Market Overview:

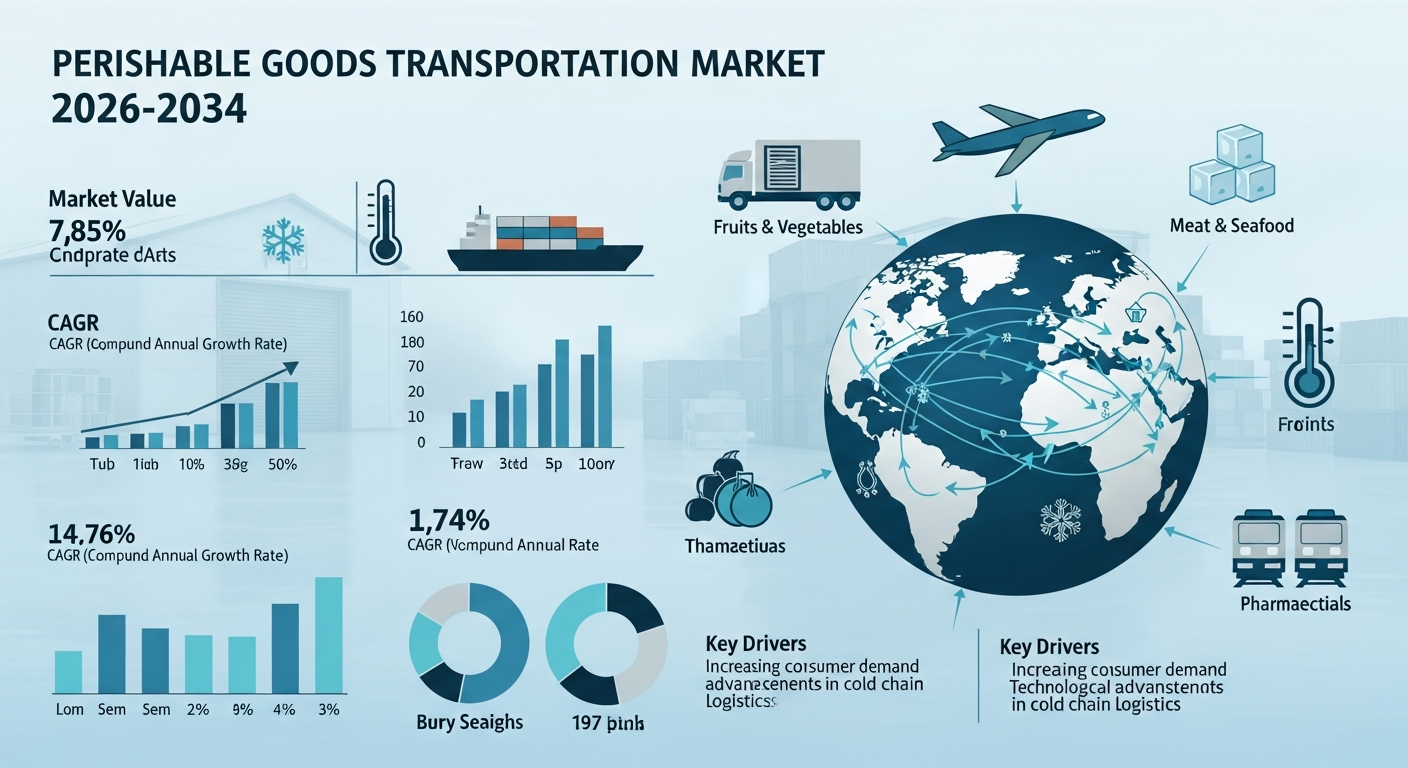

The perishable goods transportation market is experiencing rapid growth, driven by surge in global processed and convenience food demand, strengthening of national cold chain infrastructure, and expansion of e-commerce and online grocery platforms. According to IMARC Group’s latest research publication, “Perishable Goods Transportation Market Size, Share, Trends and Forecast by Type, Transportation Mode, and Region, 2026-2034”, the global perishable goods transportation market size was valued at USD 21.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 32.9 Billion by 2034, exhibiting a CAGR of 5.00% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/perishable-goods-transportation-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Perishable Goods Transportation Market

- Surge in Global Processed and Convenience Food Demand

The rapid expansion of the processed food sector is a primary catalyst for the growth of perishable logistics. As urbanization increases, with approximately 57.3% of the global population now residing in cities, consumer preferences have shifted toward ready-to-eat meals, breakfast cereals, and frozen dairy products. In North America, the market share for ready-to-eat food has reached 41.4%, while in the UK, one in five people now consumes prepared meals weekly. This reliance on processed items necessitates a robust transportation network capable of maintaining strict temperature controls over long distances. To meet this demand, companies are significantly increasing their investments in refrigerated road transport, which currently accounts for a 45.8% share of the total market. These logistics networks ensure that chemically and mechanically processed goods remain stable and safe for consumption from the point of manufacture to the retail shelf.

- Strengthening of National Cold Chain Infrastructure

Government-led initiatives are playing a pivotal role in expanding the infrastructure required for perishable goods. In 2025, the Indian government announced a substantial financial outlay of ₹6,520 crore specifically for the Pradhan Mantri Kisan SAMPADA Yojana, with ₹1,920 crore dedicated to cold chain and food safety projects. These funds support the creation of farm-level infrastructure and multi-product distribution hubs to reduce post-harvest losses. Similarly, the United States is focusing on modernization, with the market for perishable transportation estimated to increase by $2.45 billion through improved food safety protocols and optimized reefer operations. These public investments, often implemented through public-private partnerships, empower farmers and producers by providing access to energy-efficient refrigerated containers and specialized storage facilities, thereby stabilizing the supply of fresh produce and meat products in both domestic and international markets.

- Expansion of E-commerce and Online Grocery Platforms

The proliferation of digital retail is fundamentally altering how perishable goods are moved through the supply chain. E-commerce platforms now require highly efficient, specialized logistics solutions to satisfy the expectations of online consumers for timely and high-quality fresh products. Current data indicates that over 68% of logistics companies have adopted temperature-controlled solutions specifically to mitigate the spoilage risks associated with home delivery. The rise of direct-to-consumer models and meal-kit services has further intensified the need for "last-mile" refrigerated transport. To maintain a competitive edge, major players are integrating advanced warehouse management systems and real-time tracking to ensure that items like dairy, seafood, and fresh vegetables reach the consumer's doorstep in optimal condition. This digital shift is particularly prominent in the Asia-Pacific region, which now holds a 32% share of the global market.

Key Trends in the Perishable Goods Transportation Market

- Integration of IoT and Smart Sensor Technology

A defining trend in the current market is the widespread adoption of the Internet of Things (IoT) and smart sensors to ensure cold chain integrity. Approximately 57% of logistics companies are now utilizing real-time tracking and automated cooling technologies to monitor environmental variables like temperature and humidity during transit. These sensors provide a continuous data stream, allowing operators to detect and rectify temperature excursions before product spoilage occurs. For example, the implementation of Blue Yonder Warehouse Management systems by industry leaders allows for sophisticated monitoring of high-value pharmaceuticals and biologics. By providing a "live" view of the cargo's condition, these technologies reduce human error and significantly decrease the volume of waste in the supply chain, ensuring that sensitive goods such as vaccines or exotic fruits remain within their required safety parameters throughout the journey.

- Shift Toward Sustainable and Green Logistics

Sustainability has become a central pillar of the perishable goods transportation industry as firms strive to reduce their environmental footprint. More than 50% of logistics providers are currently investing in eco-friendly vehicles and energy-efficient refrigeration units. This includes the adoption of electric refrigerated trucks (EVs) and cooling systems powered by solar panels or alternative refrigerants with low global warming potential. In India, the Union Budget 2025 introduced fresh incentives for the adoption of EVs in commercial transportation, alongside tax deductions for businesses implementing green warehousing solutions. Real-world applications include the deployment of zero-emission "green zones" in urban centers and the use of recyclable packaging materials that maintain thermal insulation without the environmental cost of traditional plastics. These initiatives not only align with global climate goals but also lower long-term operational costs by reducing fuel consumption.

- Artificial Intelligence for Route and Demand Optimization

The application of Artificial Intelligence (AI) is revolutionizing the efficiency of perishable logistics by enabling predictive analytics and dynamic route planning. Logistics firms are increasingly using AI algorithms to process vast datasets—including historical sales, weather patterns, and traffic conditions—to forecast demand and optimize delivery schedules. This trend is particularly vital for the transportation of fruits and vegetables, which accounted for 30.2% of market revenue in 2024. By streamlining routes, AI reduces the time goods spend in transit, thereby extending their effective shelf life. Furthermore, AI-driven systems assist in predictive maintenance for refrigerated assets, ensuring that cooling units do not fail during critical transport phases. This move toward data-driven decision-making allows companies to manage the inherent volatility of the perishable market, improving on-time delivery rates and enhancing overall supply chain resilience in a complex global trade environment.

Leading Companies Operating in the Global Perishable Goods Transportation Industry:

- A.P. Møller – Mærsk A/S

- Africa Express Line Limited

- Bay & Bay Transportation

- C.H. Robinson Worldwide Inc

- CMA CGM Group (MERIT France SAS)

- DB Schenker

- Deutsche Post AG

- FST Logistics Inc

- Hapag-Lloyd AG

- Hellmann Worldwide Logistics SE and Co. KG

- K Line Logistics Ltd (Kawasaki Kisen Kaisha Ltd)

- Kuehne + Nagel International AG

- Orient Overseas Container Line Limited

- VersaCold Logistics Services

Perishable Goods Transportation Market Report Segmentation:

By Type:

- MPS (Meat, Poultry, and Seafood)

- Dairy and Frozen Desserts

- Vegetables and Fruits

- Bakery and Confectionery

MPS (Meat, Poultry, and Seafood) accounts for the majority of shares at 37.8%, driven by high demand, strict temperature control requirements, and growing global trade volume.

By Transportation Mode:

- Roadways

- Seaways

- Others

Roadways dominates the market with 48.3% share, offering flexible door-to-door delivery, extensive reach, and cost-effectiveness for short to medium-distance transportation.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific enjoys the leading position with over 35% market share, driven by rapid industrialization, rising demand for processed food, expanding e-commerce, and growing adoption of plant-based diets.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302