Texas is a hotspot for experts seeking career growth, competitive salaries, and a business-friendly environment. With booming industries in technology, energy, healthcare, and executive leadership, job opportunities are plentiful. However, expertise your actual take-home pay is crucial, even in a state with no income tax. That’s where a paycheck calculator Texas becomes an essential tool.

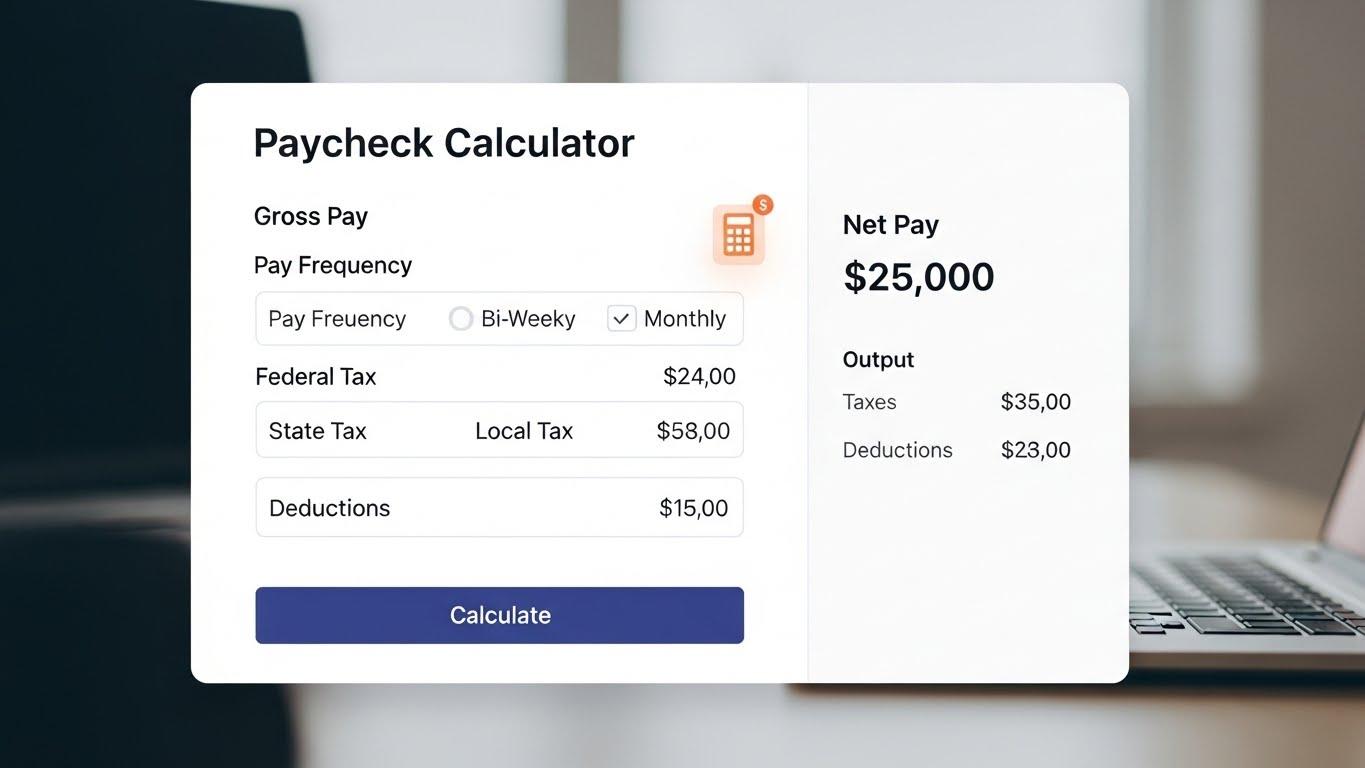

Many employees focus on gross revenue while evaluating offers, but gross earnings doesn’t reflect your net pay. Federal taxes, Social Security, Medicare, and other deductions still apply. A paycheck calculator Texas enables you to see exactly what will land in your bank account, eliminating uncertainty and allowing smarter financial planning.

Why Use a Paycheck Calculator Texas

A paycheck calculator Texas gives a detailed breakdown of your income and deductions. It allows you to understand your net earnings so you can plan effectively.

Using a paycheck calculator Texas, you can calculate:

-

Federal income tax

-

Social Security and Medicare contributions

-

Health coverage and retirement deductions

-

Your final take-home pay

Even though Texas has no state income tax, federal and other deductions can significantly impact your paycheck. Using a paycheck calculator Texas ensures you know exactly what you’re earning, making it easier to budget, save, and invest accurately.

Understanding Texas Payroll

Texas’s low tax burden makes it an attractive destination for professionals, but payroll deductions still count. A paycheck calculator Texas lets you see:

-

How much of your income is deducted for taxes

-

How retirement or health plan contributions affect net income

-

The impact of bonuses, overtime, or commissions on your take-home pay

For high-earning professionals and executives, even small miscalculations can affect lifestyle decisions and financial planning. This makes accurate payroll calculation vital.

How Professionals Use Paycheck Calculators

Smart professionals and executives depend upon tools like a paycheck calculator Texas to make informed decisions. Accurate paycheck calculations help you:

-

Compare job offers realistically

-

Plan monthly expenses

-

Understand the real value of bonuses and incentives

-

Avoid surprises on payday

When you understand your actual take-home pay, you can plan financial decisions confidently, especially with guidance from an executive employment agency.

Executives and Complex Compensation Packages

Executive compensation often includes more than base salary. It can include performance bonuses, commissions, stock options, and additional benefits. Calculating net pay manually in these cases is challenging.

This is where combining a paycheck calculator Texas with guidance from a trusted executive employment agency becomes beneficial.

The Role of an Executive Employment Agency

A trusted executive employment agency does more than match applicants with employers. They provide strategic guidance on:

-

Market pay trends and benchmarks

-

Total compensation package evaluation

-

Negotiation strategies

-

Long-term career planning

In competitive industries, working with an executive employment agency ensures your career decisions are aligned with both professional growth and financial benefit. When paired with a paycheck calculator Texas, executives gain full clarity on their income and can make smarter moves.

Real-Life Example: Salary vs. Take-Home Pay

Imagine two executive job offers in Texas. On paper, they may appear similar, but after factoring in federal taxes, retirement contributions, and other deductions, net pay can vary significantly.

A paycheck calculator Texas highlights these differences immediately, allowing professionals to make informed choices. It eliminates guesswork and ensures that salary expectations align with reality.

Executives often rely on this clarity when considering promotions, new leadership roles, or relocation to Texas.

Financial Planning Starts with Transparency

Your paycheck forms the foundation of your financial life. It affects budgeting, savings, investments, and lifestyle choices. Without accurate calculations, planning becomes unpredictable.

A paycheck calculator Texas provides transparency and control. By understanding precisely what you are taking home, you can make smarter financial decisions and evaluate career opportunities confidently.

Aligning Career Growth with Financial Reality

Career success isn’t just about earning a higher salary—it’s about earning smart. Professionals who understand their net income make better, more confident decisions.

A professional executive employment agency provides insights into compensation trends, while a paycheck calculator Texas ensures that those insights are supported by accurate numbers. Together, they help professionals maximize value in their roles while planning for long-term financial security.

Final Thoughts

Texas offers outstanding career opportunities with competitive salaries and no state income tax. However, understanding your actual take-home pay is essential for making informed decisions.

A paycheck calculator Texas gives you the clarity you need to plan and budget effectively, while a trusted executive employment agency ensures your career moves are strategic and financially sound. Professionals who integrate these tools don’t gamble—they calculate, plan, and take control of their financial future.