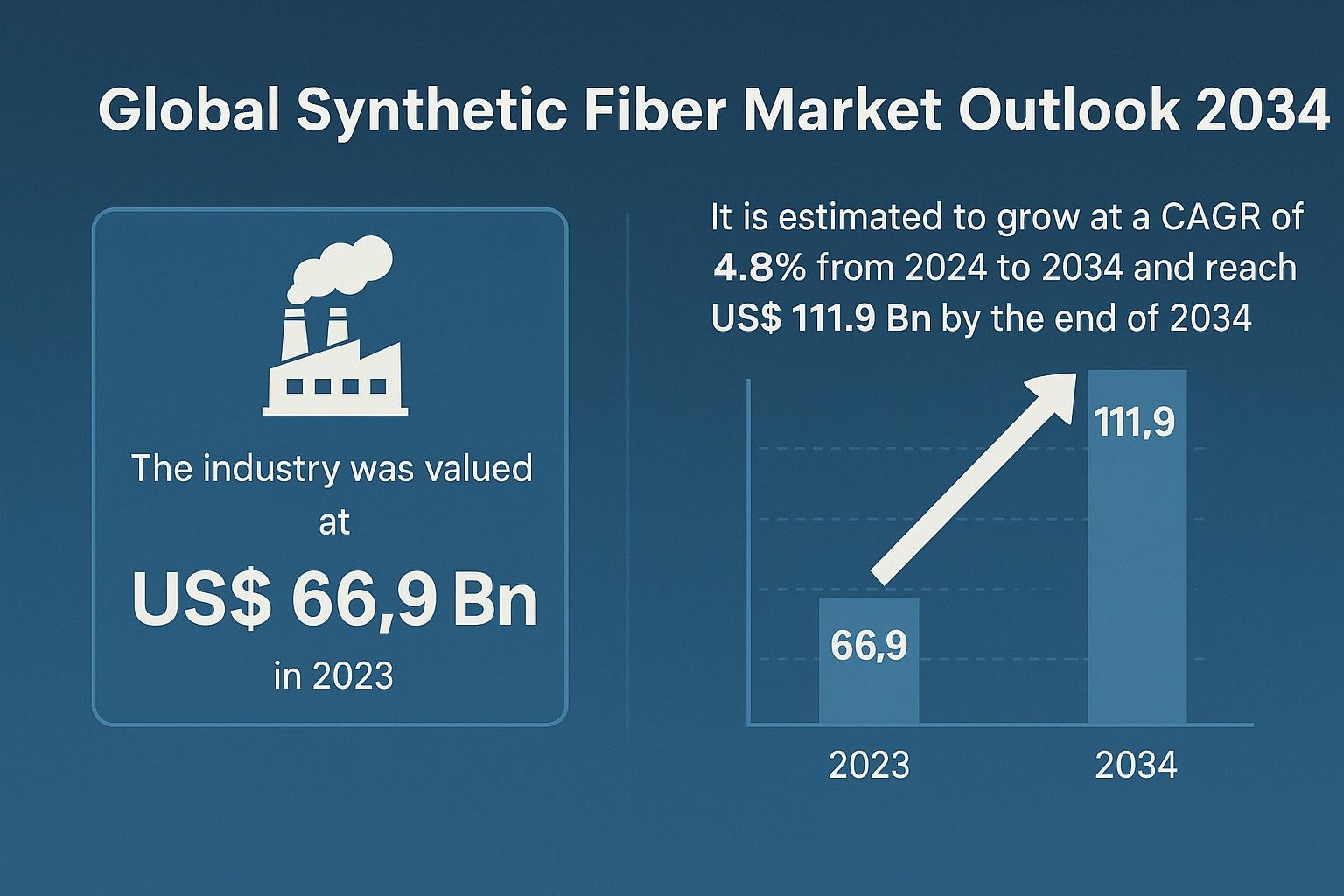

The global synthetic fiber market is entering a decade of strong transformation shaped by technological advancements, increasing industrial applications, and rising demand across high-growth sectors such as automotive, textiles, and cosmetics. Valued at US$ 66.9 Bn in 2023, the industry is projected to expand steadily at a CAGR of 4.8% between 2024 and 2034, ultimately reaching US$ 111.9 Bn by 2034. This long-term forecast reflects the powerful interplay between consumer demand, industrial innovation, and policy support that continues to elevate the role of synthetic fibers in modern manufacturing.

Analyst Viewpoint: Why Synthetic Fibers Are Becoming a Global Industrial Backbone

According to industry analysts, the synthetic fiber market is witnessing a sharp rise in demand driven significantly by lightweight automotive components, the electrification of vehicles, and the rapid expansion of the cosmetics industry. Synthetic fibers—created through chemical synthesis—offer advantages that natural fibers cannot match, including high durability, exceptional strength-to-weight ratio, versatility, wrinkle resistance, and cost efficiency. These attributes make them indispensable in a wide range of applications from home textiles to high-performance industrial materials.

With the global shift toward eco-efficient vehicles and the burgeoning demand for innovative beauty products, manufacturers are increasing their investment in R&D, capacity expansion, product diversification, and strategic partnerships. The market is further supported by regulatory initiatives promoting recycled synthetic fibers, particularly in Asia.

Market Introduction: The Science and Advantage of Synthetic Fibers

Synthetic fibers—often referred to as man-made or artificial fibers—are engineered through controlled chemical processes to mimic or enhance the characteristics of natural fibers. Popular types include nylon, polyester, acrylic, rayon, spandex, and olefin, each serving unique functions across industries.

These fibers offer:

- Superior durability and strength

- High resistance to shrinkage and wrinkles

- Low moisture absorption

- Anti-microbial properties, making them ideal for healthcare and hygiene applications

- Affordability and easy manufacturability

- Consistency in quality, unlike natural fibers which often vary based on environmental factors

As a result, synthetic fibers have become dominant in sectors such as textiles, automotive manufacturing, electronics, home furnishing, and medical materials.

Rise in Demand for Lightweight Automotive Parts Accelerates Market Expansion

The automotive sector is one of the strongest contributors to synthetic fiber consumption. As manufacturers shift toward lightweighting strategies to enhance fuel efficiency and improve electric vehicle performance, synthetic fibers are becoming increasingly essential.

Synthetic fiber-based polymer composites are used in:

- Door panels

- Boot linings

- Instrument panel supports

- Sun visors

- Interior insulation

- Wheel boxes

- Roof covers

- Bumpers

- Trunk panels

These components significantly reduce overall vehicle weight while maintaining structural strength and durability. In electric vehicles, reducing weight directly improves battery efficiency and driving range, making synthetic fibers even more valuable.

Global electrification trends further amplify this demand. For instance, Harvard Business Review reports that China’s new EV sales surged by 82% in 2022, representing nearly 60% of global EV sales—a clear indicator of the scale at which synthetic fiber usage is rising in the automotive sector.

Cosmetics Industry Emerges as an Unexpected Growth Engine

Synthetic fibers are increasingly central to the global cosmetics and personal care industry. Their versatility, softness, and ability to mimic natural textures make them ideal for:

- Makeup brushes and applicators (nylon, polyester)

- False eyelashes and extensions (polyester)

- Wigs and hair extensions (acrylic, polyester)

- Makeup sponges and puffs (polyurethane synthetic foams)

- Cleansing brushes (nylon bristles)

- Cosmetic packaging components such as mascara wands and lip gloss applicators

As beauty trends expand worldwide—driven by social media, product innovation, and rising disposable income—the demand for high-quality and affordable synthetic materials continues to intensify. This strong global consumption pattern significantly contributes to the expanding synthetic fiber market revenue.

Regional Outlook: Asia Pacific Leads Global Market Dominance

Asia Pacific remained the leading regional market in 2023, and is expected to maintain dominance through 2034. Several key factors drive this regional strength:

- Massive textile production capabilities, particularly in China, India, Vietnam, and Bangladesh

- Government regulations promoting recycled synthetic fibers, including China’s 2023 policy supporting recycled fiber usage

- Rapid automotive electrification across China, Japan, South Korea, and India

- Growing investments in sustainability and carbon-emission reduction

China—already the world’s largest producer and consumer of textiles—is accelerating efforts to encourage recycled synthetic fibers, further reinforcing its leadership position in the global market.

Competitive Landscape: Strategic Investments and Innovations Shape Industry Growth

Global industry leaders are doubling down on technology upgrades, capacity expansion, and mergers & acquisitions to strengthen their competitive positions. Demand for high-performance fibers in automotive, apparel, industrial, and consumer applications is prompting manufacturers to innovate faster than ever.

Key companies include:

- Asahi Kasei Corporation

- Indorama Corporation

- Toray Industries, Inc.

- Mitsubishi Chemical Holdings Corporation

- China Petroleum Corporation

- Reliance Industries Limited

- Tongkun Group Co., Ltd.

- Teijin Limited

- Kolon Industries, Inc.

- Eastman Chemical Company

Recent developments reflect strong M&A activity and technological advancement. For example, in March 2021, Teijin Frontier consolidated multiple subsidiaries to create Teijin Frontier Knitting Co. Ltd., targeting next-generation yarn innovation. In January 2020, Toray Industries acquired Sweden’s Alva AB and its production units to strengthen its presence in the automotive airbag market.

Conclusion: Sustainable Innovation and Industrial Demand Will Drive the Synthetic Fiber Market to US$ 111.9 Bn by 2034

As the world moves toward lighter vehicles, advanced textiles, innovative cosmetics, and sustainable manufacturing, synthetic fibers will play an increasingly central role. The projected rise from US$ 66.9 Bn in 2023 to US$ 111.9 Bn by 2034 highlights a strong decade of expansion fueled by consumer demand, industrial needs, and technological breakthroughs.

With Asia Pacific at the forefront and global manufacturers investing heavily in R&D and sustainability, the synthetic fiber market is well-positioned for consistent and transformative growth through 2034.