Gold has always been a symbol of wealth and security, and its value continues to rise in global markets. Among the various units of gold measurement, the 10 tola gold price holds a special place—especially in South Asia and the Middle East. With deep cultural and historical roots, this traditional unit remains highly relevant for modern investors. In this article, we will explore the significance of the 10 tola gold bar, factors affecting the 10 tola gold price, and tips on buying and tracking its value.

What is a 10 Tola Gold Bar?

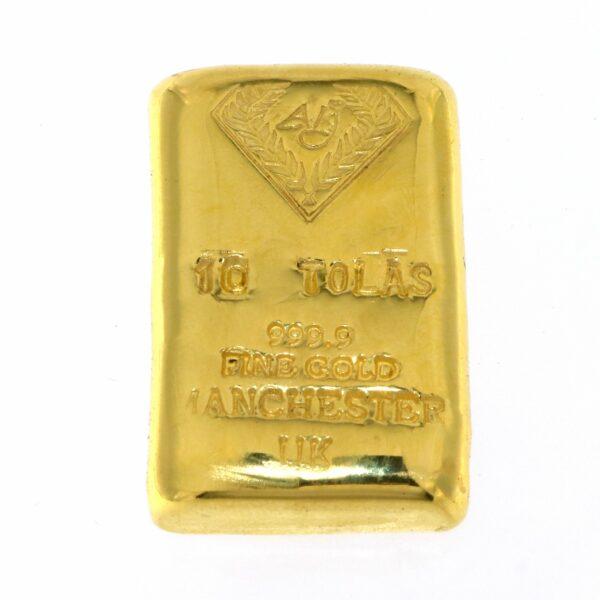

A tola is a traditional South Asian unit of mass used for measuring precious metals. One tola is approximately 11.66 grams, so a 10 tola gold bar weighs about 116.6 grams. This makes it a substantial form of gold investment—roughly equivalent to more than 3.75 troy ounces.

These bars are usually made of 24-karat gold with a purity of 999.9 (fine gold) and are widely traded in countries like India, Pakistan, UAE, and others with strong gold-buying traditions.

Why is the 10 Tola Gold Bar Popular?

1. Cultural Significance

In many cultures, tola-weighted gold bars are given as gifts during weddings, religious festivals, and family milestones.

2. Investment Value

With a weight just over 100 grams, a 10 tola gold bar represents a mid-sized investment option—ideal for those looking to store wealth in physical gold.

3. High Liquidity

10 tola bars are widely recognized and easy to sell across major bullion markets.

What Influences the 10 Tola Gold Price?

The 10 tola gold price is influenced by several key factors:

-

Global Gold Spot Price: Since gold is traded internationally, the global spot price in USD heavily impacts local tola pricing.

-

Currency Exchange Rates: The value of local currencies against the US dollar affects the final price in markets like India, Pakistan, and UAE.

-

Import Duties and Taxes: Countries with high gold import duties will see a higher 10 tola price than global averages.

-

Demand and Supply: During wedding seasons or festivals like Diwali or Eid, demand spikes can increase the premium on 10 tola bars.

-

Refiner and Brand Premiums: Bars from well-known refiners like PAMP, Valcambi, or local mints may carry slightly higher prices due to their reliability and resale value.

How to Check the 10 Tola Gold Price

You can find updated 10 tola gold prices from the following sources:

-

Bullion Dealer Websites: Online platforms like Malabar Gold, Gulf Exchange, and Kitco offer real-time gold prices, including tola rates.

-

Local Jewellers: Trusted local jewellers update their gold prices daily and can provide accurate rates including making charges or premiums.

-

Financial News Portals: Platforms like Bloomberg and Reuters track global gold prices and related trends.

Quick Tip: To calculate the 10 tola price from the gram rate, multiply the per gram gold price by 116.6.

Example: 10 Tola Gold Price Estimation

If the current gold price is $75 per gram (internationally), then:

10 Tola Gold Price = 75 × 116.6 = $8,745 USD

Note: Local taxes, import duties, and dealer premiums 10 tola gold price will increase the final retail price.

Where to Buy a 10 Tola Gold Bar

-

Authorized Bullion Dealers

-

Banks (in regions like UAE or India)

-

Online Precious Metal Retailers

-

Reputed Jewellers

Always ensure your bar comes with:

-

A certificate of authenticity

-

A recognized hallmark (e.g., LBMA-approved refinery)

-

Tamper-evident packaging

Final Thoughts

The 10 tola gold price is more than just a number—it represents a long-standing tradition of wealth preservation and financial security. Whether you're purchasing for investment, cultural reasons, or as a family heirloom, the 10 tola gold bar remains a smart and respected choice. Track its price regularly, buy from trusted sources, and enjoy the stability that only gold can provide.