Market Overview:

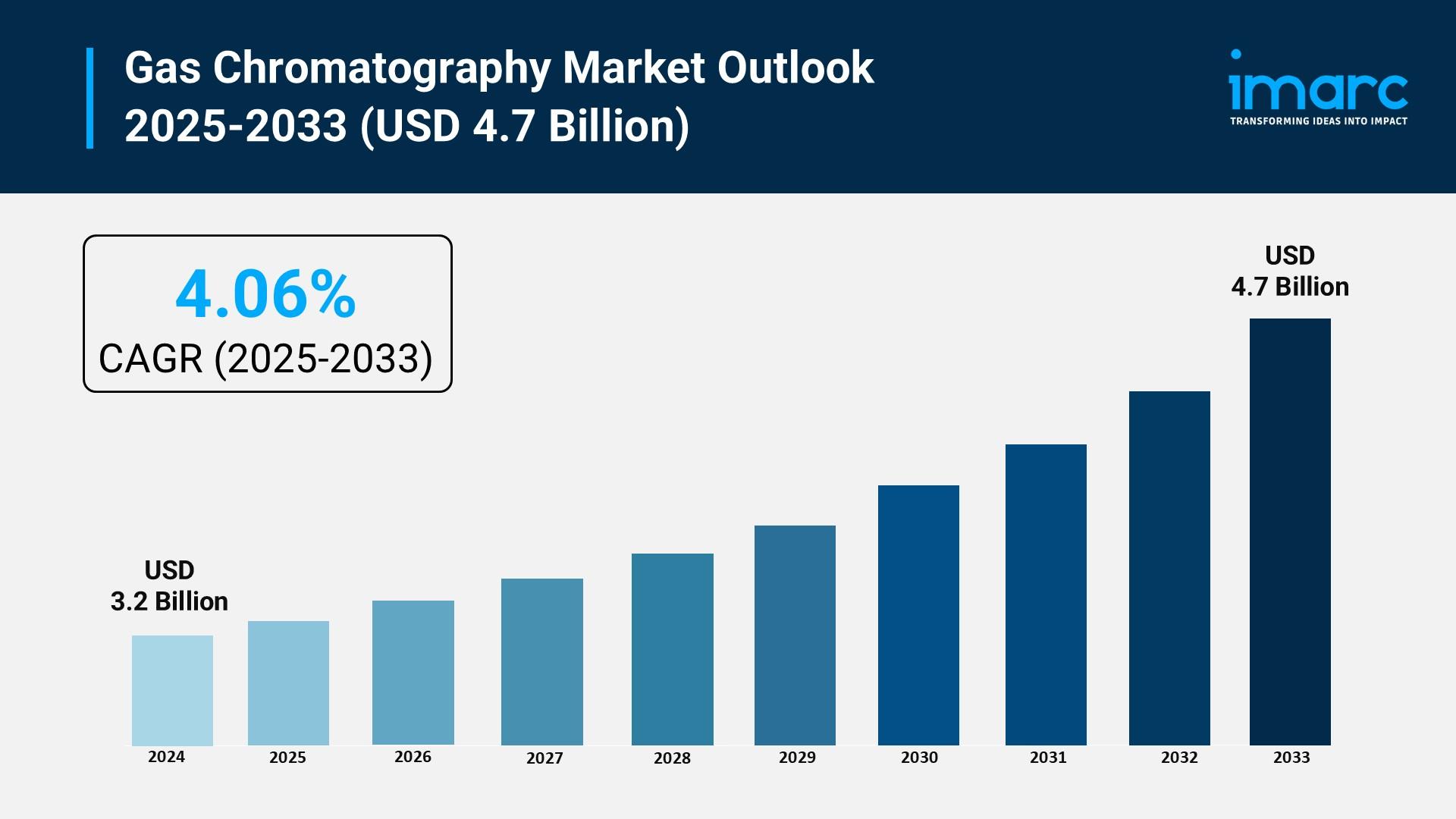

The gas chromatography market is experiencing rapid growth, driven by stringent regulatory standards in key industries, rapid expansion of environmental and safety monitoring, and continuous technological advancements and automation. According to IMARC Group’s latest research publication, “Gas Chromatography Market Report by Product (Accessories and Consumables, Instruments, Reagents), End Use Industry (Pharmaceutical, Oil and Gas, Food and Beverage, Agriculture, Environmental Biotechnology, and Others), and Region 2025-2033”, the global gas chromatography market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/gas-chromatography-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Gas Chromatography Market

- Stringent Regulatory Standards in Key Industries

The increasing enforcement of rigorous quality control and regulatory compliance across major sectors, particularly pharmaceuticals and food and beverage, is a core driver for Gas Chromatography (GC) demand. Government bodies and regulatory agencies worldwide continuously update guidelines, requiring extremely accurate and sensitive analytical tools like GC for trace analysis. For example, the pharmaceutical and biotechnology segment held a substantial 31% market share in 2024, emphasizing the central role of GC in drug development, impurity testing, and final product quality verification. This essential function drives the constant need for both new GC systems and the continuous replacement of high-purity consumables and accessories, which accounted for a dominating 55% market share in 2024, ensuring method validation and data integrity.

- Rapid Expansion of Environmental and Safety Monitoring

Growing global awareness and the implementation of stricter environmental regulations are significantly fueling the adoption of GC systems. Governments are increasingly focused on reducing and monitoring pollution, necessitating highly sensitive analytical methods to detect and quantify pollutants at trace levels in air, water, and soil. GC, particularly when coupled with Mass Spectrometry (GC-MS), is the gold standard for analyzing Volatile Organic Compounds (VOCs), which are critical targets for environmental agencies. The technology is also essential in the oil and gas sector for process monitoring and quality control, driven by the expansion of crude and shale oil production. This heightened regulatory and public concern establishes an ongoing demand for advanced GC technology to ensure adherence to safety and environmental standards.

- Continuous Technological Advancements and Automation

Innovations in GC technology, making systems more efficient, sensitive, and user-friendly, are a vital growth factor. Manufacturers like Agilent Technologies and Thermo Fisher Scientific continually introduce next-generation instruments that feature improved detector technology, enhanced column efficiency, and significant automation capabilities. For instance, the launch of new GC systems with smart diagnostics and remote connectivity by companies like Agilent (e.g., the 8890 GC) improves operational efficiency and reduces downtime for high-throughput laboratories globally. The shift toward modular and portable GC systems also expands the technology's application to on-site testing and process control, making sophisticated analysis more accessible beyond traditional laboratory settings.

Key Trends in the Gas Chromatography Market

- Integration of Artificial Intelligence and Machine Learning

The emerging trend of incorporating Artificial Intelligence (AI) and Machine Learning (ML) into GC workflow software is fundamentally transforming data analysis and instrument optimization. AI/ML algorithms are being used to automate complex tasks such as chromatogram deconvolution, peak identification, and method development, reducing the reliance on highly skilled personnel. For example, Agilent Technologies acquired advanced AI software to integrate into its GC-MS systems, aiming to boost the productivity and accuracy of high-throughput laboratories by improving data interpretation. This not only speeds up analysis but also enhances data reliability, enabling industries like forensics and clinical diagnostics to process complex samples with greater precision and efficiency.

- Growth of Portable and Miniaturized GC Systems

Miniaturization and the development of portable GC systems are expanding the market beyond traditional laboratory environments into on-site, real-time analysis. This trend addresses the need for rapid data collection directly at the source, especially in industrial and environmental applications. These compact devices offer faster analysis times and lower operational costs compared to full-sized lab instruments. For instance, companies like Thermo Fisher Scientific are actively developing and promoting miniaturized GC instruments that bring high-precision analysis to field settings for environmental monitoring or industrial process control. The convenience of these small, user-friendly systems is particularly relevant in the oil and gas industry for immediate, in-field quality checks of natural gas composition.

- Focus on Specialized GC-MS for Clinical and Forensic Applications

A distinct emerging trend is the increasing specialization of Gas Chromatography-Mass Spectrometry (GC-MS) for advanced clinical diagnostics and forensic science. GC-MS offers unparalleled selectivity and sensitivity, making it ideal for detecting and quantifying complex, low-concentration substances like metabolites, drugs of abuse, and volatile biomarkers. In the pharmaceutical sector, this technology is seeing greater use in personalized medicine for metabolic profiling and biomarker discovery, tailoring treatments based on individual patient profiles. The segment covering drug development and quality control, which includes many of these specialized applications, is projected for significant growth, highlighting the technology's evolving role in high-stakes analytical fields where absolute accuracy is paramount.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4603&method=1670

Leading Companies Operating in the Global Gas Chromatography Industry:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Chromatotec

- Merck KgaA

- PerkinElmer Inc.

- Phenomenex Inc. (Danaher Corporation)

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- W. R. Grace and Company

- Waters Corporation

Gas Chromatography Market Report Segmentation:

By Product:

- Accessories and Consumables

- Columns and Accessories

- Fittings and Tubing

- Auto-sampler Accessories

- Flow Management and Pressure Regulator Accessories

- Others

- Instruments

- Systems

- Auto-samplers

- Fraction Collectors

- Detectors

- Flame Ionization Detectors (FID)

- Thermal Conductivity Detectors (TCD)

- Mass Spectrometry Detectors

- Others

- Reagents

- Analytical Gas Chromatography Reagents

- Bioprocess Gas Chromatography Reagents

Accessories and consumables (columns and accessories, fittings and tubing, auto-sampler accessories, flow management and pressure regulator accessories, and others) exhibit a clear dominance in the market attributed to their frequent replacement and critical role in ensuring optimal performance.

By End Use Industry:

- Pharmaceutical

- Oil and Gas

- Food and Beverage

- Agriculture

- Environmental Biotechnology

- Others

Food and beverage hold the biggest market share owing to the implementation of stringent regulations and the need for accurate analysis of ingredients and contaminants.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to the strong presence of key players and high adoption of advanced chromatography techniques.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302