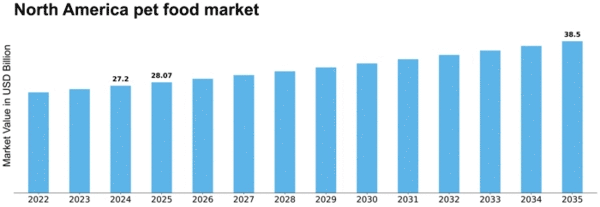

The North America Pet Food Market continues to demonstrate robust expansion fueled by shifting consumer preferences, rising rates of pet ownership, and increasing demand for premium, health-focused nutrition solutions. According to Market Research Future (MRFR), the North America pet food market size was estimated at USD 27.2 billion in 2024 and is projected to reach USD 38.5 billion by 2035, registering a compound annual growth rate (CAGR) of approximately 3.21% during the forecast period from 2025 to 2035.

A significant industry trend influencing the market landscape is the premiumization of pet nutrition. Pet owners in the United States and Canada are increasingly treating pets as family members, leading to a higher willingness to spend on nutritious, high-quality food options. This shift toward premium and functional foods reflects greater health consciousness among pet parents, who now actively seek products that support improved digestion, joint health, and overall wellness. Such wellness-oriented offerings are expected to expand at an accelerated pace, further reinforcing the growth trajectory of the pet food market in North America.

One of the key drivers of the North America pet food market is the increasing awareness of pet health and nutrition. Modern pet owners are not only focusing on basic feeding needs but are also seeking foods formulated with natural, organic, grain-free, or high-protein ingredients. This is particularly evident in the growth of niche categories such as raw diets and specialty formulations tailored to specific age groups, breeds, or health conditions. As consumers become more informed and discerning, demand for such customized nutrition solutions continues to rise.

Another important trend shaping North America pet food market dynamics is the expansion of e-commerce and online retail channels. With the convenience of home delivery and the ability to easily compare brands and product features, more pet owners are ordering food and treats online. E-commerce penetration has not only broadened product accessibility but has also helped smaller and specialty brands compete with established players by reaching niche audiences. This shift in distribution channels is expected to maintain strong momentum throughout the forecast period.

In terms of market segmentation, the North America pet food market encompasses a broad range of product types, including dry food, wet food, snacks and treats, raw food, and food supplements. Dry food continues to dominate due to its convenience and affordability, while wet and semi-moist options gain traction as pet owners look for more palatable and varied meal experiences for their pets. Snacks and treat segments are also experiencing rising demand, supported by trends in pet training, bonding, and reward-based feeding practices.

By animal type, dogs and cats represent the largest segments, with dog food accounting for a significant share of overall market revenue due to the larger dog population and higher per-capita spending on canine nutrition. Cat food, while slightly smaller in total value, is expected to grow rapidly as cat ownership rises and consumer interest in feline-specific nutrition strengthens. Other animal types such as birds, fish, and small mammals contribute meaningfully to the market as well, reflecting the diverse pet ownership landscape in North America.

Geographically, the United States dominates the North America pet food market share, supported by high disposable income, well-established retail infrastructure, and a deep culture of pet humanization. Canada is emerging as a rapidly growing market, driven by increased pet adoption rates and rising consumer interest in premium and natural pet food products. Mexico is also contributing to regional growth, albeit from a smaller base, as middle-class income expands and urbanization fosters greater adoption of companion animals.

The competitive landscape of the North America pet food market is marked by the presence of major global and regional players such as Nestlé Purina PetCare (US), Mars Petcare (US), Hill's Pet Nutrition (US), Diamond Pet Foods (US), and Blue Buffalo (US), among others. These companies continue to invest in product innovation, expanded distribution, and marketing strategies to capture growing demand and differentiate themselves in an increasingly crowded marketplace. Partnerships with retailers, strategic acquisitions, and expansions into online channels are common approaches used to strengthen market positioning.

Emerging market opportunities include subscription-based food delivery services, personalized nutrition plans using data analytics, and investment in sustainable packaging solutions to appeal to eco-conscious consumers. As pet owners place greater emphasis on convenience and environmental responsibility, brands that align with these values are likely to gain competitive advantage.

In conclusion, the North America pet food market is positioned for continued expansion through 2035, driven by evolving consumer preferences, premiumization trends, and diversified distribution channels. With sustained growth in pet ownership and a deeper focus on health and nutrition, the market is expected to remain resilient and responsive to both long-standing and emerging trends in the region.

Discover More Research Reports on Aerospace & Defense By Market Research Future: