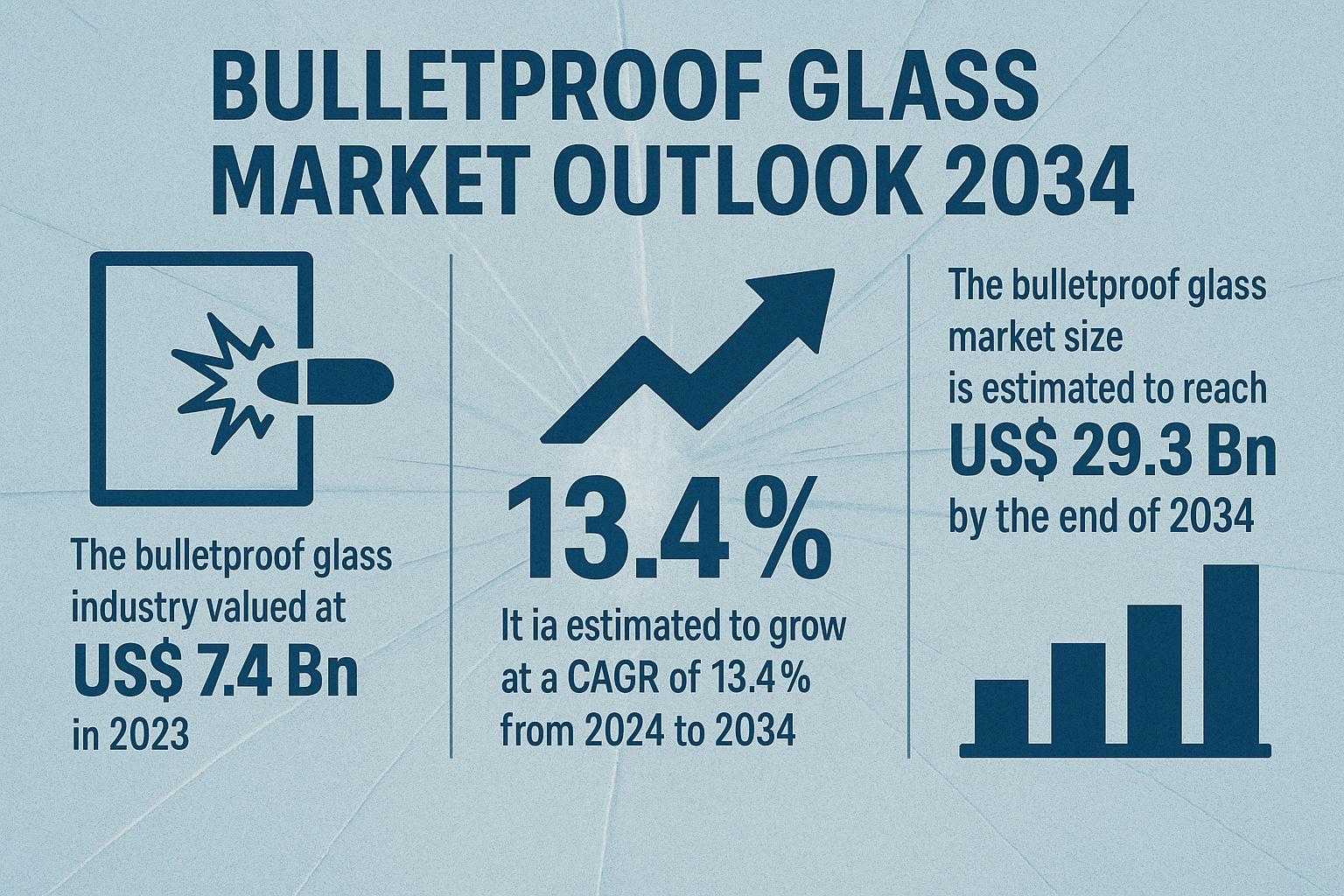

The global bulletproof glass market is undergoing a period of strong expansion, driven by escalating security concerns across defense, commercial, and residential sectors. Valued at US$ 7.4 billion in 2023, the market is projected to grow at a CAGR of 13.4% from 2024 to 2034, ultimately reaching an impressive US$ 29.3 billion by 2034. As nations and industries prioritize safety amid growing geopolitical tensions, urban crime, and terrorism threats, bulletproof glass has become an essential component of modern protection systems.

Analysts’ Viewpoint: High-Growth Scenario Driven by Global Security Priorities

Analysts highlight that bulletproof glass is witnessing “high-projection growth,” supported by a combination of rising security awareness and stronger adoption in the building and construction industry. Whether in commercial complexes, government facilities, or high-end residential properties, the need for transparent yet durable ballistic-resistant materials is at an all-time high.

A significant share of this growth comes from North America, a region marked by stringent security regulations and heightened safety consciousness. Manufacturers are investing heavily in R&D to enhance transparency, reduce weight, and improve impact resistance, enabling applications in non-traditional sectors such as automotive and aerospace.

As a result, bulletproof glass is evolving beyond its traditional uses, becoming a critical component in next-generation safety systems.

Global Market Overview: Rising Threat Levels Drive Demand

The demand for bulletproof glass is strongly tied to rising global incidents of terrorism, violent crime, and geopolitical instability. Governments, military organizations, banks, financial service providers, and increasingly, homeowners are embracing advanced ballistic protection technologies.

Bulletproof glass—typically made of laminated glass and polycarbonate layers—offers high levels of ballistic resistance while maintaining full visibility, making it suitable for a wide range of environments.

Furthermore, public safety regulations are becoming stricter, pushing industries to upgrade their security infrastructure. Advancements in materials science are also promoting the use of lightweight yet robust composites, making bulletproof installations feasible in high-rise buildings, luxury vehicles, and critical public infrastructure.

Key Market Drivers

1. Increasing Global Military and Defense Spending

The biggest catalyst for bulletproof glass market expansion is the surge in military and defense expenditures. Heightened geopolitical tensions—spanning from territorial disputes to international terrorism—are compelling nations to strengthen their defense capabilities. Countries like the United States, China, India, and Russia are continually upgrading their military infrastructure, which includes incorporating ballistic-resistant materials in armored vehicles, aircraft, bunkers, and border control systems.

Bulletproof glass has become fundamental in:

- Armored personnel carriers

- Military tanks and helicopters

- Secure command centers

- High-risk training facilities

Additionally, evolving warfare tactics—especially the rise of unmanned aerial vehicles (UAVs)—are creating new opportunities. Bulletproof glass is increasingly integrated into UAV control centers and field equipment to safeguard operators and mission-critical assets.

With national security remaining a top priority, defense-linked demand for bulletproof glass is expected to remain robust throughout the forecast period.

2. Rapid Adoption in Commercial and Financial Sectors

The commercial landscape is experiencing a parallel surge in security needs. Banks, ATMs, retail facilities, and high-value corporate workplaces have become regular targets of theft, armed robbery, and political unrest. As a result, organizations are investing heavily in protective materials.

Banks and financial institutions are among the most significant adopters of bulletproof glass, using it in:

- Teller counters

- Secure transaction rooms

- ATM booths

- Customer interaction barriers

Luxury retailers, especially those dealing with jewelry and high-value merchandise, are also turning to bulletproof glass to mitigate smash-and-grab incidents. As urbanization intensifies and crimes involving forced entry increase, bulletproof glass is becoming a cornerstone of commercial safety.

Traditional Laminated Glass Leads Material Segmentation

Among the various material types, traditional laminated glass holds approximately 36% of the total market share, making it the most widely used variant. Its sandwich structure—combining layers of glass and polycarbonate—offers strong ballistic resistance, optical clarity, and adaptability for use in government buildings, banks, and armored vehicles.

The continued preference for laminated solutions is driven by:

- Durability

- Cost-effectiveness

- Broad application suitability

- Compliance with global safety standards

As security concerns intensify, this segment is expected to expand steadily, supported by ongoing innovations in lamination techniques and material engineering.

Regional Insights: North America Leads with 35.3% Market Share

The bulletproof glass market is geographically diverse, with distinct consumption patterns across regions.

North America – 35.3% Market Share (Leading Region)

The region’s dominance stems from:

- High crime and gun violence statistics

- Heavy military expenditure

- Strict regulatory guidelines for commercial and government security installations

Europe – ~29% Market Share

European countries are increasing investments in public safety, especially in the banking, transportation, and government sectors.

Asia-Pacific – Fastest Emerging Market

Growth is propelled by:

- Rapid urbanization

- Expanding automotive industry

- Rising security concerns in China and India

Latin America & Middle East/Africa – Growing Adoption

Rising crime rates and greater institutional investment in security drive demand in these regions.

Competitive Landscape: Innovation and Niche Specialization

The global bulletproof glass industry is competitive, blending large multinational manufacturers with specialized regional players. Major industry leaders include:

- Saint-Gobain

- AGC Inc.

- Schott AG

- TAIWAN GLASS IND. CORP.

These companies focus on high-volume applications across defense, automotive, and construction. Meanwhile, niche-focused firms like Total Security Solutions, Armortex, and Binswanger Glass specialize in customized protective products such as vehicle armoring or banking security.

Industry dynamics are influenced by continuous product innovations, strategic partnerships, and regional expansion initiatives.

Recent Market Developments

- January 2022: Magistral Ltd introduced an advanced 82-mm thick bulletproof glass capable of performing across extreme temperatures ranging from –50°C to +50°C. This solution is particularly useful for armored vehicles used by Russian defense agencies.

- October 2022: Binswanger Glass sold its auto glass division to Safelite Group, allowing Binswanger to refocus on commercial and residential safety glass offerings.

These developments highlight the industry’s commitment to innovation and strategic refocusing.

Conclusion

With increasing security threats, rising defense budgets, and growing commercial adoption, the bulletproof glass market is entering a period of sustained expansion. Innovations in lightweight composite materials, expanding applications across automotive and aerospace, and strict global safety mandates ensure continued growth.

By 2034, as the market reaches US$ 29.3 billion, bulletproof glass will play an even more critical role in shaping the safety infrastructure of governments, businesses, and consumers worldwide.