Gunshot Detection System Market: Global Industry Analysis and Forecast (2025–2032)

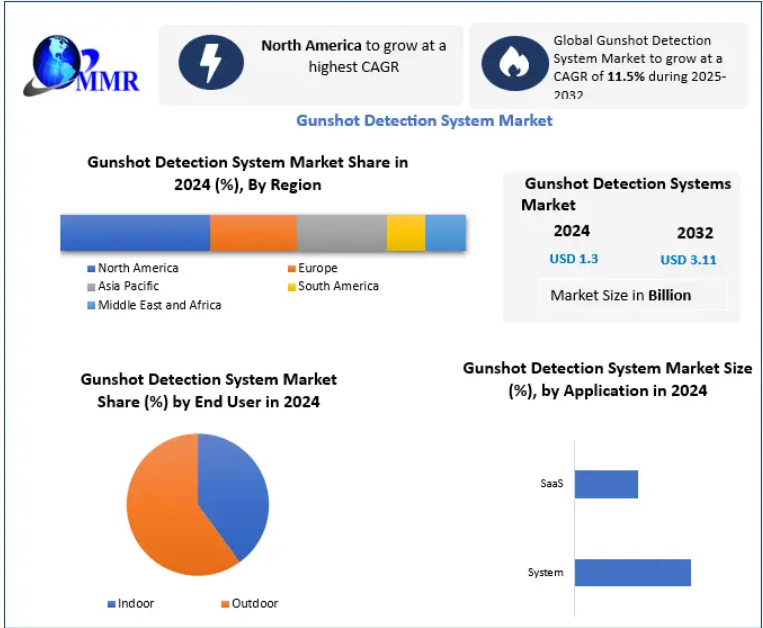

The Global Gunshot Detection System (GDS) Market was valued at USD 1.3 billion in 2024 and is projected to expand at a CAGR of 11.5% from 2025 to 2032, reaching nearly USD 3.11 billion by 2032. This robust growth is driven by rising concerns over public safety, increasing gun violence, and the growing adoption of smart city surveillance technologies worldwide.

Market Overview

A gunshot detection system is an advanced security solution that uses acoustic, optical, infrared, and GPS-enabled sensors to detect and locate firearm discharges in real time. These systems immediately alert law enforcement agencies, enhancing situational awareness and significantly reducing emergency response times. By enabling rapid intervention, GDS technologies play a crucial role in minimizing casualties and improving urban safety.

The market has gained strong traction due to escalating gun-related incidents in urban areas, schools, commercial hubs, and military zones. Governments across the globe are increasingly prioritizing investments in AI-enabled security infrastructure to strengthen homeland security and defense preparedness.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29340/

Market Drivers

Rising Gun Violence in Public and Educational Institutions

Gun-related incidents in schools, colleges, and universities have emerged as a major concern, particularly in the United States. According to FBI analyses of active shooter incidents, educational institutions account for over 22% of shooting cases, highlighting the urgent need for preventive surveillance solutions. Indoor and outdoor gunshot detection systems provide instant alerts during active shooter scenarios, enabling faster lockdowns, emergency response coordination, and life-saving interventions.

Smart City Initiatives and Urban Surveillance Expansion

The rapid development of smart cities has accelerated the deployment of fixed gunshot detection systems across metropolitan regions. These systems integrate seamlessly with city-wide surveillance networks, traffic control systems, and emergency response platforms, making them an essential component of modern urban infrastructure.

Market Restraints

High Installation and Maintenance Costs

Despite their benefits, gunshot detection systems involve substantial initial investments. The requirement for widespread sensor deployment across large geographic areas, combined with ongoing system maintenance and monitoring costs, can limit adoption—particularly for smaller municipalities and developing economies.

Technological Advancements and Opportunities

AI, IoT, and Cloud-Based Innovations

Technological progress in artificial intelligence, Internet of Things (IoT), and cloud computing is transforming the gunshot detection landscape. Next-generation systems offer plug-and-play sensor deployment, SaaS-based monitoring platforms, and self-learning AI algorithms that continuously enhance detection accuracy. These innovations significantly reduce installation complexity, operational costs, and human intervention requirements.

Cloud-enabled platforms also allow real-time data access through mobile and web applications, making system management more efficient for law enforcement agencies. As a result, gunshot detection technology is becoming increasingly accessible, scalable, and cost-effective.

Impact of COVID-19

The COVID-19 pandemic temporarily disrupted the gunshot detection system market, particularly in the commercial segment. Lockdowns, travel restrictions, and budget reallocations led to delayed installations and reduced project expansions. However, as urban activity and public safety investments rebound, the market has regained momentum, with long-term demand expected to remain strong.

Segment Analysis

By Product

- Commercial

- Defense

The commercial segment is anticipated to grow at the fastest rate during the forecast period, driven by rising security requirements in smart cities, educational campuses, and corporate facilities. Defense applications continue to witness steady demand due to increasing border surveillance and military modernization programs.

By Type

- Fixed Installation

- Vehicle Mounted

- Soldier Mounted

The fixed installation segment dominated the market in 2024, owing to its extensive use in urban environments, airports, and public spaces. These systems offer continuous monitoring, high accuracy, and cost efficiency for large-area coverage.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29340/

Regional Insights

North America

North America held the largest market share in 2024 and is expected to maintain its dominance through 2032. The United States leads regional growth due to high firearm-related crime rates, strong government support, and widespread deployment across major cities such as Chicago, New York, and Los Angeles. Defense applications further strengthen the market, with military-grade systems increasingly deployed across borders and overseas facilities.

Competitive Landscape

The global gunshot detection system market is moderately consolidated, with key players focusing on AI-driven innovation, smart city integration, and strategic defense partnerships.

Key Market Players Include:

- ShotSpotter Inc. (SoundThinking Inc.)

- Raytheon Technologies Corporation

- Safran Electronics & Defense

- Rheinmetall AG

- Thales Group

- QinetiQ

- AmberBox Gunshot Detection

ShotSpotter leads the civilian urban segment, while Raytheon and Safran dominate military and defense applications. Strategic collaborations and geographic expansion remain key competitive strategies.

Market Trends

| Trend | Description |

| AI Integration | Enhanced accuracy and faster gunfire localization |

| Smart City Growth | Increasing adoption in urban surveillance networks |

| Real-Time Intelligence | Immediate alerts for rapid law enforcement response |

Key Developments

- March 2024: ShotSpotter expanded its detection network across multiple U.S. cities.

- August 2024: Safran partnered with EU defense agencies for UAV-based acoustic surveillance.

- January 2025: AmberBox introduced integrated indoor security detection solutions.

- March 2025: Rheinmetall secured a major vehicle-mounted GDS contract in Eastern Europe.

Conclusion

The global gunshot detection system market is poised for sustained growth, driven by rising public safety concerns, technological innovation, and increasing smart city adoption. As AI-powered, cloud-based systems become more affordable and scalable, gunshot detection solutions are expected to become a standard component of urban and defense security infrastructures worldwide.