Europe E-Bike Market: Industry Outlook and Growth Analysis (2025–2032)

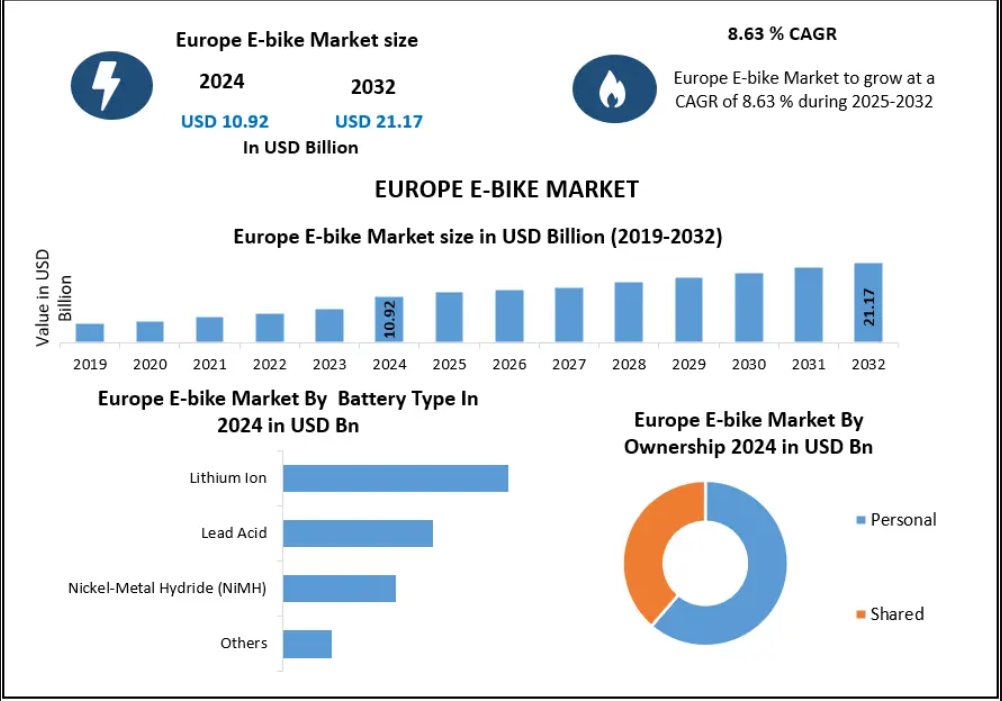

The Europe E-bike Market was valued at USD 10.92 billion in 2024 and is projected to expand at a CAGR of 8.63% from 2025 to 2032, reaching approximately USD 21.17 billion by 2032. This strong growth trajectory highlights the accelerating shift toward sustainable mobility solutions and the growing integration of electric bicycles into Europe’s urban and recreational transport ecosystem.

Market Overview

E-bikes have become a cornerstone of Europe’s transition toward low-emission transportation. Supported by strong environmental policies, advanced cycling infrastructure, and rising consumer awareness, electric bicycles are increasingly viewed as a practical alternative to cars for short- and medium-distance travel. The market benefits from favorable government incentives, technological advancements in battery and motor systems, and changing mobility preferences driven by urban congestion and fuel costs.

The Europe E-bike Market encompasses a broad ecosystem including manufacturing clusters, component suppliers, leasing providers, and digital retail platforms. In addition to consumer adoption, the market is also shaped by trade flows, localized production strategies, and evolving regulatory frameworks aimed at reducing carbon emissions and promoting active mobility.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/21420/

Key Market Drivers

Sustainability and Policy Support

Europe’s strong commitment to sustainability has significantly accelerated e-bike adoption. Governments across the region offer subsidies, tax benefits, and incentives for electric mobility, making e-bikes more accessible to a broader population. Investments in cycling lanes and urban infrastructure further strengthen demand, positioning e-bikes as a viable daily transport option.

Technological Advancements

Continuous innovation in lithium-ion batteries, lightweight frames, and integrated drive systems has enhanced e-bike performance, safety, and user comfort. Improvements in battery efficiency and motor reliability have reduced maintenance concerns while extending travel range, contributing to higher consumer confidence and repeat purchases.

Rising Urbanization and Mobility Needs

Urban congestion and limited parking space have made compact, energy-efficient transport solutions increasingly attractive. E-bikes offer flexibility, cost efficiency, and ease of navigation in dense city environments. Cargo e-bikes, in particular, are gaining popularity among families and logistics providers as alternatives to cars.

Leasing and Subscription Models

The emergence of leasing and subscription programs has lowered the barrier to entry for high-priced e-bikes. These flexible ownership models are especially popular in countries such as Germany, Belgium, and the Netherlands, supporting steady market growth even amid economic uncertainty.

Market Challenges

High Initial Purchase Costs

Despite long-term cost savings, e-bikes remain more expensive than conventional bicycles due to battery and electronic component costs. This limits adoption among price-sensitive consumers, particularly in Southern and Eastern Europe.

Supply Chain Constraints

The availability of key components such as batteries and drive systems continues to challenge manufacturers. Capacity limitations among major suppliers have occasionally disrupted production schedules, impacting market supply during peak demand periods.

Regulatory Fragmentation

Differences in e-bike classification, speed limits, and usage regulations across European countries create complexities for manufacturers and consumers alike. These inconsistencies hinder cross-border standardization and market scalability.

Segment Analysis

By Mode

Pedal-assist e-bikes dominate the European market due to regulatory compatibility, superior energy efficiency, and a more natural riding experience. These models align well with health-conscious and sustainability-focused consumer preferences. Throttle-based e-bikes, while smaller in market share, are gaining traction in niche urban and short-distance applications.

By Design

Non-foldable e-bikes hold the largest share owing to their durability, higher battery capacity, and suitability for long-distance commuting and cargo transport. Meanwhile, foldable e-bikes are experiencing rapid growth in metropolitan areas, driven by portability needs, compact storage, and multimodal commuting trends.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/21420/

Regional Insights

Germany remains the largest and most influential e-bike market in Europe, supported by a mature cycling culture, strong domestic manufacturing base, and extensive retail networks. Despite a decline in conventional bicycle sales, e-bike adoption continues to rise, accounting for nearly half of all bicycle sales in the country.

The DACH region (Germany, Austria, and Switzerland) shows high e-bike ownership rates, reflecting advanced infrastructure and strong consumer acceptance. However, countries such as the Netherlands and Belgium lead Europe in terms of e-bike penetration within total bicycle sales, with e-bikes accounting for more than half of all units sold.

The United Kingdom is witnessing rapid growth, particularly in urban centers, while France, Italy, and Spain continue to expand their markets through infrastructure investments and mobility reforms.

Competitive Landscape

The Europe E-bike Market is highly competitive, characterized by innovation-driven strategies and brand differentiation. Leading manufacturers focus on product customization, advanced electronics integration, and sustainability-focused designs. Key players include Accell Group, Brompton Bicycle, Pon Holdings, Riese & Müller, Royal Dutch Gazelle, VanMoof, Haibike, Bianchi, and several emerging regional brands.

1. Accell Group

2. Brompton Bicycle

3. CUBE Bikes

4. Georg Fritzmeier GmbH & Co. KG

5. Kalkhoff Werke GmbH

6. Pon Holdings B.V.

7. Riese & Müller GmbH

8. Royal Dutch Gazelle

9. Swiss E-Mobility Group

10. VanMoof BV

11. Haibike

12. F.I.V.E. Bianchi S.p.A.

13. Moustache Bikes

14. Gocycle

15. AIMA Ebike

16. Lekker Bikes

17. Tenways

18. WATT e-Bike

19. BearEBike

20. E-BIKE FANTOM

21. Others

Conclusion

The Europe E-bike Market is set for sustained growth as electric bicycles become deeply integrated into the region’s mobility landscape. Supported by environmental policies, technological innovation, and evolving consumer preferences, e-bikes are no longer a niche product but a mainstream transportation solution. Manufacturers that address affordability, supply chain resilience, and regulatory alignment will be best positioned to capitalize on the expanding opportunities across Europe.