Healthcare Cold Chain Logistics Market: Ensuring Integrity in the Global Distribution of Life-Saving Therapies (2025–2032)

Market Overview

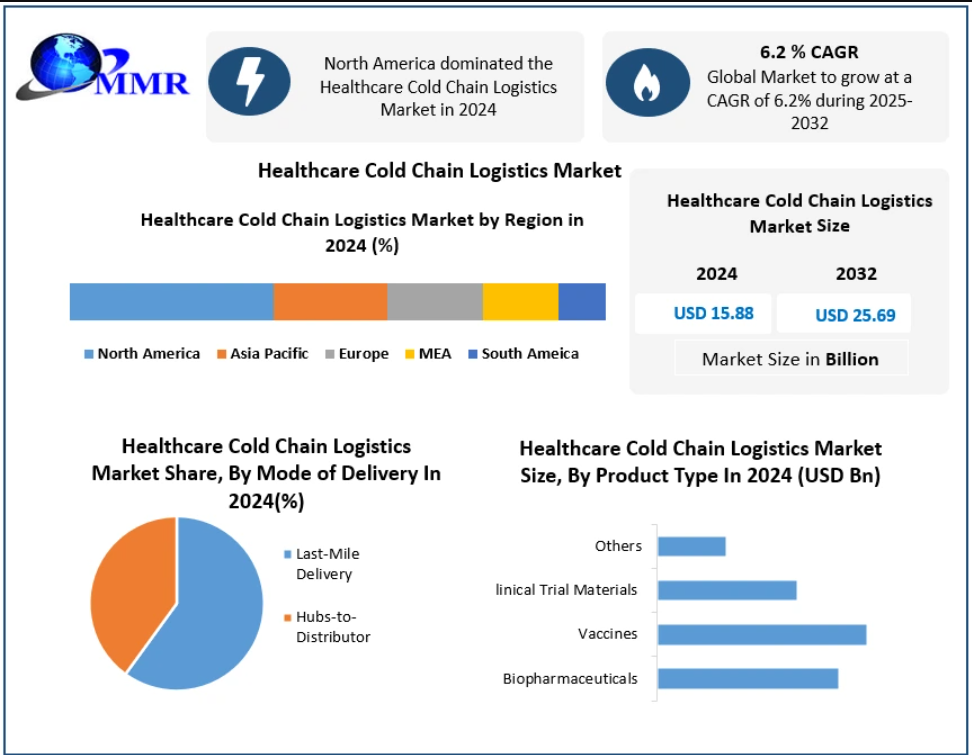

The Healthcare Cold Chain Logistics Market plays a pivotal role in safeguarding the quality, potency, and safety of temperature-sensitive medical products as they move from manufacturers to end users. In 2024, the market was valued at USD 15.88 billion, and it is projected to expand at a CAGR of 6.2% from 2025 to 2032, reaching approximately USD 25.69 billion by 2032.

Cold chain logistics in healthcare encompasses a highly specialized ecosystem of refrigerated storage facilities, temperature-controlled transportation, insulated packaging, and continuous monitoring systems. These components work together to preserve the efficacy of pharmaceuticals, biologics, vaccines, and clinical trial materials across increasingly complex global supply networks.

Rising production of biologics and vaccines, expansion of personalized medicine, and growing regulatory scrutiny are reshaping this market into a technology-intensive and compliance-driven industry. North America leads the global landscape, supported by mature infrastructure, strict regulatory enforcement, and a strong export base of temperature-sensitive pharmaceuticals.

Get a sample of the report@https://www.maximizemarketresearch.com/request-sample/83326/

Market Drivers

Expanding Biopharmaceutical and Vaccine Demand

The accelerating adoption of biologics, cell and gene therapies, and advanced vaccines has sharply increased reliance on cold chain logistics. Many of these therapies require precise thermal control across long distribution routes, making specialized logistics a mission-critical function rather than a support service.

Government Investments and Public Health Programs

Governments are strengthening healthcare cold chain infrastructure through investments in refrigerated warehouses, specialized fleets, and last-mile delivery systems. Immunization campaigns, pandemic preparedness initiatives, and public-private partnerships are creating sustained demand for reliable cold chain capacity, particularly in emerging and underserved regions.

Regulatory Stringency and Quality Assurance

Regulations such as Good Distribution Practices (GDP), WHO cold chain guidelines, and FDA compliance policies require continuous temperature validation, documentation, and traceability. Compliance obligations are driving healthcare companies to partner with specialized logistics providers capable of maintaining product integrity throughout the distribution lifecycle.

Emerging Opportunities

Digitalization and Smart Cold Chains

Digital technologies are transforming traditional cold chain operations into intelligent logistics networks.

- IoT sensors enable continuous temperature and humidity monitoring.

- AI-driven analytics optimize routing, predict risks, and reduce transit losses.

- Blockchain platforms enhance traceability and audit readiness across global supply chains.

- Automation and robotics improve accuracy and efficiency in high-volume cold storage facilities.

These innovations reduce spoilage, strengthen regulatory compliance, and provide competitive differentiation for service providers.

Growth in Emerging Healthcare Markets

Asia Pacific, Latin America, and parts of Africa are witnessing rapid healthcare infrastructure development. Expansion of vaccination programs, chronic disease management, and clinical research activity in these regions is creating long-term opportunities for cold chain logistics providers.

Market Restraints

Sustainability and Environmental Pressures

Cold chain logistics is energy-intensive and heavily dependent on refrigerants with environmental impact. Regulators and customers are pushing providers toward low-emission refrigeration, renewable energy warehouses, and reusable packaging. While environmentally beneficial, these transitions require high capital investment and complex operational redesigns.

High Infrastructure and Compliance Costs

Ultra-low temperature storage, validated equipment, trained personnel, and regulatory audits increase operational expenses. Smaller logistics players often struggle to meet the technical and financial thresholds required for large pharmaceutical contracts.

Segment Insights

By Service Type

Storage dominates the market due to the central role of temperature-controlled warehouses, ultra-low freezers, and cryogenic facilities in maintaining product stability. Long-term vaccine stockpiling, clinical trial material storage, and pandemic readiness programs further strengthen this segment.

Transportation and packaging remain critical but are structurally dependent on storage as the foundational layer of cold chain reliability.

By Product Type

Vaccines represent the largest segment, driven by global immunization programs and the rise of mRNA platforms requiring ultra-low temperature handling. Government funding, international aid programs, and mass vaccination campaigns continue to anchor vaccine distribution as the core demand generator in this market.

Get a sample of the report@https://www.maximizemarketresearch.com/request-sample/83326/

Regional Outlook

North America – Market Leader

North America leads due to advanced healthcare infrastructure, strict regulatory enforcement, and strong pharmaceutical exports. The region is also at the forefront of sustainable cold chain practices and digital integration. Growth in pharmaceutical e-commerce and home delivery models is creating new specialized logistics opportunities.

Asia Pacific – Fastest Growing Region

Asia Pacific is expected to record the highest growth rate during the forecast period. Expansion of healthcare infrastructure, rising biologics production, increasing mergers and acquisitions, and regulatory harmonization are key growth drivers.

India’s large-scale pharmaceutical manufacturing base and expanding cold storage ecosystem position it as a strategic hub for regional cold chain logistics.

Competitive Landscape

The market is characterized by strong global players with integrated infrastructure, regulatory expertise, and advanced digital platforms.

- DHL Supply Chain leads through its GDP-compliant Life Sciences Temp Control network and AI-enabled tracking systems.

- FedEx strengthens its position with predictive analytics platforms such as FedEx Surround and SenseAware.

- Kuehne + Nagel leverages its KN PharmaChain ecosystem with blockchain-enabled chain-of-custody solutions.

- UPS Healthcare stands out for large-scale vaccine distribution and priority handling through UPS Premier services.

These players compete on reliability, compliance, geographic reach, and technological sophistication rather than price alone.

Recent Industry Developments

- FedEx (2025) launched FedEx Surround in the UAE, providing AI-powered real-time risk detection and proactive intervention for sensitive healthcare shipments.

- CEVA Logistics (2024) introduced reusable cold-pack rental solutions, reducing single-use packaging waste while maintaining 2–8 °C stability for extended durations.

- Americold (2025) expanded capacity through a major Houston cold storage acquisition, strengthening its multi-industry temperature-controlled footprint.

Key Trends Shaping the Market

- Rapid growth in biologics, vaccines, and advanced therapies

- Increased adoption of IoT, AI, and blockchain for monitoring and traceability

- Expansion of cold chain infrastructure in emerging economies

- Heightened regulatory enforcement and documentation requirements

- Rising focus on sustainable refrigeration and reusable packaging

Market Outlook

The healthcare cold chain logistics market is transitioning from a traditional transport-storage function into a strategic pillar of global healthcare delivery. As biologics, personalized medicine, and advanced vaccines reshape therapeutic landscapes, the ability to preserve product integrity across continents will determine commercial success and public health outcomes.

With strong growth prospects, accelerating digital transformation, and increasing sustainability mandates, the market is positioned for steady expansion through 2032. Providers that successfully combine regulatory excellence, technological innovation, and environmental responsibility will emerge as long-term leaders in this mission-critical industry.