Market Overview:

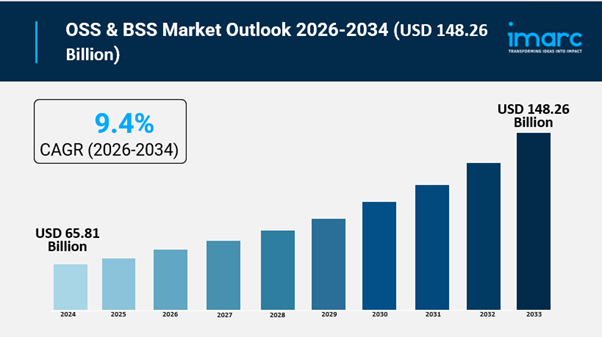

The OSS & BSS market is experiencing rapid growth, driven by rollout of 5g infrastructure and network slicing, rapid transition to cloud-native architectures, and government-led digital transformation initiatives. According to IMARC Group's latest research publication, "OSS & BSS Market Size, Share, Trends and Forecast by Component, OSS & BSS Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region 2026-2034", The global OSS & BSS market size was valued at USD 65.81 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 148.26 Billion by 2034, exhibiting a CAGR of 9.4% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/oss-bss-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the OSS & BSS Market

- Rollout of 5G Infrastructure and Network Slicing

The global expansion of 5G technology is a primary driver for the modernization of operational and business support systems. Unlike previous generations, 5G requires dynamic resource allocation and the ability to manage complex network slicing, where different virtual networks are created for specific use cases like autonomous driving or industrial automation. This complexity necessitates advanced OSS solutions for real-time orchestration and BSS platforms capable of usage-based charging. In 2024, the global OSS BSS market was valued at approximately USD 68.79 billion, with a significant portion of growth attributed to the urgent need for 5G monetization frameworks. Telecom giants like Ericsson have recently signed long-term agreements, such as a five-year extension with Ooredoo Qatar, specifically to integrate radio access technologies with sophisticated 5G management systems. These systems allow operators to transition from selling simple data plans to offering specialized, high-value network services.

- Rapid Transition to Cloud-Native Architectures

Communication Service Providers (CSPs) are increasingly moving away from rigid, on-premise legacy systems toward flexible, cloud-native OSS and BSS environments. This shift is driven by the need for scalability and a faster time-to-market for digital services. Cloud-based deployments currently represent a dominant share of the market, with estimates placing the public cloud subsegment at nearly 55% of the total cloud OSS BSS solution space. By utilizing microservices and containerization, companies can update individual billing or provisioning modules without disrupting the entire network. Recent activities include the collaboration between Prodapt and Amazon Web Services (AWS) to accelerate digital transformation for carriers. These cloud-first strategies enable operators to handle massive traffic surges and implement "zero-touch" automation, which reduces manual intervention in service delivery and significantly lowers the total cost of ownership for large-scale enterprise infrastructures.

- Government-Led Digital Transformation Initiatives

National policies aimed at enhancing digital connectivity and infrastructure are providing a robust tailwind for the OSS and BSS industry. In India, the "Digital India" and "Smart Cities Mission" have prompted state-owned and private telecom operators like BSNL and Reliance Jio to modernize their backend frameworks to support urban management and rural broadband. The Government of India has also mandated the adoption of open-source software (OSS) in e-governance systems to ensure strategic control and transparency. Similarly, in Europe, the implementation of GDPR and other regulatory frameworks has forced enterprises to adopt secure, compliant platforms that integrate seamlessly with automated network operations. These initiatives often involve large-scale investments in infrastructure; for instance, the European market size reached USD 21.15 billion in 2025, supported by regional efforts to achieve 100% 5G coverage and highly resilient telecom networks across member nations.

Key Trends in the OSS & BSS Market

- Integration of Generative AI and AIOps

Artificial Intelligence is no longer just a peripheral tool; it is becoming the central "nervous system" of modern OSS and BSS platforms. Through the application of Generative AI, operators can now automate hyper-personalized marketing offers and instant configuration via natural language commands. At the 2025 Global Telecoms Awards, Huawei and Safaricom were recognized for BSS/OSS modernization that leverages AI to shorten time-to-market from months to mere days. These AI-driven systems achieve configuration accuracy rates as high as 90%, significantly outperforming manual methods. Furthermore, AIOps (Artificial Intelligence for IT Operations) is being utilized for predictive maintenance, allowing networks to identify and resolve faults before they impact the end user. This trend towards "Self-X" functions enables autonomous network healing and dynamic monitoring of Net Promoter Scores (NPS) to enhance the overall quality of experience.

- Rise of Digital Marketplaces and Partner Ecosystems

Modern BSS is evolving into an open ecosystem that supports "beyond-connectivity" services, such as fintech, media, and IoT. Telecom operators are increasingly adopting API-driven architectures, such as the TM Forum’s Open Digital Architecture, to integrate third-party services into their billing platforms. This allows carriers to act as digital aggregators, offering customers a single invoice for data, streaming subscriptions, and smart home services. For example, T-Mobile has successfully utilized an open API platform to launch integrated services that drive incremental revenue and improve customer loyalty. This trend is particularly evident in the growth of the BSS segment, which accounts for over 55% of the total market share due to its role in managing diverse monetization models. By creating these digital marketplaces, operators can diversify their revenue streams and compete with global "over-the-top" (OTT) service providers.

- Expansion of IoT and eSIM Management

The proliferation of Internet of Things (IoT) devices is necessitating a specialized approach to OSS and BSS, focusing on massive-scale connectivity and remote provisioning. The adoption of eSIM and iSIM technology allows for the activation of thousands of devices without physical SIM swaps, which is essential for global logistics and smart manufacturing. Current market trends show a heavy focus on unified dashboards that manage multiple carriers across different regions from a single interface. Companies like Telkomsel have implemented spatio-temporal digital twins to monitor real-time service orchestration for millions of connected endpoints. These platforms handle complex, metered billing and rapid service launches for diverse IoT applications, ranging from smart watches to industrial sensors. This trend ensures that as the number of connected devices grows, the underlying support systems can scale efficiently while maintaining precise usage tracking and fraud detection.

We explore the factors propelling the oss & bss market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the OSS & BSS Industry:

- Amdocs

- Comarch SA

- Comviva

- CSG Systems, Inc.

- Infosys Limited

- Mavenir

- Netcracker

- Nokia Corporation

- Optiva, Inc.

- Suntech S.A

- Telefonaktiebolaget LM Ericsson

OSS & BSS Market Report Segmentation:

By Component:

- Solution

- Services

In 2024, the solution segment leads the market with 62.4% share, driven by billing and revenue management systems, with Netcracker Technology recognized for its innovative OSS/BSS solutions.

By OSS & BSS Solution Type:

- Network Planning and Design

- Service Delivery

- Service Fulfillment

- Service Assurance

- Billing and Revenue Management

- Network Performance Management

- Customer and Product Management

- Others

Network planning and design dominate with 19.3% market share in 2024, enabling effective infrastructure planning and peak performance, as highlighted by Netcracker's top vendor position.

By Deployment Mode:

- On-premises

- Cloud-based

The on-premises segment leads with 62.4% market share in 2024, driven by data security and compliance concerns, with Amdocs collaborating with Microsoft to enhance cloud-native solutions.

By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold a 62.4% market share in 2024 due to their substantial resources and need for scalable OSS/BSS solutions that manage complex networks effectively.

By Industry Vertical:

- IT and Telecom

- BFSI

- Media and Entertainment

- Retail and E-Commerce

- Others

The IT and telecom sector leads with 61.8% market share in 2024, utilizing OSS/BSS solutions for operational efficiency and customer experience, exemplified by Vivo's automation of its B2B processes.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

In 2024, North America dominates the OSS/BSS market with over 35.6% share, driven by advanced technology and a focus on digital transformation, as seen in Etiya's support for Fizz's expansion in Canada.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302