Market Overview

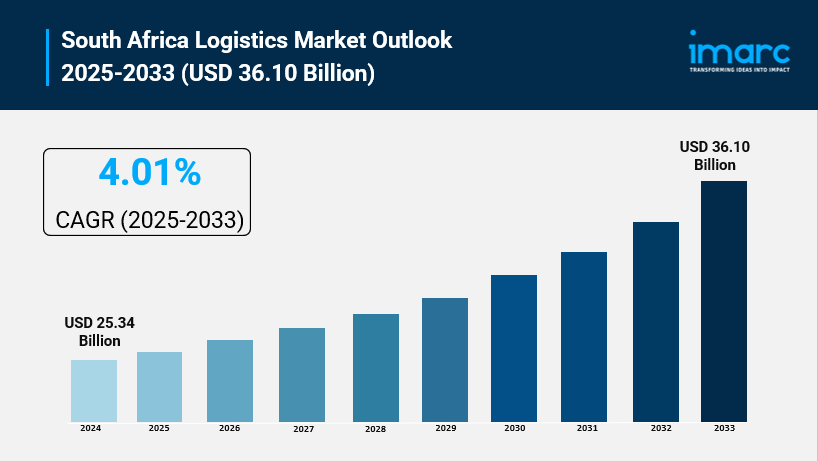

The South Africa logistics market size reached USD 25.34 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.10 Billion by 2033, exhibiting a growth rate (CAGR) of 4.01% during 2025-2033. The market is expected to grow significantly, driven by robust infrastructure investments, including major upgrades to ports, railways, and roads, as well as the rise of digital logistics solutions enhancing operational efficiency. Key sectors such as wholesale and retail are major contributors.

How AI is Reshaping the Future of South Africa Logistics Market

- AI-powered logistics platforms are optimizing route planning and reducing delivery times, significantly boosting operational efficiency in South Africa's logistics sector

- Government infrastructure investments, such as a R1 Trillion allocation emphasizing transport and logistics, create an enabling environment for AI implementation in supply chain management.

- Leading logistics companies are deploying AI-driven cold chain technologies that maintain product quality and reduce losses, especially for perishable goods like pharmaceuticals and fresh food.

- AI-enabled smart warehouses, like Huawei’s 14,000 square meter automated facility in Johannesburg, enhance security, monitoring, and energy efficiency using AI and solar technologies.

- Digital dealer platforms supported by AI facilitate rapid distribution and regulatory compliance for automotive OEMs, exemplified by DP World's turnkey solutions in South Africa.

- Ongoing enhancements in AI-driven monitoring and automated documentation improve compliance, quality assurance, and sustainability within the logistics market.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-logistics-market/requestsample

Market Growth Factors

The rapid expansion of e-commerce continues to reshape the South African logistics landscape, as online retail platforms drive surging demand for efficient last-mile delivery and parcel handling services. Consumers increasingly expect faster, reliable, and traceable shipments, prompting providers to invest in digital platforms, real-time tracking systems, and optimized urban distribution networks. This shift also encourages partnerships with local retailers and the development of pickup points to address challenges like traffic congestion and security concerns in key metropolitan areas. Overall, the integration of technology enhances operational visibility and customer satisfaction, supporting sustained momentum in parcel volumes across major provinces.

Infrastructure modernization and public-private partnerships emerge as critical forces revitalizing transport networks, particularly in rail and port operations. Initiatives to upgrade key corridors, reduce congestion at major facilities like Durban and Cape Town, and introduce private sector participation aim to improve efficiency and capacity. These efforts facilitate smoother multimodal movements, shifting some freight from overburdened roads to more sustainable alternatives while alleviating longstanding bottlenecks. Enhanced connectivity strengthens South Africa's position as a regional gateway, fostering better trade flows and operational reliability for businesses reliant on timely supply chains.

Implementation of the African Continental Free Trade Area accelerates intra-regional commerce, boosting demand for cross-border logistics solutions and diversified trade routes. As barriers diminish and merchandise flows increase toward neighboring markets, multimodal transport options gain prominence to handle varied cargo types efficiently. This integration encourages investments in border facilitation, digital customs processes, and corridor enhancements, enabling logistics operators to capitalize on expanded opportunities. Consequently, the sector benefits from greater trade volumes, supporting economic diversification and positioning South Africa as a pivotal hub within the continent's evolving supply chain dynamics.

Market Segmentation

Model Type Insights:

- 2PL

- 3PL

- 4PL

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Recent Developments & News

- May 2025: DP World introduced a turnkey logistics solution for automotive OEMs in South Africa, tested with Foton Motor, enabling rapid distribution, regulatory compliance, and digital dealer support, enhancing market accessibility for automotive manufacturers.

- April 2025: Huawei launched a 14,000 square meter smart warehouse in Johannesburg featuring advanced automation, AI monitoring, and solar power, significantly improving logistics efficiency and sustainability in the region.

- May 2025: The South African government announced a R1 Trillion infrastructure investment focusing on transport and logistics, including R93.1 Billion for national road maintenance and R66.3 Billion for rail improvements, poised to accelerate logistics sector growth.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302