Global Smart Fleet Management Market Poised to Reach USD 854.65 Billion by 2030 as Digitalization Transforms Global Transportation

Global Market Outlook

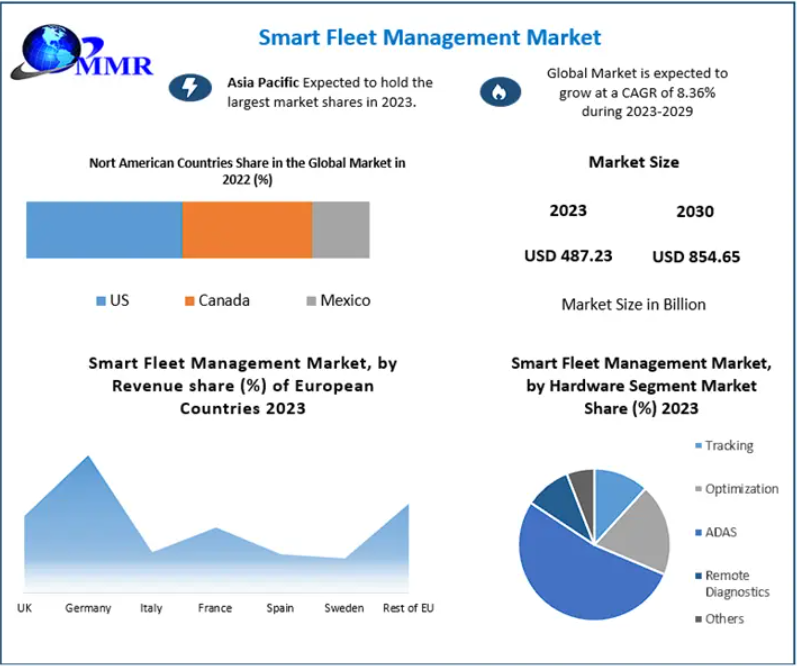

The Global Smart Fleet Management Market is undergoing a transformative phase, driven by rapid digitalization across transportation ecosystems. Valued at USD 487.23 billion in 2023, the market is projected to expand at a CAGR of 8.36% from 2024 to 2030, reaching USD 854.65 billion by 2030. The growth reflects rising demand for intelligent fleet operations, cost optimization, safety enhancement, and regulatory compliance across automotive, marine, and rolling stock sectors.

Smart fleet management solutions enable organizations to monitor, analyze, and optimize fleet performance through real-time data, leveraging technologies such as IoT, cloud computing, GPS, telematics, big data analytics, and artificial intelligence. These platforms enhance vehicle tracking, predictive maintenance, driver behavior analysis, fuel management, and operational decision-making—delivering measurable efficiency gains for fleet owners worldwide.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞:https://www.maximizemarketresearch.com/request-sample/3041/

Market Growth Drivers

Digital Transformation of Transportation and Logistics

The global transportation industry is rapidly transitioning toward connected and data-driven operations. Fleet operators increasingly rely on real-time diagnostics, remote monitoring, and analytics-enabled insights to reduce operational risks, control fuel costs, and improve delivery accuracy. With fuel accounting for nearly 25% of total fleet expenditure, smart fleet solutions have become essential tools for cost containment and margin protection.

Expansion of Shared Mobility and Fleet-Based Services

The accelerating adoption of shared mobility services—including vehicle leasing, ride-hailing, rentals, and subscription models—has significantly increased the size and complexity of managed fleets. Service providers are expanding and modernizing their vehicle portfolios, integrating connected, electric, and automated vehicles, which in turn fuels demand for advanced fleet management platforms capable of handling dynamic operational environments.

Real-Time Fleet Monitoring and Predictive Intelligence

Real-time vehicle and driver monitoring is emerging as a cornerstone of smart fleet management. Cloud-based platforms ingest data from onboard sensors, GPS modules, and telematics devices to provide actionable insights on routing efficiency, driver compliance, vehicle health, and asset utilization. The ability to proactively address maintenance issues and operational deviations is a key factor driving market adoption across industries.

Technology Innovation: ADAS Integration Reshaping Fleet Operations

The integration of Advanced Driver Assistance Systems (ADAS) within fleet management platforms represents a major technological shift. ADAS features such as lane departure warnings, collision avoidance, speed limit recognition, and pedestrian detection significantly enhance driver safety and asset protection.

By integrating ADAS data into fleet dashboards, operators gain a holistic view of vehicle performance and external traffic conditions. This convergence of safety intelligence and operational analytics is expected to accelerate adoption, particularly among large commercial fleets and urban delivery networks where risk mitigation is a top priority.

Regulatory Influence on Market Expansion

Government policies and safety regulations play a critical role in shaping the smart fleet management landscape. Regulatory frameworks such as the Compliance Safety Accountability (CSA) program in the United States, along with similar initiatives globally, mandate stricter oversight of fleet operations, driver behavior, and emissions compliance.

As regulatory complexity increases, fleet operators are increasingly adopting automated reporting and compliance-driven software solutions to streamline audits, reduce administrative burdens, and ensure adherence to evolving standards. This regulatory push continues to reinforce long-term demand for smart fleet management platforms.

Segment Insights

By Transportation

The automotive segment dominated the market in 2023, accounting for approximately 65% of total revenue. The dominance is driven by the vast number of passenger vehicles, commercial trucks, and urban transit fleets, combined with strong adoption of telematics, IoT, and ADAS technologies. Rapid urbanization, growth in e-commerce delivery fleets, and expanding ride-sharing services further strengthen this segment’s leadership.

By Connectivity

Short-range communication technologies held the leading market position and are expected to maintain dominance through 2030. These systems enable vehicle-to-vehicle and vehicle-to-infrastructure communication, supporting real-time navigation, traffic intelligence, and collision prevention. Cloud connectivity is also gaining traction, particularly among small and mid-sized fleet operators seeking scalable solutions with lower upfront investment.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞:https://www.maximizemarketresearch.com/request-sample/3041/

Regional Analysis

Asia Pacific Leads Global Adoption

The Asia Pacific region emerged as the leading market in 2023, driven by expanding transportation infrastructure and rising adoption of connected vehicle technologies in China, India, Japan, South Korea, and Southeast Asia. Increasing road safety concerns and government mandates for vehicle safety systems are accelerating demand for smart fleet and ADAS solutions.

According to regional safety data, Asia Pacific accounts for a significant share of global road fatalities, prompting governments to enforce stricter safety standards and promote intelligent vehicle technologies.

North America and Europe Maintain Strong Momentum

North America and Europe continue to represent mature, high-value markets. Strong technological ecosystems, early adoption of electric and autonomous vehicles, and robust regulatory frameworks support steady growth. Europe’s role as a global automotive manufacturing hub provides significant opportunities for OEM-integrated fleet management solutions.

Competitive Landscape

The smart fleet management market is characterized by continuous innovation, strategic partnerships, and ecosystem collaborations. Leading players are investing in R&D to enhance analytics capabilities, cybersecurity, cloud scalability, and EV fleet integration.

Recent strategic developments include collaborations between technology providers and automotive manufacturers to support fleet electrification, connected mobility, and intelligent vehicle platforms. Partnerships involving Siemens, Cisco, Continental, HERE, and major OEMs reflect the industry’s shift toward integrated, end-to-end fleet solutions.

Market Outlook

The Global Smart Fleet Management Market is set for sustained expansion through 2030, underpinned by digital transformation, regulatory enforcement, and the convergence of connectivity, safety, and automation technologies. As fleets grow more complex and performance-driven, smart fleet management will remain a critical enabler of operational efficiency, safety, and sustainability across global transportation networks.