Market Overview:

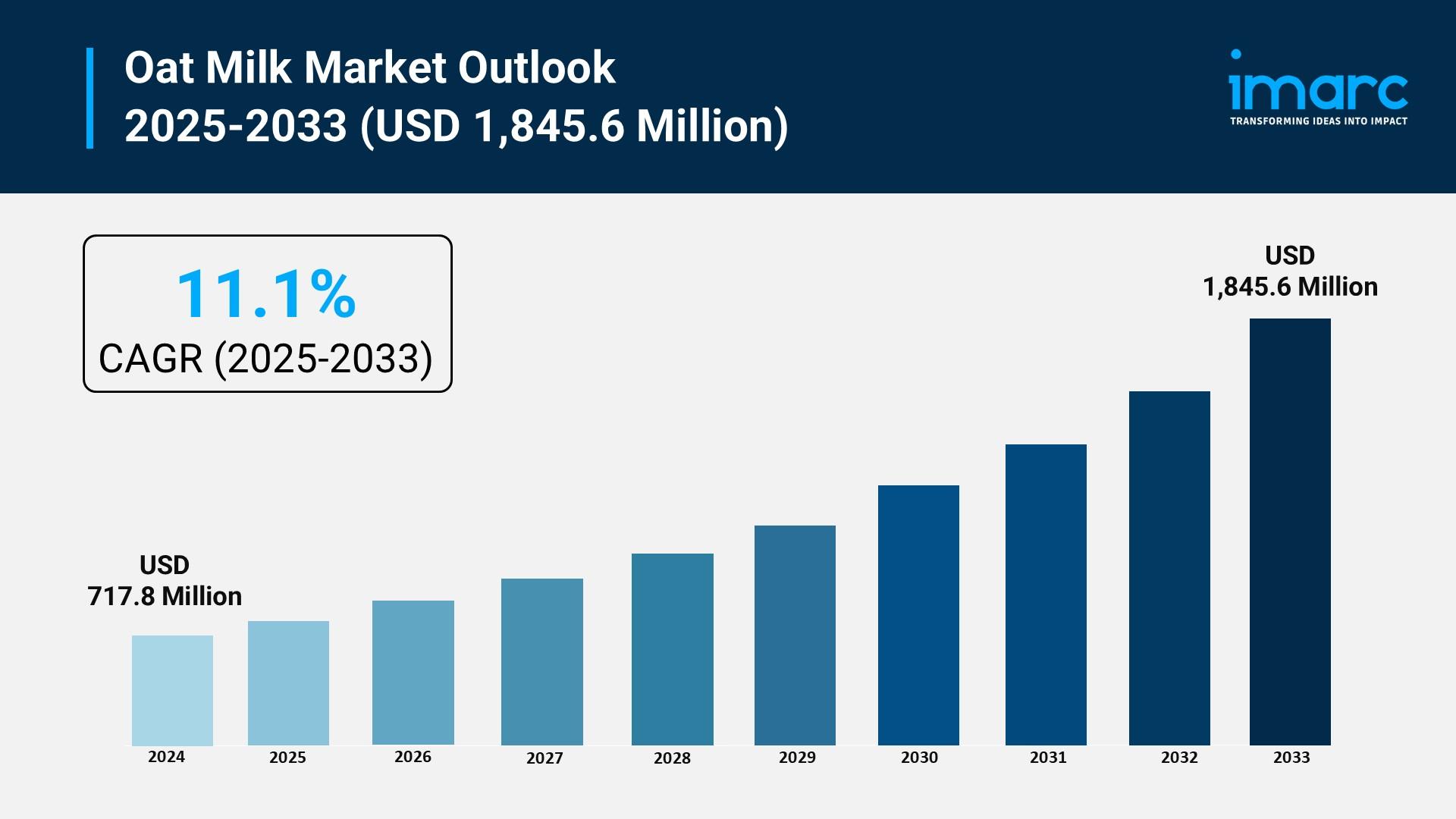

The oat milk market is experiencing rapid growth, driven by environmental sustainability and resource efficiency, rising rates of lactose intolerance and veganism, and expansion into foodservice and café culture. According to IMARC Group's latest research publication, "Oat Milk Market Size, Share, Trends, and Forecast by Source, Product, Packaging Type, Application, Distribution Channel, and Region, 2025-2033", the global oat milk market size was valued at USD 717.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,845.6 Million by 2033, exhibiting a CAGR of 11.1% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/oat-milk-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Oat Milk Market

- Environmental Sustainability and Resource Efficiency

A primary driver for the expansion of the oat milk market is its significantly lower environmental footprint compared to traditional dairy and other plant-based alternatives. Environmental studies indicate that producing a liter of oat milk requires approximately 60% less energy and 80% less land than cow’s milk, while emitting 80% fewer carbon emissions. Furthermore, oat cultivation is notably more water-efficient than almond production, which has historically faced criticism for its high irrigation demands in water-scarce regions. Major industry players like Oatly have leveraged these statistics to appeal to eco-conscious Gen Z and Millennial consumers, who increasingly view food choices as a form of environmental activism. Government bodies and non-governmental organizations are also supporting this shift by promoting regenerative agriculture and organic farming practices, which further enhances the appeal of oats as a sustainable raw material for the global beverage industry.

- Rising Rates of Lactose Intolerance and Veganism

The global increase in diagnosed lactose intolerance and a broader shift toward vegan and flexitarian lifestyles are propelling the demand for dairy-free alternatives. In regions like North America and Europe, an estimated 50% to 75% of certain populations report varying degrees of dairy sensitivity, making oat milk a critical nutritional substitute. Unlike soy or almond milk, oat milk is naturally free from common allergens such as nuts and soy, positioning it as a safer "clean label" option for households with multiple dietary restrictions. Strategic company activities have mirrored this trend; for instance, Danone and Lactalis have recently repurposed former dairy processing facilities specifically for oat milk production to meet this escalating demand. This institutional shift from dairy to plant-based infrastructure underscores the permanence of the consumer transition toward allergen-friendly, nutrient-dense beverages that do not compromise on taste or texture.

- Expansion into Foodservice and Café Culture

The integration of "Barista Edition" oat milk into global coffee chains and independent cafés has acted as a major catalyst for market growth. Oat milk’s unique chemical composition allows it to produce a stable micro-foam and creamy mouthfeel that closely mimics whole dairy milk, a feat that thinner alternatives like rice or almond milk often fail to achieve. In the United States, oat milk’s share of the plant-based milk market recently grew to 25%, largely driven by its dominance in coffee applications. Partnerships between oat milk brands and major retailers have become a standard growth strategy; for example, Blue Diamond and SunOpta have expanded their portfolios to include extra-creamy formulations specifically for the HoReCa (Hotel, Restaurant, and Café) sector. This visibility in the "on-trade" segment introduces the product to a wider audience, encouraging repeat purchases in the retail sector for home consumption.

Key Trends in the Oat Milk Market

- Functional and Nutrient-Enhanced Formulations

One of the most prominent trends is the move beyond basic dairy substitution toward "functional" oat milk that offers targeted health benefits. Manufacturers are now fortifying products with more than just the standard Calcium and Vitamin D; new formulations include added pea protein, probiotics for gut health, and Vitamin B12 to support energy metabolism. For example, some brands have launched ready-to-drink meal replacements that contain up to 23 grams of protein per serving alongside prebiotic fiber. This trend caters to the growing segment of health-conscious individuals and gym enthusiasts who seek "performance-driven" beverages. By transforming oat milk into a vehicle for wellness, companies are successfully capturing a larger share of the nutraceutical market, moving the product from a simple coffee whitener to a comprehensive nutritional supplement that supports a holistic lifestyle.

- Gourmet Flavor Innovation and Premiumization

The oat milk market is moving away from purely "plain" or "unsweetened" varieties toward sophisticated, culinary-inspired flavor profiles. While traditional vanilla and chocolate remain popular, emerging trends include botanical infusions and indulgent options like salted caramel, mocha, matcha, and turmeric. Real-world applications of this trend are visible in the rapid launch of seasonal and limited-edition lines that treat oat milk as a premium treat rather than a utility. Numerical insights from retail data suggest that flavored variants are growing at a faster rate than unflavored options, as younger demographics—particularly Millennials—seek novel sensory experiences. This "premiumization" allows brands to command higher price points by offering exotic taste profiles that appeal to the "foodie" culture, ensuring that oat milk remains a vibrant and exciting category in a crowded beverage landscape.

- Sustainable Packaging and Distribution Breakthroughs

As the product itself is marketed on a platform of sustainability, the packaging is undergoing a parallel revolution. While traditional paperboard cartons remain the standard, there is a surge in the use of infinitely recyclable aluminum cans and "flat-pack" 2D-printed technology. Some innovative companies have even developed oat milk "sheets" that can be reconstituted with water, reducing packaging waste by 94% and significantly lowering shipping weights. This technological advancement addresses the logistical costs and carbon footprint associated with transporting heavy liquid products. Additionally, the rise of the "Direct-to-Consumer" (DTC) model and subscription services ensures that these eco-friendly formats reach urban consumers with maximum efficiency. These packaging breakthroughs not only align with the core environmental values of the oat milk consumer but also help manufacturers optimize their supply chains in an increasingly competitive global market.

The oat milk market report provides a comprehensive overview of the industry. This analysis is essential for stakeholders aiming to navigate the complexities of the xx market and capitalize on emerging opportunities.

Leading Companies Operating in the Oat Milk Industry:

- Califia Farms LLC

- Earth's Own Food Company Inc

- Elmhurst Milked Direct LLC

- Happy Planet Foods Inc.

- Oatly AB (Cereal Base Ceba AB)

- Pacific Foods of Oregon LLC (Campbell Soup Company)

- Planet Oat Oatmilk (HP Hood LLC.)

- RISE Brewing Co.

- The Hain Celestial Group Inc.

- Thrive Market Inc.

Oat Milk Market Report Segmentation:

By Source:

- Organic

- Conventional

Conventional oat milk leads (74.0% share) due to affordability, wide availability, and strong supply chain integration, while organic variants grow steadily.

By Product:

- Plain

- Flavored

Plain oat milk dominates (58.3% share) for its versatility, clean-label appeal, and suitability for cooking, beverages, and dietary preferences.

By Packaging Type:

- Cartons

- Bottles

- Others

Cartons hold the largest share (53.2%) owing to convenience, sustainability, and effective preservation, aligning with eco-conscious consumer trends.

By Application:

- Food

- Beverages

Beverages lead (68.2% share) as oat milk’s creamy texture and neutral taste make it a preferred dairy alternative in coffee and drinks.

By Distribution Channel

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

Supermarkets & hypermarkets capture 40.4% share due to product variety, accessibility, and promotional strategies driving consumer purchases.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe dominates (52.8% share) with strong plant-based adoption, sustainability focus, and supportive policies, led by Germany, UK, and Sweden.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302