Managing finances is one of the most critical responsibilities of any business, regardless of size or industry. Accurate records, organized accounts, and clear financial reporting are the foundation of long-term stability and growth. Yet many business owners struggle to keep up with day-to-day financial tasks while also focusing on operations, customers, and strategy. This is where a professional Bookkeeper becomes an invaluable asset.

The role of bookkeeping in modern businesses

Bookkeeping goes far beyond recording income and expenses. It involves maintaining accurate financial records, reconciling accounts, tracking cash flow, and ensuring that financial data is always up to date. These tasks provide business owners with a clear picture of their financial health and allow them to make informed decisions.

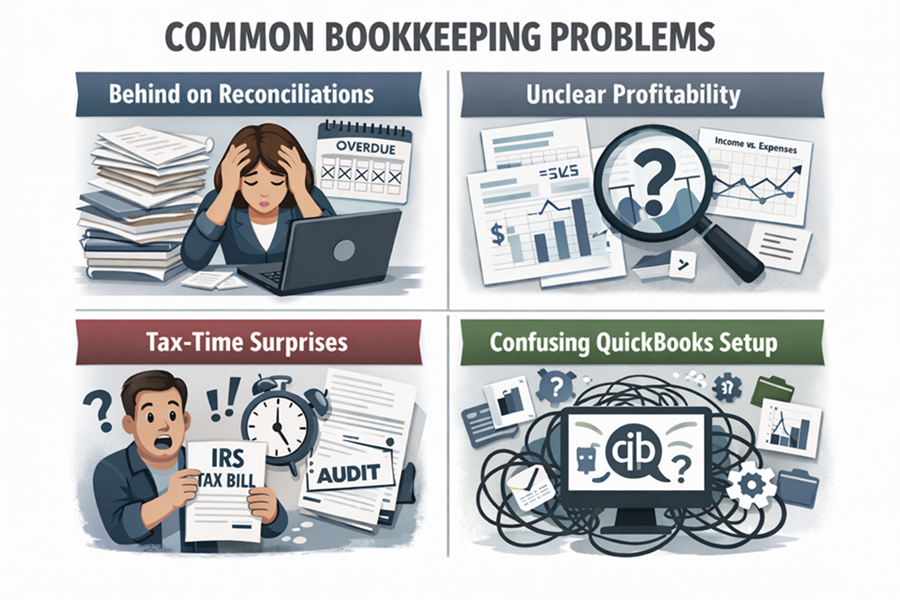

Without proper bookkeeping, businesses risk errors, missed payments, compliance issues, and financial confusion. Over time, small mistakes can accumulate and lead to serious financial problems.

Why accuracy matters

Accurate financial records are essential for understanding how a business is performing. They help identify profitable areas, uncover unnecessary expenses, and support strategic planning. When records are disorganized or incomplete, business owners may rely on guesswork instead of facts.

A professional bookkeeper ensures that every transaction is recorded correctly and consistently. This accuracy reduces the risk of costly errors and provides reliable data that can be used for budgeting, forecasting, and growth planning.

Saving time and reducing stress

Many entrepreneurs attempt to handle bookkeeping themselves, especially in the early stages of a business. While this may seem cost-effective at first, it often leads to frustration and lost time. Financial tasks can be time-consuming and require attention to detail, taking focus away from core business activities.

Hiring a bookkeeper allows business owners to concentrate on what they do best—running and growing their business. Knowing that financial records are being managed professionally provides peace of mind and reduces stress.

Supporting cash flow management

Cash flow is the lifeblood of any business. Even profitable companies can struggle if cash flow is not managed properly. Bookkeeping plays a key role in monitoring incoming and outgoing funds, tracking invoices, and managing expenses.

With accurate cash flow information, business owners can plan ahead, avoid shortages, and make timely financial decisions. A bookkeeper helps ensure that bills are paid on time and that customers are invoiced promptly, improving overall financial stability.

Compliance and financial organization

Staying compliant with financial regulations and reporting requirements is essential for avoiding penalties and legal issues. Proper bookkeeping ensures that records are organized and ready for audits, tax filings, and financial reviews.

A professional bookkeeper understands financial processes and maintains documentation in a structured way. This organization simplifies reporting and ensures that important financial information is always accessible when needed.

Better decision-making through financial clarity

Clear and accurate financial records empower business owners to make better decisions. Whether it’s expanding operations, hiring staff, adjusting pricing, or investing in new opportunities, financial data provides the insights needed to evaluate risks and rewards.

With up-to-date records, business owners can analyze trends, compare performance over time, and set realistic goals. This clarity supports sustainable growth and long-term success.

A scalable solution for growing businesses

As a business grows, its financial complexity increases. More transactions, more accounts, and more reporting requirements can quickly overwhelm internal resources. Professional bookkeeping services can scale alongside the business, adapting to changing needs without disruption.

This flexibility ensures that financial management remains efficient and accurate, even as the business evolves. Having a reliable bookkeeping system in place makes growth smoother and more manageable.

A smart investment, not an expense

Some business owners hesitate to outsource bookkeeping, viewing it as an unnecessary expense. In reality, professional bookkeeping is an investment that often pays for itself. By preventing errors, improving financial insight, and saving time, it adds measurable value to the business.

The cost of poor financial management—missed opportunities, penalties, and inefficiencies—often exceeds the cost of hiring a professional.

Building a strong financial foundation

Every successful business is built on a solid financial foundation. Bookkeeping provides the structure and clarity needed to support daily operations and future growth. It ensures that financial decisions are based on accurate information rather than assumptions.

By working with a professional, businesses gain confidence in their numbers and control over their financial future.

Conclusion

Financial organization is not optional for a successful business—it is essential. Accurate records, clear reporting, and effective cash flow management create stability and support growth. A professional bookkeeper provides the expertise and reliability needed to maintain this foundation.