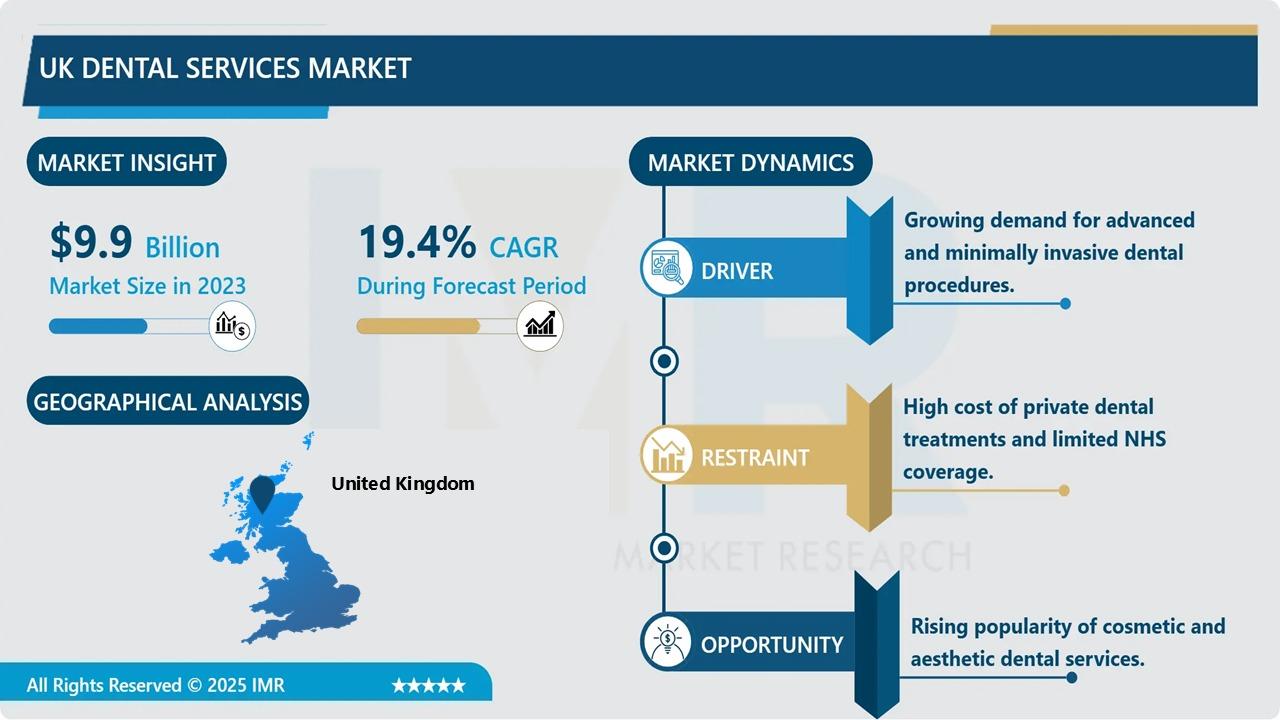

The UK Dental Services Market is undergoing a period of profound structural transformation, driven by a decisive shift from public-funded National Health Service (NHS) dentistry to high-value private care models. This market encompasses a comprehensive range of oral health interventions, including routine general dentistry, specialized orthodontics, restorative endodontics, and the rapidly expanding field of cosmetic dentistry. As patient expectations evolve, the sector is increasingly defined by the integration of advanced digital workflows, such as intraoral scanning and AI-assisted diagnostics, which offer significant speed and precision advantages over traditional clinical methods.

The market’s primary utility lies in the maintenance of systemic health and the enhancement of aesthetic well-being. Major developments in the UK are characterized by the rise of Dental Service Organizations (DSOs)—corporate entities that manage the non-clinical business operations of multiple practices. This consolidation allows for greater economies of scale, improved procurement of advanced medical supplies, and more professionalized marketing strategies. As the UK grapples with dental workforce shortages and funding reforms, the private sector is emerging as the primary engine of innovation, catering to a growing demographic of health-conscious consumers seeking elective and preventive treatments.

Market Segmentation:

The UK Dental Services Market is segmented into Service, and End User. By Service, the market is categorized into General Dentistry, Orthodontics, Cosmetic Dentistry, Periodontics, and Others. By End User, the market is categorized into Dental Surgeons, Endodontists, General Dentists, and Others.

Growth Driver:

Rising Demand for Cosmetic and Elective Procedures: A primary driver for the UK dental services market is the surge in consumer interest for aesthetic dentistry, including teeth whitening, veneers, and clear aligners. Influenced by social media trends and an increased focus on "self-care" post-pandemic, more UK adults are opting for elective procedures that were previously considered luxury services. This trend is bolstered by the increasing availability of affordable monthly payment plans and interest-free financing offered by private clinics, making high-end cosmetic transformations accessible to a broader segment of the middle-class population.

Market Opportunity:

Integration of AI-Driven Practice Management and Teledentistry: A significant market opportunity lies in the adoption of Artificial Intelligence (AI) and teledentistry solutions to address the UK’s current access challenges. AI can streamline administrative tasks and improve diagnostic accuracy, while teledentistry enables remote consultations for initial assessments and post-operative follow-ups. By leveraging these technologies, dental groups can optimize their clinical hours, reach patients in rural or underserved areas, and reduce the overhead costs associated with routine check-ups. This digital-first approach aligns with the growing consumer demand for convenience and personalized, data-backed treatment plans.

Detailed Segmentation:

UK Dental Services Market, Segmentation The UK Dental Services Market is segmented on the basis of Service, and End User.

Service The Service segment is further classified into General Dentistry, Orthodontics, Cosmetic Dentistry, and Periodontics. Among these, the General Dentistry sub-segment accounted for the highest market share in 2023. General dentistry remains the foundational entry point for patients, encompassing essential services such as examinations, cleanings, and simple fillings. The dominance of this segment is driven by the consistent need for routine oral maintenance and the role of general practitioners as "gatekeepers" who refer patients to more specialized services.

End User The End User segment is further classified into Dental Surgeons, Endodontists, and General Dentists. Among these, the General Dentists sub-segment accounted for the highest market share in 2023. This is largely due to the sheer volume of general practitioners (GPs) within the UK workforce—representing approximately 90% of all registered dentists. General dentists are the primary providers of both NHS and private outpatient care, and they are increasingly joining DSOs to mitigate the financial risks and administrative burdens of solo practice ownership.

Some of The Leading/Active Market Players Are-

- Bupa Dental Care (UK)

- MyDentist (IDH Group) (UK)

- Portman Dental Care (UK)

- Dentex Healthcare Group (UK)

- Colosseum Dental (Switzerland/UK)

- Rodericks Dental Partners (UK)

- Bhandal Dental Practice (UK)

- Envisage Dental (UK)

- The Real Good Dental Company (UK)

- Clyde Munro Dental Group (UK)

- RiverRidge Dental (UK)

- ALS Dental (UK)

- and other active players.

Key Industry Developments

News 1: In September 2024, Christie & Co reported a significant resurgence in dental practice acquisitions, with corporate and large groups increasing their share of offers from 8% to 45% within a single year. This development indicates a "re-entry" of corporate consolidators into the UK market, targeting high-quality private and mixed practices. The shift suggests that larger operators have successfully refined their internal operating models and are now aggressively pursuing strategic expansion to capitalize on the growing private patient base.

News 2: In December 2024, the National Audit Office (NAO) released an audit revealing that the NHS Dental Recovery Plan was falling short of its intended targets for patient access. This news highlights the ongoing "critical state" of public dental funding in the UK. The persistent difficulty for patients in obtaining NHS appointments is a major catalyst driving volume toward the private sector, as consumers increasingly switch to private dental plans, such as Denplan, to ensure faster access to care and more consistent treatment quality.

Key Findings of the Study

- Cosmetic Dentistry is the fastest-growing service segment, fueled by social media influence and increased disposable income.

- Consolidation is a major trend, with DSOs acquiring independent practices to create "super hubs" for operational efficiency.

- Digital Dentistry (CAD/CAM and AI imaging) is viewed by 86% of professionals as the primary engine for future growth.

- Workforce shortages remain a key restraint, though the dental register saw a net growth of over 1,300 registrations for 2025.

About Us

At Introspective Market Research Private Limited, we are a forward-thinking research consulting firm committed to driving growth in the UK Dental Services Market. With deep insights, strategic solutions, and holistic research, we empower businesses to achieve success and dominance in the global Healthcare and Medical Services industry.

📞 Contact Us Introspective Market Research Pvt. Ltd. Phone: +91-91753-37569 Email: sales@introspectivemarketresearch.com Web: www.introspectivemarketresearch.com