Market Overview:

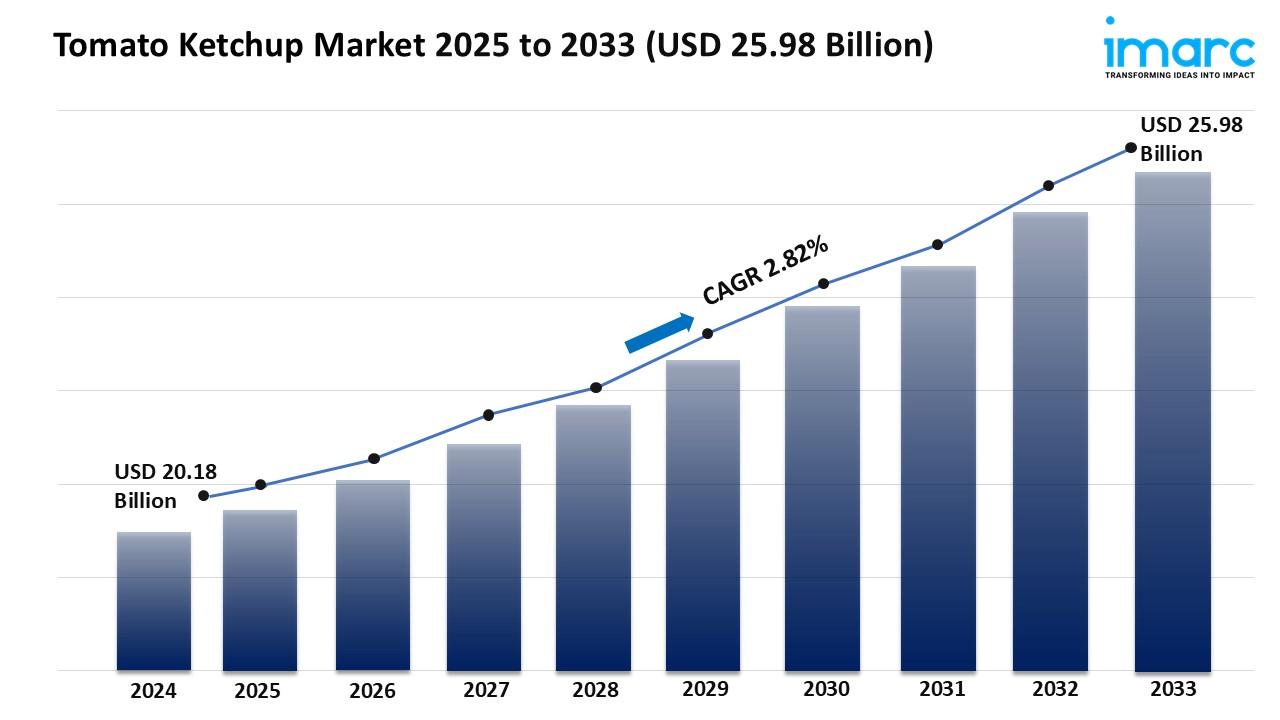

The tomato ketchup market is experiencing rapid growth, driven by expansion of global quick service restaurants (QSRs), government support for food processing infrastructure, and rising demand for convenience and ready-to-eat foods. According to IMARC Group's latest research publication, "Tomato Ketchup Market Size, Share, Trends and Forecast by Type, Packaging, Distribution Channel, Application, and Region, 2025-2033", the global tomato ketchup market size was valued at USD 20.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.98 Billion by 2033, exhibiting a CAGR of 2.82% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, flavor innovation boom, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/prefeasibility-report-on-a-tomato-ketchup-manufacturing-plant/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Tomato Ketchup Market

- Expansion of Global Quick Service Restaurants (QSRs)

The rapid expansion of Quick Service Restaurant (QSR) networks across both developed and emerging economies is a primary catalyst for the tomato ketchup market. International franchises such as Domino’s Pizza and McDonald's are significantly increasing their footprint, particularly in Asia-Pacific and Latin America, where Western-style fast food is gaining immense popularity. For instance, recent financial reports from major pizza chains highlighted a 5.9% growth in global retail sales, which directly correlates with the rising volume of tomato-based condiments used for dipping and toppings. This institutional demand is further bolstered by government initiatives that encourage foreign food service investments to stimulate local economies and job creation. As these QSR chains standardize their menus globally, tomato ketchup has become a non-negotiable accompaniment, ensuring a consistent and robust demand stream from the commercial food service sector that complements traditional household consumption patterns.

- Government Support for Food Processing Infrastructure

Substantial government intervention and subsidies are playing a critical role in scaling the production and availability of tomato ketchup. In India, the Ministry of Food Processing Industries has implemented the "Operation Greens" scheme, which provides a 50% subsidy on the transportation and storage of tomatoes to reduce post-harvest losses and stabilize the supply chain. Such initiatives help manufacturers maintain consistent production levels despite seasonal volatility in raw material prices. Furthermore, the supportive policy environment in various nations is facilitating the establishment of advanced manufacturing plants equipped with modern pulping and pasteurization technology. These government-backed infrastructure improvements allow the food processing sector to expand into rural markets, making value-added products like ketchup more accessible to a broader demographic. By strengthening the linkage between farmers and processors, these policies ensure that the industry can meet the rising global appetite for processed condiments.

- Rising Demand for Convenience and Ready-to-Eat Foods

The accelerating pace of modern urban life has led to a significant reliance on convenience and ready-to-eat (RTE) food products, which serves as a major engine for ketchup consumption. As dual-income households become the norm, consumers are increasingly seeking time-efficient meal solutions that require minimal preparation. Tomato ketchup is frequently utilized as an instant flavor enhancer for these pre-packaged meals, sandwiches, and snacks. Data suggests that in some European regions, the average per capita intake of ready-to-eat food has reached 19 kilograms annually, providing a consistent platform for condiment growth. Manufacturers are responding to this "on-the-go" lifestyle by innovating with portable and user-friendly packaging, such as single-serve sachets and squeezable pouches with nozzle packs. This shift toward convenience is not only boosting retail sales but is also encouraging household consumers to stockpile versatile condiments that have a long shelf life and provide immediate culinary utility.

Key Trends in the Tomato Ketchup Market

- Clean Label and Health-Focused Reformulation

A significant shift toward health and wellness is driving a "clean label" trend in the ketchup industry. Modern consumers are increasingly wary of high sugar and sodium content, leading brands to reformulate their classic recipes with natural alternatives. Leading manufacturers are now introducing variants that utilize non-GMO tomatoes and natural sweeteners like agave or date syrup instead of high-fructose corn syrup. For example, some organic ketchup lines have seen sales growth of up to 18% following targeted campaigns that emphasize the absence of artificial preservatives and synthetic additives. This trend is further reinforced by updated regulatory standards, such as the FDA’s criteria for "healthy" labeling, which encourages companies to reduce added sugars. By focusing on transparency and nutrient density—highlighting antioxidants like lycopene—brands are successfully appealing to fitness-oriented and wellness-conscious shoppers who previously avoided processed condiments.

- Sustainable and Eco-Friendly Packaging Innovations

Environmental sustainability has moved from a niche concern to a mainstream requirement, prompting major innovations in how ketchup is packaged and delivered. To address the growing plastic waste crisis, companies are transitioning away from traditional multi-layer plastics toward fully recyclable PET bottles and biodegradable sachets. Some innovative brands have even moved to laminated, squeezable nozzle packs that minimize material waste and eliminate the need for additional cutlery during "on-the-go" consumption. This trend is driven by consumer preferences for eco-conscious brands, with some companies reporting that 73% of their audience values sustainable packaging as a key purchasing factor. Furthermore, manufacturers are experimenting with circular economy models, such as using pear or other fruit leftovers that would otherwise go to waste to create unique, sustainable flavor bases. These eco-friendly initiatives help brands differentiate themselves in a crowded market while aligning with global environmental goals.

- Premiumization and Gourmet Flavor Diversification

The market is witnessing a distinct move toward "premiumization," where consumers are willing to pay a higher price for artisanal and exotic flavor profiles. Moving beyond the standard sweet-and-tangy profile, the industry is seeing a surge in fusion-flavored ketchups, including roasted garlic, spicy tabasco, habanero, and even pickle-flavored variants. For instance, the launch of a pickle-flavored ketchup in early 2024 aimed to capitalize on the fact that over 70% of certain consumer demographics enjoy the taste of pickles. This trend also includes "gourmet" applications, where brands use premium ingredients like San Marzano tomatoes or balsamic vinegar to simulate a restaurant-quality dining experience at home. By offering limited-edition jars and celebrity-endorsed collaborations, manufacturers are transforming a basic pantry staple into a high-end culinary accessory that appeals to "adventurous eaters" and the younger Gen Z and Millennial demographics.

Leading Companies Operating in the Global Tomato Ketchup Industry:

- Bolton Group S.r.l.

- Campbell Soup Company

- Conagra Brands Inc

- Del Monte Food Inc.

- General Mills Inc.

- Lee Kum Kee Company Limited

- Nestlé S.A.

- Premier Foods plc

- Sky Valley & Organicville (Litehouse Inc.)

- Tate & Lyle plc

- The Kraft Heinz Company

- Unilever Plc

Tomato Ketchup Market Report Segmentation:

By Type:

- Flavored

- Regular

- Others

Regular tomato ketchup dominates the market in 2024 with 65.4% share due to its versatility and appeal across various foods.

By Packaging:

- Pouch

- Bottle

- Others

Bottles lead the packaging market with 57.6% share in 2024, offering convenience, control, and better protection for the product.

By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets account for 45.0% of the market in 2024, providing a diverse range of products and competitive pricing for consumers.

By Application:

- Household

- Commercial

- Others

Tomato ketchup is a staple in households and commercial spaces, widely used for a variety of dishes due to its broad appeal.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the largest market share at 35.7% in 2024, driven by cultural preferences and the strong presence of iconic ketchup brands.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302