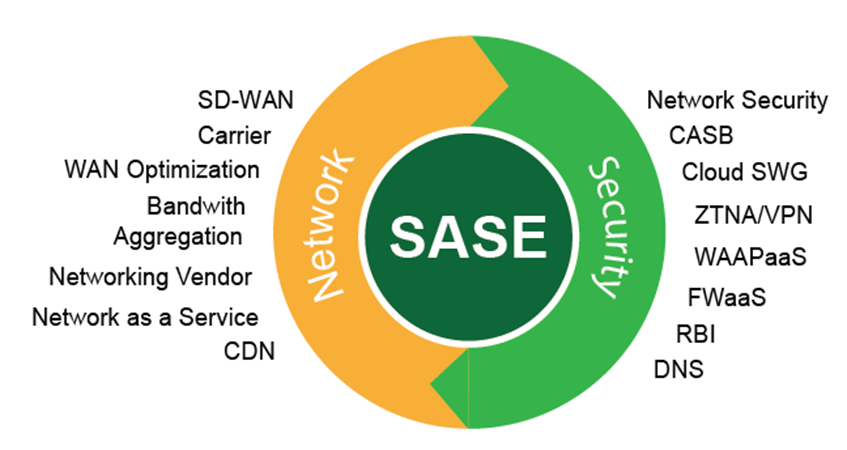

The Secure Access Service Edge (SASE) market is, by its very definition, a story of technological consolidation. The entire concept of SASE is about consolidating a wide range of previously separate and siloed networking and security functions into a single, unified, cloud-delivered service. This powerful wave of Secure Access Services Edge Industry Share Consolidation is not just a market trend; it is the fundamental value proposition of the market itself. For decades, enterprises have had to purchase, deploy, and manage a complex and costly stack of physical appliances in their data centers to secure their network—a firewall from one vendor, a secure web gateway from another, a WAN optimization appliance from a third, and so on. SASE consolidates all of these functions, and more, into a single software stack delivered from the cloud. The primary driver of this consolidation is the overwhelming need for simplicity and operational efficiency in a world where users, applications, and data are now distributed everywhere. The old, appliance-based model is simply too complex, too rigid, and too expensive to scale in the modern, cloud-first, work-from-anywhere era.

This functional consolidation is being enabled and accelerated by a wave of corporate consolidation, as the major platform vendors are aggressively using M&A to build out their complete SASE offerings. The market is too broad and the technologies too diverse for any single company to have organically developed best-in-class capabilities across all the necessary components. Therefore, the race to build a leading SASE platform has become a high-stakes M&A game. A vendor with a strong background in network firewalls might acquire a leading Cloud Access Security Broker (CASB) company to strengthen its data security capabilities. A company with a market-leading SD-WAN solution will acquire a Zero Trust Network Access (ZTNA) startup to add a critical remote access security component to its portfolio. This M&A-driven strategy is a direct response to enterprise customers who are demanding a single, integrated platform from a single strategic vendor. They no longer want the headache of being a systems integrator, stitching together a dozen different security and networking point solutions.

The long-term impact of this consolidation—both functional and corporate—is a fundamental restructuring of the enterprise networking and security market. The market is rapidly moving away from a fragmented landscape of hundreds of point-solution vendors and is coalescing around a handful of major SASE platform providers who can offer a credible, end-to-end solution. This is creating a new tier of "cybersecurity super-vendors" with incredibly broad and powerful platforms. For enterprise customers, this can lead to significant benefits in terms of simplified management, better integration, and potentially lower total cost of ownership. However, it also raises significant long-term concerns about vendor lock-in, as it becomes increasingly difficult to switch away from a deeply entrenched, all-encompassing platform. The consolidation of the SASE market is therefore a double-edged sword, offering simplicity at the potential cost of future flexibility and choice. The Secure Access Services Edge Market size is projected to grow to USD 42.86 Billion by 2035, exhibiting a CAGR of 22.1% during the forecast period 2025-2035.

Top Trending Reports -