Pyridine Prices: Global Trends, Regional Analysis, and Market Forecast

Executive Summary

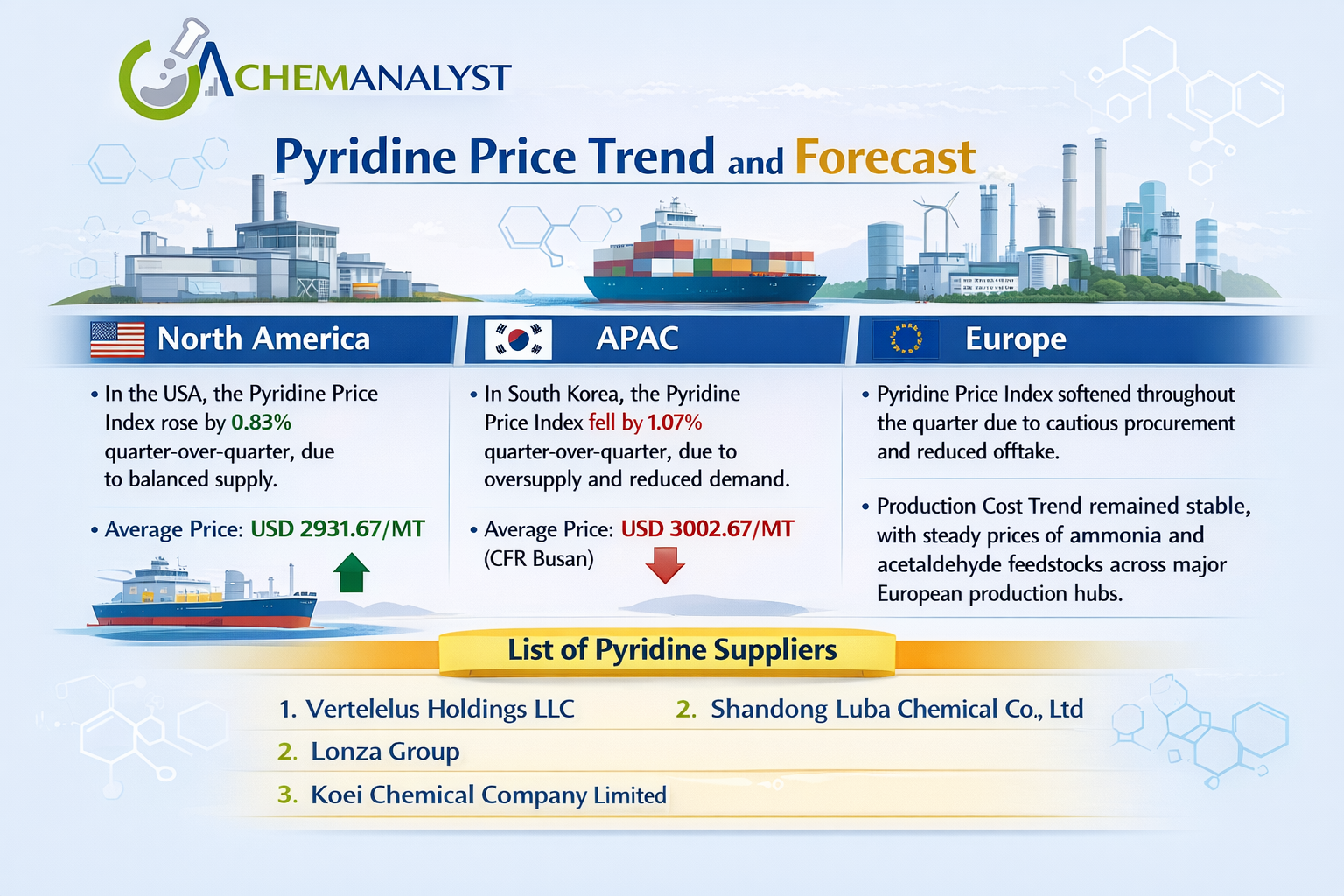

Pyridine, a key heterocyclic compound widely used in agrochemicals, pharmaceuticals, and industrial applications, experienced moderate price fluctuations across major regions in the last quarter. In North America, prices showed slight upward momentum due to balanced supply and stable inventories. Conversely, in APAC, oversupply and reduced demand drove prices lower, particularly in South Korea. European markets reflected cautious procurement behavior and softened offtake, despite stable production costs. This article provides a detailed overview of Pyridine price trends, factors influencing market dynamics, regional breakdowns, and a list of key suppliers to aid buyers and industry stakeholders in making informed decisions.

Introduction

Pyridine, with its chemical formula C₅H₅N, is a vital intermediate in the production of herbicides, insecticides, solvents, and pharmaceutical compounds. Given its widespread application, Pyridine pricing is closely monitored by manufacturers, traders, and end-users globally. Price trends are influenced by feedstock costs, production capacities, demand from downstream industries, and logistics constraints. Understanding regional movements and market drivers is essential for effective procurement strategies.

Get Real time Prices for Pyridine : https://www.chemanalyst.com/Pricing-data/pyridine-1172

Global Pyridine Price Overview

Globally, Pyridine prices displayed mixed trends in the last quarter. The North American market saw modest gains supported by balanced supply and stable inventory levels, while APAC faced price softening due to oversupply conditions. European markets reflected a cautious purchasing approach, with production costs remaining steady. The global Pyridine price landscape underscores the interplay between supply-demand balance, regional consumption patterns, and feedstock stability.

| Region | Quarter Price Index Change | Average Price (USD/MT) | Key Drivers |

| North America | +0.83% | 2931.67 | Balanced supply, stable inventories |

| APAC | -1.07% | 3002.67 | Oversupply, reduced demand |

| Europe | Softened | N/A | Cautious procurement, stable feedstock costs |

North America Pyridine Market Analysis

In the United States, the Pyridine Price Index recorded a slight increase of 0.83% quarter-over-quarter. The average price for the quarter was approximately USD 2931.67 per metric ton. This upward movement was largely supported by balanced supply levels and steady inventory positions, allowing suppliers to maintain price stability despite moderate fluctuations in demand.

Quarterly Movements

- The market remained relatively resilient, with buyers maintaining regular procurement schedules.

- Spot market activity was stable, as inventory levels at both production and distribution centers were sufficient to meet ongoing demand.

Supply Conditions

- Production capacities remained near full operation, supported by consistent feedstock availability.

- Logistics operations in North America were largely unimpacted, facilitating smooth distribution of Pyridine to end-users.

🌐 🔗 Track real time Pyridine Prices and market trends on ChemAnalyst: https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Pyridine

Procurement Behavior

- Buyers displayed cautious optimism, slightly increasing orders in anticipation of stable prices.

- Large-scale industrial users in pharmaceuticals and agrochemicals maintained strategic stockpiling.

APAC Pyridine Market Analysis

In APAC, South Korea witnessed a 1.07% decline in the Pyridine Price Index quarter-over-quarter. The average price on a CFR Busan basis was approximately USD 3002.67 per metric ton. Oversupply in regional production hubs, coupled with reduced demand from downstream sectors, pressured prices downward.

Quarterly Movements

- Spot market prices softened as suppliers sought to offload excess inventories.

- Reduced purchasing by agrochemical and pharmaceutical companies contributed to subdued market activity.

Supply Conditions

- Production volumes remained high, but weak offtake led to temporary inventory accumulation.

- Logistics and shipping operations were stable, though some delays occurred due to regional port congestion.

Procurement Behavior

- Buyers adopted a wait-and-see approach, delaying large orders in expectation of further price corrections.

- Contract negotiations reflected flexibility in pricing, allowing for volume discounts.

European Pyridine Market Analysis

European markets saw Pyridine prices soften throughout the quarter due to cautious procurement and reduced offtake from major downstream industries, including pharmaceuticals, agrochemicals, and specialty chemicals.

Quarterly Movements

- Prices remained under moderate pressure despite stable production costs.

- Seasonal demand trends, along with macroeconomic considerations, influenced procurement schedules.

Production and Cost Trends

- Pyridine production costs remained stable, underpinned by consistent ammonia and acetaldehyde feedstock prices.

- Energy costs normalized across European production hubs, mitigating any upward pricing pressure.

Procurement and Trade

- Buyers in Europe adopted a cautious procurement strategy, limiting exposure to volatile markets.

- Export volumes remained steady, but domestic demand recovery was gradual, reflecting broader industrial trends.

Factors Influencing Pyridine Prices

Pyridine pricing is determined by multiple interconnected factors:

- Feedstock Costs: Prices of ammonia, acetaldehyde, and other intermediates directly impact Pyridine production costs.

- Supply-Demand Balance: Overproduction can lead to oversupply in regional markets, while disruptions can tighten availability.

- Downstream Consumption: Demand from agrochemicals, pharmaceuticals, and specialty chemical industries drives quarterly price changes.

- Logistics and Trade Flows: Shipping capacity, port congestion, and international trade regulations influence delivered prices.

- Global Economic Conditions: Industrial activity, inflation, and currency fluctuations affect procurement decisions and price stability.

List of Key Pyridine Suppliers

Several suppliers dominate the global Pyridine market, providing competitive pricing, consistent quality, and reliable supply:

- Vertellus Holdings LLC – A leading North American manufacturer with a strong presence in pharmaceuticals and agrochemicals.

- Lonza Group – A global supplier offering high-purity Pyridine for specialty chemical applications.

- Shandong Luba Chemical Co., Ltd – A major Chinese producer catering to both domestic and international markets.

- Koei Chemical Company Limited – A Japanese supplier focused on high-quality chemical intermediates.

These companies are instrumental in shaping regional and global Pyridine pricing trends, offering both spot market supply and long-term contracts.

Market Outlook and Forecast

Looking ahead, the Pyridine market is expected to maintain moderate stability, with regional variations:

- North America: Prices may experience slight upward pressure due to steady demand from downstream industries and balanced supply levels.

- APAC: Oversupply conditions may persist in some markets, leading to limited price recovery unless downstream consumption picks up.

- Europe: Cautious procurement and stable feedstock costs are likely to sustain mild price corrections, while industrial demand gradually recovers.

Buyers and suppliers should closely monitor feedstock prices, production output, and macroeconomic trends to anticipate market movements and optimize procurement strategies.

Conclusion

Pyridine prices have shown a regionally diverse performance in the past quarter. North America experienced modest growth due to stable inventories, APAC faced price pressure from oversupply, and Europe saw cautious procurement temper market activity. Understanding these regional dynamics, along with production costs and downstream demand, is essential for informed decision-making in the Pyridine market. With major suppliers such as Vertellus Holdings, Lonza Group, Shandong Luba Chemical, and Koei Chemical shaping supply chains, industry participants can leverage real-time data and market intelligence to navigate pricing fluctuations effectively.

Get Real time Prices for Pyridine : https://www.chemanalyst.com/Pricing-data/pyridine-1172

Contact Us:

United States

Call +1 3322586602

420 Lexington Avenue, Suite 300, New York, NY,

United States, 10170

Germany

Call +49-221-6505-8833

S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Email: sales@chemanalyst.com

Website: https://www.chemanalyst.com/

LinkedIn: https://www.linkedin.com/company/chemanalyst/

Facebook: https://www.facebook.com/ChemAnalysts/

Twitter: https://x.com/chemanalysts

YouTube: https://www.youtube.com/@chemanalyst

Instagram: https://www.instagram.com/chemanalyst_