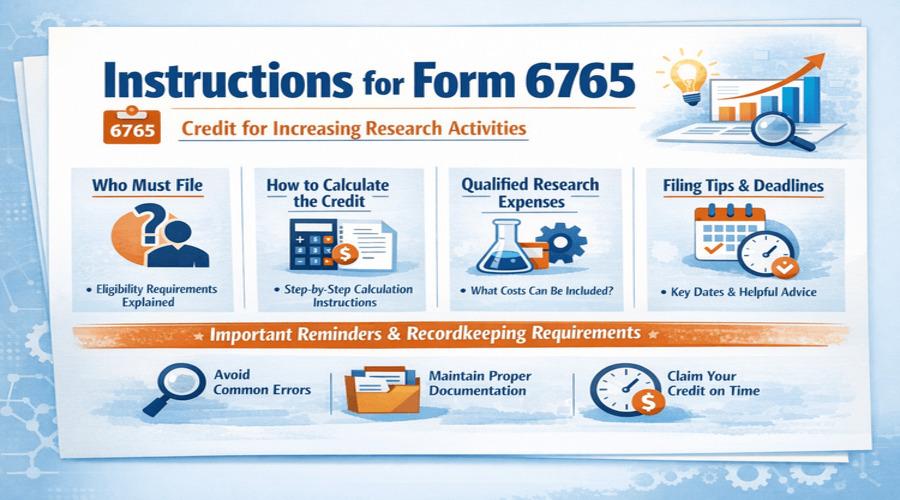

Form 6765 allows businesses to claim the Research & Development (R&D) tax credit by reporting qualified research expenses accurately using clear IRS Form 6765 instructions.

Filing taxes is stressful enough, but claiming R&D tax credits can feel like trying to solve a Rubik’s cube blindfolded. That’s why understanding the Instructions for Form 6765 is crucial. At BooksMerge, we help businesses navigate complex forms, avoid errors, and maximize credits. Call +1-866-513-4656 for expert assistance anytime.

Whether you’re a startup exploring payroll offsets or a small business owner calculating QREs, this guide breaks it down in a human, practical, and clear way.

Table of Contents

-

What is Form 6765 Used For?

-

Who Qualifies for R&D Tax Credit?

-

Understanding QREs (Qualified Research Expenses)

-

How to Calculate ASC vs Regular Method

-

Step-by-Step IRS Form 6765 Instructions

-

Form 6765 Instructions 2025 Updates

-

Documents Required for Form 6765

-

Can Startups Use Payroll Offset?

-

Common Mistakes to Avoid

-

BooksMerge Expertise for R&D Tax Filing

-

Conclusion

-

FAQs

What is Form 6765 Used For?

Form 6765 is the IRS form businesses use to claim the Research & Development (R&D) tax credit. It helps reduce federal tax liability by reporting qualified research expenses (QREs) incurred during the year.

Businesses can use Form 6765 Instructions to offset regular income taxes or payroll taxes, depending on eligibility. Using the form correctly ensures you claim all eligible credits while staying compliant with IRS rules.

Who Qualifies for R&D Tax Credit?

Not every business is eligible. Generally, to claim R&D credits you must:

-

Conduct activities aimed at improving or developing products, processes, or software

-

Incur qualified research expenses (QREs), including wages, supplies, and contract research costs

-

Operate within the United States or have U.S.-based research

Small businesses and startups can also qualify, even if they have limited taxable income. Many startups leverage the payroll offset option to apply credits against payroll taxes.

Fun Fact: About 60% of small businesses underestimate their R&D credits. You can see more in our Financial Literacy Statistics.

Understanding QREs (Qualified Research Expenses)

QREs are the core of R&D credit calculation. These include:

-

Employee wages for research activities

-

Supplies used in experimentation

-

Contract research costs

-

Rental or lease costs for computers used in R&D

QREs must be directly linked to qualified research. Guessing or inflating numbers can trigger IRS audits, so it’s best to follow IRS instructions closely.

Source: IRS Form 6765 instructions

How to Calculate ASC vs Regular Method

When calculating R&D credits, the IRS allows two methods:

-

Regular Credit Method: Uses a percentage of QREs above a base amount from prior years.

-

Alternative Simplified Credit (ASC) Method: Often easier for startups or businesses without historical records, calculating a flat 14% of QREs above 50% of average QREs from the past three years.

Choosing the right method depends on historical records, QRE trends, and your tax strategy.

Step-by-Step IRS Form 6765 Instructions

Filling out Form 6765 requires attention to detail. Follow these steps:

-

Part I – Regular Credit:

-

Enter base amounts, total QREs, and calculate the credit using IRS tables.

-

-

Part II – ASC Credit:

-

Enter QREs and compute the simplified credit.

-

-

Part III – Payroll Tax Credit for Startups:

-

Eligible small startups can apply credits against Social Security payroll taxes.

-

-

Part IV – Summary & Carryforward:

-

Report total credit and indicate carryforward amounts if credits exceed current tax liability.

-

Always keep detailed records. A completed Form 6765 example PDF can help visualize the process.

Form 6765 Instructions 2025 Updates

The IRS updated Form 6765 in 2025 to:

-

Clarify instructions for startups using payroll offsets

-

Provide more guidance on ASC vs Regular Method calculations

-

Improve formatting to reduce errors

Following irs form 6765 instructions ensures compliance and avoids delays. Always download the latest version from IRS.gov.

Documents Required for Form 6765

Before filling the form, gather:

-

Payroll records and wage details

-

Receipts for supplies used in R&D

-

Contracts or agreements for outsourced research

-

Financial statements showing expenses and revenue

Accurate documentation supports your claim and reduces audit risks.

Can Startups Use Payroll Offset?

Yes! Eligible startups can use R&D credits to offset Social Security payroll taxes if they:

-

Have less than $5 million in gross receipts

-

Are within the first five years of operation

This allows early-stage companies to benefit even if they do not owe federal income tax.

Common Mistakes to Avoid

-

Reporting non-qualified expenses as QREs

-

Miscalculating ASC vs regular method

-

Forgetting payroll tax offsets

-

Not attaching proper documentation

-

Using outdated Form 6765 versions

Avoid these pitfalls to maximize your credit and minimize IRS scrutiny.

BooksMerge Expertise for R&D Tax Filing

At BooksMerge, we specialize in helping businesses understand and file Form 6765 correctly. Our team:

-

Reviews QREs to maximize your R&D credit

-

Chooses the best credit calculation method

-

Ensures compliance with the latest IRS Form 6765 instructions

-

Provides step-by-step guidance for startups using payroll offsets

Call +1-866-513-4656 today to discuss your R&D credits with an expert.

Conclusion

Filing Form 6765 correctly requires understanding QREs, choosing the right credit method, and following IRS instructions closely. Accurate reporting saves money, reduces audit risks, and can provide substantial tax relief, especially for startups and small businesses.

Remember, using professional guidance ensures you don’t leave money on the table and stay compliant with the IRS.

FAQs

What is Form 6765 used for?

Form 6765 is used to claim the federal Research & Development (R&D) tax credit, reducing income or payroll taxes based on qualified research expenses.

Who qualifies for R&D tax credit?

Businesses conducting qualified research in the U.S., including startups and small businesses, can claim credits if they incur QREs.

What are QREs?

Qualified Research Expenses (QREs) include wages, supplies, contract research, and computer rental costs directly related to R&D activities.

How to calculate ASC vs regular method?

The regular method uses base QREs from prior years, while ASC applies a flat percentage of current QREs above 50% of the average of the past three years.

What documents are required?

Payroll records, receipts for supplies, contract agreements, and financial statements documenting QREs are required to support Form 6765.

Can startups use payroll offset?

Yes, eligible startups with less than $5 million in gross receipts in their first five years can offset R&D credits against Social Security payroll taxes.

What changed in 2025?

Form 6765 instructions were updated to clarify payroll offsets, ASC vs regular method guidance, and improve formatting to reduce errors.

Read Also: IRS form list