"Regional Overview of Executive Summary Point of Sale (POS) Payment Technologies Market by Size and Share

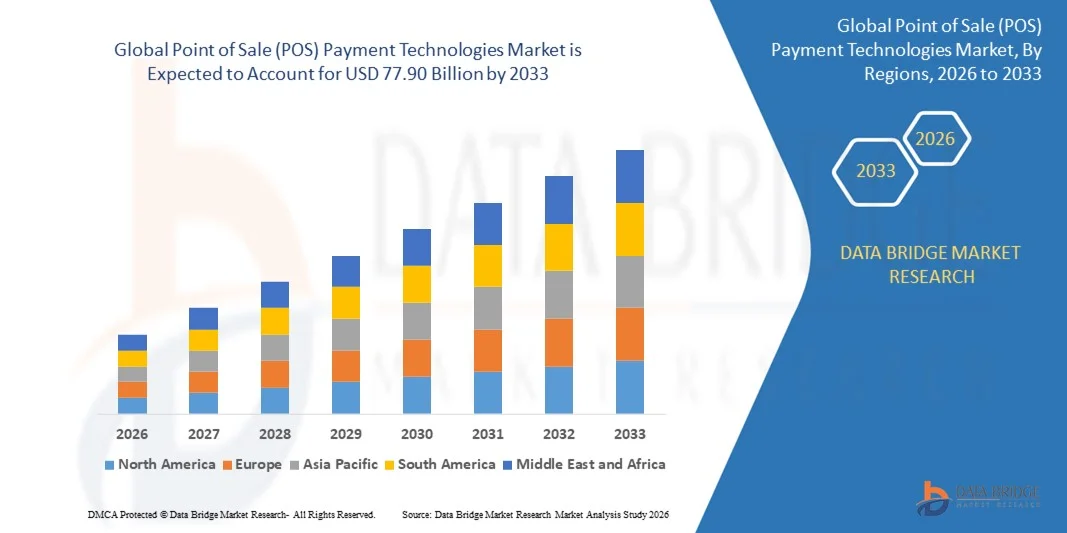

- The global point of sale (POS) payment technologies market size was valued at USD 22.33 billion in 2025 and is expected to reach USD 77.90 billion by 2033, at a CAGR of 16.90% during the forecast period

The strategies encompassed in the Point of Sale (POS) Payment Technologies report mainly include new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others that boost their footprints in this market. This gives a more accurate understanding of the market landscape, issues that may affect the industry in the future, and how to best position specific brands. Which will tell you how the Point of Sale (POS) Payment Technologies Market is going to perform in the forecast years by informing you what the market definition, classifications, applications, and engagements are.

Point of Sale (POS) Payment Technologies Market research report contains complete background analysis of industry, which includes an assessment of the parental market. All the statistical and numerical that has been forecasted in this Point of Sale (POS) Payment Technologies report is represented with the help of graphs, charts, or tables which makes this report more user friendly. The Point of Sale (POS) Payment Technologies report contains thorough description, competitive scenario, wide product portfolio of key vendors and business strategy adopted by competitors along with their SWOT analysis and porter's five force analysis. Whether it is about renewing a business plan, preparing a presentation for a key client, or giving recommendations to an executive, this Point of Sale (POS) Payment Technologies Market report will surely help you to a degree.

Learn how the Point of Sale (POS) Payment Technologies Market is evolving—insights, trends, and opportunities await. Download report:

https://www.databridgemarketresearch.com/reports/global-point-of-sale-pos-payment-technologies-market

Point of Sale (POS) Payment Technologies Market Introduction

Segments

- By Component: Hardware, Software, Services

- By Deployment: On-premise, Cloud-based

- By Vertical: Retail, Hospitality, Healthcare, Entertainment, Others

The global point of sale (POS) payment technologies market is segmented based on components, deployment, and verticals. When it comes to components, the market is categorized into hardware, software, and services. Hardware includes devices such as card readers, touchscreens, and barcode scanners. Software consists of POS applications and payment processing software. Services encompass installation, maintenance, and support services. On the basis of deployment, the market is divided into on-premise and cloud-based solutions. On-premise POS systems are installed locally on the business premises, while cloud-based systems are accessed remotely through the internet. In terms of verticals, the market caters to industries such as retail, hospitality, healthcare, entertainment, and others.

Market Players

- Verifone

- Ingenico Group

- PAX Technology

- NCR Corporation

- Toshiba Corporation

- Epicor Software Corporation

- Micros Systems Inc.

- Panasonic Corporation

- HP Development Company

- Samsung Electronics Co. Ltd.

Key market players in the global POS payment technologies market include Verifone, Ingenico Group, PAX Technology, NCR Corporation, Toshiba Corporation, Epicor Software Corporation, Micros Systems Inc., Panasonic Corporation, HP Development Company, and Samsung Electronics Co. Ltd. These companies are actively involved in developing innovative POS solutions to meet the evolving needs of businesses across various industries. With a focus on enhancing payment security, improving customer experience, and driving operational efficiencies, these market players are crucial in shaping the future of POS technology.

The global point of sale (POS) payment technologies market continues to witness significant growth and transformation driven by technological advancements and changing consumer preferences. Key market players such as Verifone, Ingenico Group, and NCR Corporation are at the forefront of innovation, continually developing cutting-edge POS solutions to cater to the diverse needs of businesses in the retail, hospitality, healthcare, and entertainment sectors. These companies are leveraging technologies such as artificial intelligence, machine learning, and data analytics to enhance payment security, streamline operations, and improve the overall customer experience. In addition, the shift towards omnichannel retailing and the increasing demand for contactless payment solutions are reshaping the POS landscape, pushing companies to adapt and evolve their offerings to stay competitive in the market.

One of the emerging trends in the POS payment technologies market is the integration of advanced biometric authentication features. Biometric authentication, such as fingerprint scanning and facial recognition, offers enhanced security and convenience for both merchants and consumers. By incorporating biometric technologies into POS systems, businesses can further strengthen payment security and reduce the risk of fraud, creating a more secure and seamless transaction experience. Moreover, the ongoing digitalization of payment processes and the growing adoption of mobile POS solutions are driving the demand for more flexible and agile payment technologies that can adapt to changing business requirements and consumer preferences.

Another key development in the POS payment technologies market is the emphasis on data analytics and business intelligence. POS systems are increasingly being used not only for processing transactions but also for gathering valuable data on customer behavior, sales trends, and inventory management. By analyzing this data effectively, businesses can gain actionable insights that enable them to make informed decisions, optimize their operations, and enhance customer engagement. As a result, market players are focusing on developing sophisticated analytics tools and reporting features that empower businesses to leverage data-driven strategies and drive profitability.

Furthermore, the integration of POS systems with other business applications such as inventory management, customer relationship management (CRM), and e-commerce platforms is becoming more prevalent. This integration enables seamless data sharing and communication between different systems, streamlining processes and providing a unified view of the business operations. By creating a connected ecosystem of technologies, businesses can improve efficiency, productivity, and decision-making, ultimately driving growth and competitive advantage in the market.

Overall, the global POS payment technologies market is poised for continued expansion and innovation, fueled by evolving customer demands, technological advancements, and industry trends. Key market players will play a pivotal role in shaping the future of POS technology by delivering robust, secure, and feature-rich solutions that meet the dynamic needs of businesses across various sectors. As the market continues to evolve, businesses that embrace technology, data analytics, and seamless integration will be well-positioned to thrive in a rapidly changing business environment.The global point of sale (POS) payment technologies market is experiencing a significant shift towards more advanced and secure solutions to meet the growing demands of businesses and consumers alike. As technology continues to evolve, key market players are investing heavily in innovation to develop cutting-edge POS systems that offer enhanced payment security, seamless customer experience, and operational efficiency. The integration of biometric authentication features, such as fingerprint scanning and facial recognition, is a notable trend shaping the market landscape. By incorporating biometric technologies into POS systems, businesses can strengthen security protocols and minimize the risks associated with fraudulent activities, thus ensuring a safer and more streamlined transaction process.

Moreover, the emphasis on data analytics and business intelligence is another key development driving the evolution of POS payment technologies. POS systems are no longer limited to transaction processing but are increasingly being leveraged to gather valuable insights on customer behavior, sales patterns, and inventory management. By harnessing the power of data analytics, businesses can make informed decisions, optimize operations, and boost customer engagement, ultimately leading to enhanced profitability and business growth. Market players are responding to this trend by developing sophisticated analytics tools and reporting features that empower businesses to embrace data-driven strategies and drive competitive advantage in the market.

Additionally, the integration of POS systems with other business applications such as inventory management, CRM, and e-commerce platforms is gaining traction in the POS payment technologies market. This integration facilitates seamless data exchange and communication between different systems, streamlining operations and providing a cohesive view of business activities. By creating a connected ecosystem of technologies, businesses can improve overall efficiency, productivity, and decision-making processes, thereby driving growth and enhancing their competitive position in the market. The trend towards omnichannel retailing and the rising demand for contactless payment solutions are also influencing the POS landscape, prompting companies to adapt and innovate their offerings in response to changing consumer preferences and market dynamics.

In conclusion, the global POS payment technologies market is poised for continual expansion and transformation, propelled by technological advancements, evolving customer expectations, and industry trends. Market players such as Verifone, Ingenico Group, and NCR Corporation will continue to play a vital role in shaping the future of POS technology by delivering secure, feature-rich, and adaptable solutions that cater to the diverse needs of businesses across various sectors. As businesses increasingly embrace digitalization, data analytics, and integration capabilities, they will be well-positioned to thrive in an ever-evolving business environment and seize opportunities for growth and success in the competitive POS market.

Gain insights into the firm’s market contribution

https://www.databridgemarketresearch.com/reports/global-point-of-sale-pos-payment-technologies-market/companies

Point of Sale (POS) Payment Technologies Market – Analyst-Ready Question Batches

- What is the global market size for the Point of Sale (POS) Payment Technologies sector currently?

- What is the expected growth trajectory for the Point of Sale (POS) Payment Technologies Market?

- What are the segment highlights provided in the Point of Sale (POS) Payment Technologies Market report?

- Which enterprises are leading the Point of Sale (POS) Payment Technologies Market space?

- Which nations have detailed data in the Point of Sale (POS) Payment Technologies report?

- What major brands are identified in the Point of Sale (POS) Payment Technologies Market?

Browse More Reports:

Global Ophthalmoplegia Market

Global Optogenetics Market

Global Orbital Atherectomy Market

Global Organic Deodorant Market

Global Orthopedic Surgical Energy Devices Market

Global Oryzanol Market

Global Otitis Drug Market

Global Outdoor Living Products Market

Global Overnight Face Mask Market

Global Oxygen Conservers Market

Global Packaged Water Treatment System Market

Global Packaging Peanut Market

Global Padlock Seal Market

Global Pallet Box Market

Global Panthenol Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"