Market Overview:

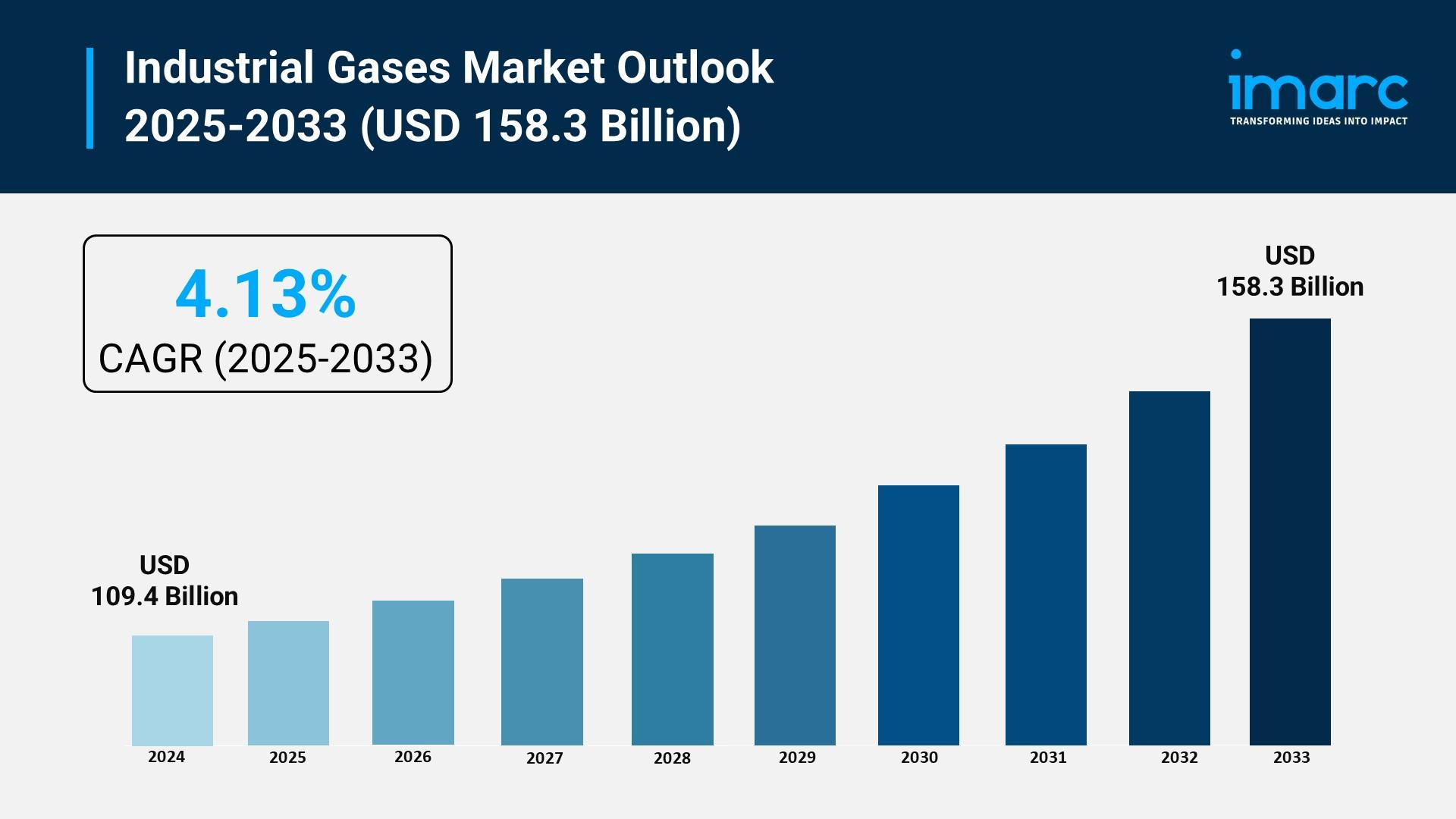

The industrial gases market is experiencing rapid growth, driven by expanding medical and pharmaceutical requirements, surge in green hydrogen and decarbonization initiatives, and growth of high-tech manufacturing and electronics. According to IMARC Group’s latest research publication, “Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2025-2033”, the global industrial gases market size reached USD 109.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 158.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.13% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/industrial-gases-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Industrial Gases Market

- Expanding Medical and Pharmaceutical Requirements

The healthcare sector has emerged as a primary driver for the industrial gases market, particularly due to the increasing necessity for medical-grade oxygen, nitrous oxide, and nitrogen. As of January 2026, the global demand for high-purity oxygen remains critical for respiratory therapies and surgical procedures, with the healthcare segment accounting for approximately 27% of the total market revenue. Pharmaceutical companies are also scaling up their use of nitrogen for blanketing and purging to prevent oxidation in life-saving drugs and vaccines. In early 2025, Air Liquide underscored this growth by securing contracts with 20 major European hospitals to provide low-carbon medical gases. Furthermore, the rising global elderly population and expanded healthcare access initiatives in developing nations have solidified the role of specialty gases in diagnostic imaging and cryopreservation, ensuring a steady increase in consumption volumes across clinical and laboratory settings worldwide.

- Surge in Green Hydrogen and Decarbonization Initiatives

The global shift toward sustainable energy is significantly accelerating the demand for hydrogen, which is now positioned as a cornerstone of the clean energy transition. Government policies are playing a pivotal role; for instance, India’s National Green Hydrogen Mission has targeted a production capacity of 5 million metric tons by 2032, supported by 125 gigawatts of renewable energy. Major corporate players are matching these ambitions, with Reliance Industries investing approximately 75,000 crore INR in green hydrogen infrastructure, including a massive facility in Jamnagar. In the transportation sector, hydrogen fuel cells are being integrated into heavy-duty trucks and buses, a move supported by pilot projects launched in March 2025. This transition is not only boosting hydrogen volume but is also creating a ripple effect in the demand for other industrial gases like oxygen and nitrogen, which are essential for the operation of large-scale electrolysis and carbon capture systems.

- Growth of High-Tech Manufacturing and Electronics

The electronics industry’s rapid expansion is fueling a massive requirement for ultra-high-purity gases essential for semiconductor fabrication and display panel manufacturing. With global semiconductor sales reaching 627.6 billion USD recently, the need for precision gases like nitrogen, argon, and specialized fluorinated compounds has never been higher. These gases are indispensable for processes such as chemical vapor deposition and plasma etching, where even microscopic impurities can ruin a wafer. The proliferation of artificial intelligence, 5G technology, and Internet of Things (IoT) devices is forcing manufacturers to build more advanced "fabs" in regions like Taiwan, South Korea, and the United States. In these facilities, nitrogen is often the most consumed gas, used for maintaining inert atmospheres during assembly. The manufacturing sector as a whole continues to dominate the market share, driven by these high-tech applications and the continued modernization of industrial assets globally.

Key Trends in the Industrial Gases Market

- Expansion of On-Site Gas Production

A significant shift is occurring as industrial consumers move away from traditional bulk liquid deliveries toward on-site gas generation. This trend is driven by the desire to reduce transportation costs, minimize supply chain disruptions, and lower the carbon footprint associated with heavy trucking. By installing modular cryogenic air separation plants or Pressure Swing Adsorption (PSA) systems directly at their facilities, companies in the steel, chemical, and electronics sectors can secure a continuous, reliable flow of high-purity nitrogen or oxygen. In 2026, industries are increasingly adopting hybrid systems that combine on-site production with liquid backup storage to ensure 100% uptime. This model allows manufacturers to tailor the gas purity and pressure to their specific operational needs while avoiding the price volatility often associated with the merchant gas market and external logistics.

- Digital Transformation and AI-Driven Operations

The integration of the Industrial Internet of Things (IIoT) and Artificial Intelligence is revolutionizing how industrial gases are produced, distributed, and monitored. Leading gas suppliers are deploying smart sensors and predictive analytics to optimize the energy-intensive air separation process, which is expected to yield energy savings of 5% to 10% in modern facilities. AI-driven platforms now allow for real-time monitoring of gas consumption patterns at customer sites, enabling "smart replenishment" where deliveries are scheduled automatically before inventory runs low. Furthermore, digital twins of gas plants are being used to simulate maintenance needs, reducing unplanned downtime. This digital evolution is also transforming the workforce, as technicians must now balance traditional cryogenic expertise with data science skills to manage the complex, automated networks that define the modern gas supply chain.

- Integration of Carbon Capture and Circular Economy Models

Environmental, Social, and Governance (ESG) mandates are pushing the industrial gases industry to adopt circular economy principles, specifically through Carbon Capture, Utilization, and Storage (CCUS). Instead of viewing carbon dioxide as a waste byproduct, companies are increasingly capturing it from industrial emissions and repurposing it for food carbonation, enhanced oil recovery, or as a feedstock for green methanol. In January 2026, the Government of India expanded its Carbon Credit Trading Scheme to include 208 additional high-polluting entities, incentivizing the adoption of these capture technologies. This trend is leading to the development of "integrated energy stations" that offer conventional fuels alongside hydrogen and carbon-capture services. By treating CO2 as a valuable commodity, the industry is aligning its growth with global net-zero targets while creating new revenue streams from emissions that were previously unrecovered.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging industrial gases market trends.

Leading Companies Operating in the Industrial Gases Industry:

- Air Liquide S.A.

- Linde Group

- Air Products and Chemicals, Inc.

- Airgas, Inc.

Industrial Gases Market Report Segmentation:

By Type:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

Nitrogen dominates the market due to its versatile applications in preservation and purging, safety advantages, and ongoing production technology advancements enhancing purity levels.

By Application:

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Manufacturing leads the segment as industrial gases are essential for welding, cutting, and process optimization across multiple production industries.

By Supply Mode:

- Packaged

- Bulk

- On-site

Packaged gases hold significant share owing to their portability, convenience, and wide usage across diverse industrial and healthcare applications.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific accounts for the largest share, driven by rapid industrialization, manufacturing growth, and expanding healthcare infrastructure across emerging economies.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302