Market Overview:

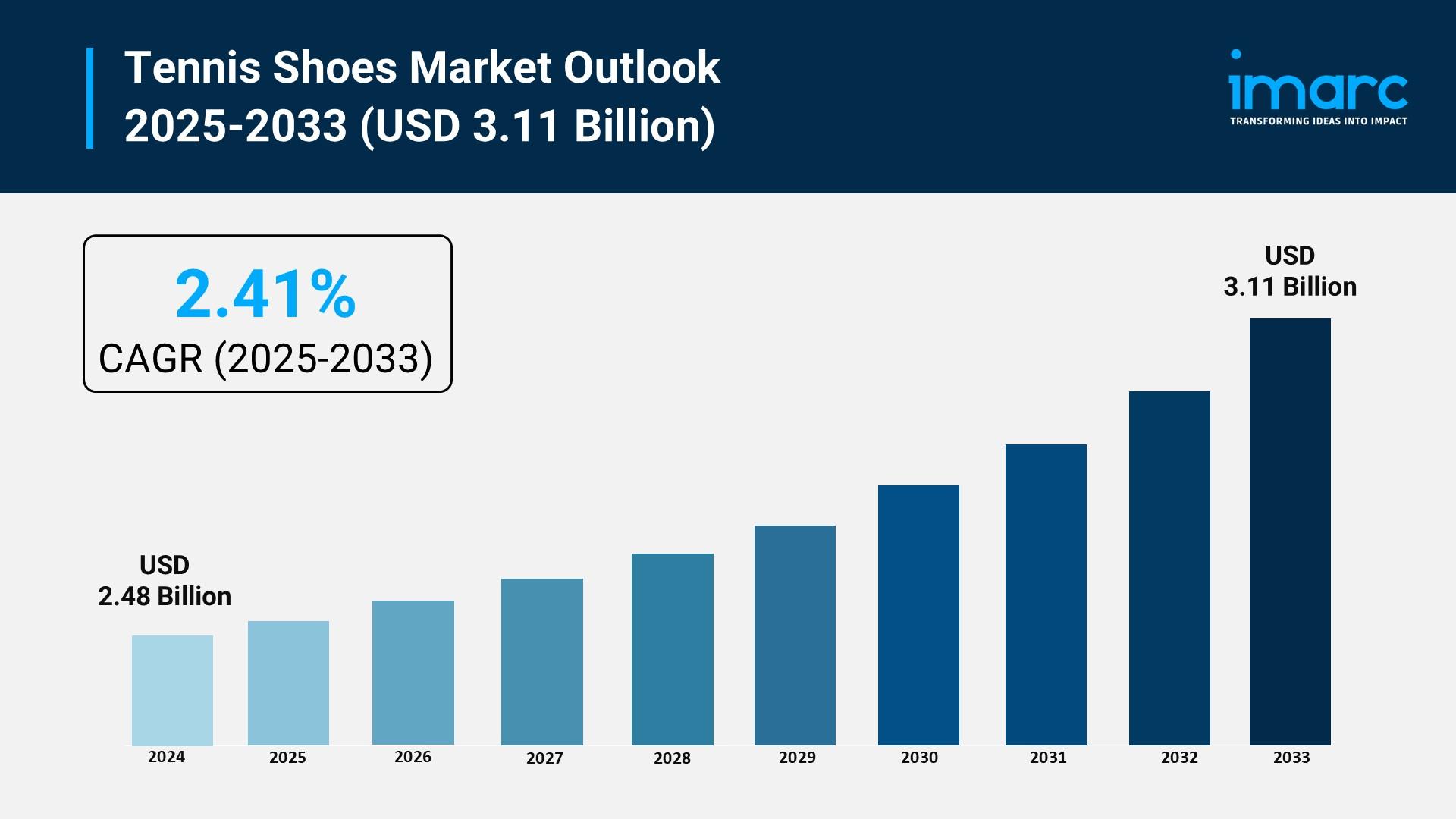

The tennis shoes market is experiencing rapid growth, driven by rising global tennis participation, government focus on sports infrastructure and health, and technological innovation and performance enhancement. According to IMARC Group's latest research publication, "Tennis Shoes Market Size, Share, Trends and Forecast by Playing Surface, Application, Distribution Channel, and Region, 2025-2033", The global tennis shoes market size reached USD 2.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.11 Billion by 2033, exhibiting a growth rate (CAGR) of 2.41% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/tennis-shoes-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Tennis Shoes Market

- Rising Global Tennis Participation

The global increase in tennis participation is a foundational driver for the tennis shoe industry. The International Tennis Federation (ITF) recently reported that the number of global tennis players has surpassed 100 million for the first time, reflecting a substantial rise in engagement with the sport. In the United States alone, participation has seen a consistent increase of 31% since 2020. This surge is not limited to professional athletes; it includes recreational players and new entrants who require specialized footwear for safety and performance. As a direct consequence, this expanding player base creates a sustained, high-volume demand for hard-court, clay-court, and grass-court specific tennis shoes, ensuring consistent market growth across major regions like North America and Europe, and emerging markets. This consistent demand underpins the market's stability.

- Government Focus on Sports Infrastructure and Health

Government initiatives worldwide are increasingly emphasizing public health and community building through sports, which directly fuels the tennis shoe market. A key example is India's Khelo India initiative, which involves the development of new sports facilities, including tennis courts. This effort expands access to the sport, particularly in urban and semi-urban centers, leading to higher participation rates. In the United States and Canada, public funding for major-league sports stadiums and arenas reached $33 billion between 1970 and 2020, with state and local governments covering a significant portion of construction costs. This continued investment in sports infrastructure provides more venues for training and competition, driving the necessity for appropriate, specialized tennis footwear for a growing base of new and experienced players alike.

- Technological Innovation and Performance Enhancement

Continuous investment in advanced footwear technology is crucial for market expansion, particularly in the premium segment. Brands are actively integrating material science and design engineering to enhance comfort, stability, and durability. For instance, companies like Nike have launched innovations, such as the NikeCourt Air Zoom Vapor Pro 2 featuring Claybreaker technology and responsive cushioning, aimed at improving player agility and reducing injury risk on the court. Furthermore, the integration of smart wearable technologies into footwear is becoming a reality, with some brands developing smart shoes that use embedded sensors to track performance metrics like fatigue, steps, and posture. These features are highly appealing to performance-focused athletes and tech-savvy consumers, elevating the average selling price of footwear and driving revenue in the high-end tier of the market.

Key Trends in the Tennis Shoes Market

- The Athleisure and Lifestyle Crossover

A significant trend blurring the lines between athletic gear and everyday fashion is the 'athleisure' movement, which has propelled tennis shoes from the court to the street. Consumers are seeking versatile footwear that offers both the comfort of performance gear and a stylish aesthetic for casual wear. This cross-functional demand has spurred major brands to launch designer collaborations and limited-edition runs, creating aspirational value and strong consumer demand. For example, the premium segment of the athletic footwear market is growing the fastest, highlighting consumer willingness to spend more on stylish, high-quality products. This trend expands the tennis shoe market beyond its traditional user base, making stylish, comfortable tennis-inspired sneakers a staple of urban fashion globally, and driving growth outside of just the sport itself.

- Sustainability and Eco-Conscious Manufacturing

The growing consumer preference for environmentally responsible products is pushing manufacturers toward sustainable materials and practices. This trend is demonstrated by the fact that more than 65% of global footwear brands are integrating sustainable materials, such as recycled mesh, bio-based rubber, and regenerated plastics, into their tennis shoe lines. Brands are making strategic commitments to reduce their environmental footprint, with new companies in the sector, such as Hylo, focusing entirely on advanced materials science to produce athletic footwear with measurably lower environmental impacts. This shift towards "green" manufacturing is not only an ethical choice but a competitive advantage, appealing strongly to a market segment that prioritizes corporate social responsibility and product lifecycle longevity.

- Digital Retail and Direct-to-Consumer (DTC) Sales

The rapid expansion of e-commerce and direct-to-consumer (DTC) sales channels is fundamentally reshaping the distribution landscape for tennis shoes. Online retail channels are posting the fastest growth rates across the athletic footwear market. Digital platforms offer consumers unmatched convenience, competitive pricing, and global access to a wide array of products. Furthermore, advancements in digital technology, such as virtual try-on features and personalized recommendations, enhance the online shopping experience. The DTC model allows major brands to build stronger, direct relationships with their customers, gather valuable data, and offer exclusive products, which not only improves brand loyalty but also gives them greater control over branding and pricing strategies.

We explore the factors propelling the tennis shoes market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Tennis Shoes Industry:

- Adidas AG

- ANTA Sports Products Limited

- ASICS Corporation

- Babolat

- Diadora S.p.A. (Geox S.p.a)

- FILA Holdings Corp.

- Lotto Sport Italia S.p.A.

- Mizuno Corporation

- New Balance Inc.

- Nike Inc.

- Reebok International Limited (Authentic Brands Group LLC)

- Xtep International Holdings Limited

- Yonex Co. Ltd.

Tennis Shoes Market Report Segmentation:

By Playing Surface:

- Hard Court Tennis Shoes

- Clay Court Tennis Shoes

- Grass Court Tennis Shoes

Hard court tennis shoes represent the largest segment as they are specifically designed to provide the necessary support, stability, and traction needed to perform optimally on these surfaces, making them the preferred choice for many tennis players.

By Application:

- Men

- Women

- Kids

Men account for the majority of the market share due to societal norms and cultural perceptions emphasizing athleticism and sports participation more prominently.

By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores dominate with a 64% market share in 2024, offering exclusive products, personalized experiences, and premium brand collaborations that foster customer loyalty.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the tennis shoes market on account of a large population of tennis enthusiasts, with a robust culture surrounding the sport.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302