According to a TechSci Research report titled “UAE Luxury Car Market – By Region, Competition, Forecast & Opportunities, 2030F”, the UAE luxury car market was valued at USD 442.51 million in 2024 and is projected to reach USD 541.23 million by 2030, expanding at a compound annual growth rate (CAGR) of 3.46% during the forecast period. This steady yet resilient growth underscores the UAE’s position as one of the most attractive luxury automotive markets globally.

The United Arab Emirates has long been synonymous with affluence, innovation, and premium lifestyles. Within this context, luxury automobiles occupy a prominent role, functioning not merely as transportation tools but as powerful symbols of success, individuality, and technological sophistication. The UAE luxury car market thrives on a unique blend of high disposable incomes, cosmopolitan demographics, world-class infrastructure, and a deep-rooted appreciation for high-end products and experiences.

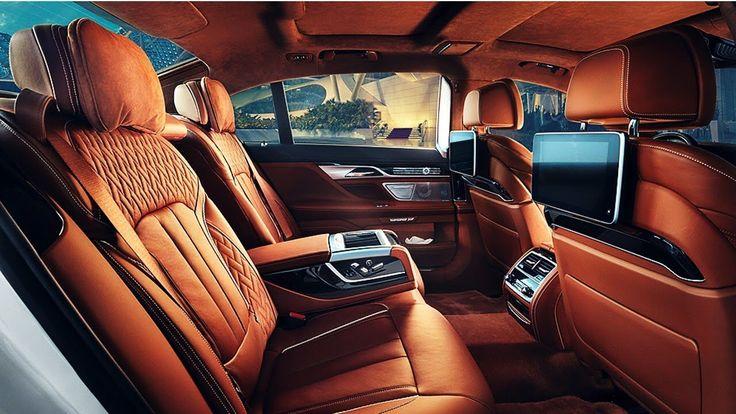

Luxury vehicles in the UAE are embedded within the country’s cultural fabric. From iconic supercars cruising Sheikh Zayed Road to ultra-luxury sedans parked outside five-star hotels, premium automobiles reflect the nation’s emphasis on style, performance, and exclusivity. This environment creates fertile ground for luxury car manufacturers to introduce cutting-edge technologies, bespoke offerings, and next-generation mobility solutions.

The UAE as a Global Hub for Luxury Automotive Brands

The UAE’s strategic geographic position, business-friendly policies, and robust logistics infrastructure make it an ideal regional headquarters for luxury automakers targeting the Middle East, Africa, and South Asia. Zero or low import duties on premium goods, coupled with efficient port operations and modern road networks, enable brands to distribute high-value vehicles efficiently across the region.

Additionally, the country’s large expatriate population—comprising senior executives, entrepreneurs, and professionals—has significantly expanded the consumer base for luxury vehicles. These buyers bring global tastes and expectations, pushing automakers to maintain international standards of quality, service, and innovation.

Luxury car manufacturers leverage the UAE as a showcase market, often launching flagship models, limited editions, and concept vehicles in the region. High-profile auto exhibitions, exclusive brand events, and private unveilings reinforce the UAE’s image as a premier destination for luxury mobility.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=9398

Consumer Behavior and the Luxury Ownership Experience

Luxury car ownership in the UAE extends far beyond functional needs. For many buyers, vehicles represent a fusion of personal identity, lifestyle aspirations, and social status. Consumers demand excellence across every dimension—design, performance, comfort, safety, and technology.

High-net-worth individuals and affluent professionals prioritize brands with strong heritage, global recognition, and a reputation for innovation. German luxury brands dominate the premium performance segment, while British and Italian marques cater to ultra-luxury and exotic tastes. Meanwhile, niche manufacturers and hypercar brands find a receptive audience among collectors and enthusiasts.

Customization has become a defining feature of the UAE luxury car market. Buyers increasingly seek bespoke interiors, exclusive exterior finishes, handcrafted materials, and personalized design elements. This demand has driven manufacturers to expand customization programs, offering near-limitless combinations of materials, colors, and features. Digital configurators and immersive showroom experiences allow customers to visualize and tailor their vehicles with precision, elevating the purchasing journey into a luxury experience in itself.

Industry Key Highlights

-

The UAE luxury car market continues to grow steadily despite global economic uncertainties.

-

High disposable income and aspirational lifestyles drive consistent demand for premium vehicles.

-

Electric luxury vehicles represent the fastest-growing propulsion segment.

-

Bespoke customization and personalization are becoming central to consumer decision-making.

-

SUVs and luxury crossovers are gaining popularity alongside traditional sedans.

-

Digitalization is transforming luxury car retail and customer engagement.

-

Abu Dhabi is emerging as the fastest-growing regional market.

-

Sustainability and environmental awareness are influencing purchasing behavior.

-

Certified pre-owned luxury vehicles are gaining acceptance among younger buyers.

-

Competition among luxury brands is intensifying, driving innovation and service excellence.

Market Drivers

High Disposable Income and Wealth Concentration

One of the most significant drivers of the UAE luxury car market is the country’s high concentration of wealth. The UAE consistently ranks among nations with the highest per capita income levels, supported by diversified economic activities across finance, tourism, real estate, trade, and energy.

Affluent consumers view luxury vehicles as essential lifestyle assets rather than discretionary indulgences. This mindset ensures stable demand even during periods of economic volatility, reinforcing the market’s resilience.

Lifestyle-Oriented Consumption Patterns

Luxury consumption in the UAE is deeply lifestyle-driven. Consumers actively seek products that align with exclusivity, innovation, and prestige. Luxury vehicles complement this lifestyle by offering advanced technology, premium comfort, and striking aesthetics.

The integration of luxury cars into hospitality, tourism, and entertainment ecosystems further enhances demand. Valet services, chauffeur-driven experiences, and luxury vehicle rentals expose a wider audience to premium automotive brands, stimulating aspiration and eventual ownership.

Favorable Policy and Infrastructure Environment

Government support for infrastructure development, smart cities, and sustainable mobility plays a critical role in shaping the luxury automotive market. Well-maintained road networks, advanced traffic systems, and high safety standards create ideal conditions for high-performance vehicles.

Policies promoting electric mobility—such as incentives for EV ownership, charging infrastructure development, and sustainability targets—are encouraging luxury brands to expand their electric portfolios in the UAE.

Emerging Trends in the UAE Luxury Car Market

Electrification of Luxury Mobility

Electrification is reshaping the future of luxury automotive mobility in the UAE. While internal combustion engine (ICE) vehicles continue to dominate due to performance appeal and established fueling infrastructure, electric luxury cars are experiencing rapid adoption.

Luxury EVs offer a compelling combination of sustainability, silent performance, instant torque, and advanced digital interfaces. High-end buyers appreciate the seamless driving experience and futuristic appeal, positioning electric luxury vehicles as symbols of innovation and environmental responsibility.

As charging infrastructure expands across residential areas, commercial centers, and highways, range anxiety is diminishing, further supporting EV adoption.

Digital Transformation of the Purchase Journey

The luxury car buying process in the UAE is undergoing a significant digital transformation. Consumers increasingly begin their purchasing journey online, conducting extensive research, comparing configurations, and engaging with brands through digital platforms.

Luxury automakers are investing heavily in online configurators, virtual showrooms, augmented reality experiences, and remote consultations. This hybrid model blends digital convenience with personalized in-person interactions, redefining customer engagement standards.

Social media and influencer marketing also play a pivotal role in shaping preferences, particularly among younger high-income buyers who value brand storytelling and experiential content.

Growth of Certified Pre-Owned (CPO) Luxury Vehicles

Certified pre-owned luxury vehicles are gaining traction as an entry point for aspiring luxury car buyers. These programs offer manufacturer-backed warranties, rigorous inspections, and maintenance packages, providing peace of mind and value assurance.

CPO vehicles appeal to professionals and entrepreneurs who seek premium experiences without the full cost of new vehicle ownership. This trend is expanding the luxury car customer base and enhancing long-term brand loyalty.

Shift Toward SUVs and Performance Crossovers

Luxury SUVs and performance-oriented crossovers are increasingly popular in the UAE, reflecting changing consumer preferences. These vehicles combine commanding road presence, versatility, and premium comfort, making them suitable for urban driving as well as desert and long-distance travel.

Manufacturers are expanding SUV portfolios across entry-level, mid-range, and ultra-luxury segments, intensifying competition in this category.

Market Segmentation Analysis

By Vehicle Type

The UAE luxury car market is segmented into hatchbacks, sedans, and SUVs/MPVs. Sedans remain a symbol of executive luxury, while SUVs are gaining dominance due to practicality and design appeal. Hatchbacks occupy niche positions, catering to urban luxury buyers seeking compact yet premium mobility.

By Propulsion Type

-

Internal Combustion Engine (ICE): Continues to hold the largest market share due to performance appeal and consumer familiarity.

-

Electric Vehicles (EVs): The fastest-growing segment, driven by incentives, sustainability goals, and technological innovation.

By Price Segment

-

Entry-Level Luxury: Targets younger professionals and first-time luxury buyers.

-

Mid-Range Luxury: Appeals to established executives and entrepreneurs.

-

Premium and Ultra-Luxury: Serves high-net-worth individuals seeking exclusivity and bespoke experiences.

Regional Analysis

Abu Dhabi: The Fastest-Growing Luxury Car Market

Abu Dhabi has emerged as the fastest-growing region within the UAE luxury car market. The emirate’s rapid urban development, expanding business districts, and rising population of high-income residents are driving strong demand for premium vehicles.

Government-led economic diversification initiatives and smart city projects are fostering a conducive environment for luxury mobility adoption. Abu Dhabi’s emphasis on sustainability and clean energy further supports the growth of electric and hybrid luxury vehicles.

The presence of global institutions, diplomatic missions, and multinational corporations contributes to a steady influx of affluent professionals, reinforcing long-term market growth.

Competitive Analysis

The UAE luxury car market is intensely competitive, with global automotive giants and niche luxury manufacturers vying for market share.

Competitive Strategies

-

Brand Differentiation: Emphasis on heritage, performance, and innovation.

-

Customization Programs: Expanding bespoke offerings to meet individual preferences.

-

Digital Engagement: Enhancing online platforms and virtual experiences.

-

After-Sales Excellence: Offering premium service packages, extended warranties, and concierge services.

-

Limited Editions: Launching exclusive models to attract collectors and enthusiasts.

Major Market Players

-

Rolls-Royce Motor Cars Limited

-

BMW AG

-

Koenigsegg Automotive AB

-

Automobili Lamborghini S.p.A.

-

W Motors

-

Daimler AG

-

Volkswagen AG

-

Aston Martin Lagonda Limited

-

Ferrari S.p.A.

-

Automobiles Ettore Bugatti

These players leverage global expertise, local partnerships, and innovation to strengthen their competitive positioning in the UAE.

Market Challenges

Despite favorable conditions, the UAE luxury car market faces several challenges:

-

Market saturation in major urban centers

-

Intense competition among established brands

-

Supply chain disruptions affecting delivery timelines

-

Rising regulatory focus on emissions and sustainability

-

High ownership costs, including maintenance and insurance

Manufacturers are addressing these challenges through flexible financing, service innovations, and sustainable product development.

Future Outlook

The future of the UAE luxury car market remains positive, supported by economic diversification, technological advancement, and evolving consumer preferences. Electric and hybrid luxury vehicles are expected to capture a growing share of the market, while digitalization will continue to reshape customer engagement.

Personalization, sustainability, and experiential ownership will define competitive success. As Abu Dhabi and emerging urban centers gain prominence, regional diversification will further strengthen market expansion.

By 2030, the UAE luxury car market is expected to be more technologically advanced, environmentally conscious, and customer-centric than ever before.

10 Benefits of the Research Report

-

Provides comprehensive market size and growth forecasts through 2030.

-

Offers detailed segmentation by vehicle type, propulsion, price, and region.

-

Identifies key drivers, challenges, and emerging trends.

-

Delivers in-depth competitive landscape analysis.

-

Supports strategic planning and investment decision-making.

-

Highlights high-growth segments and regional opportunities.

-

Assists automakers in product and pricing strategy formulation.

-

Enables distributors to optimize market entry strategies.

-

Helps stakeholders anticipate regulatory and technological shifts.

-

Serves as a reliable reference for long-term market planning.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: sales@techsciresearch.com

Website: www.techsciresearch.com