The financial services industry is undergoing a massive transformation driven by digital innovation. Traditional banking systems and manual processing are being rapidly replaced by intelligent, automated, and highly secure fintech applications. Today, organizations across the world are adopting advanced financial technology solutions integrated with Artificial Intelligence (AI) and Machine Learning (ML) to deliver personalized, faster, and smarter financial experiences. These cutting-edge technologies have reshaped everything—from payment processing and fraud detection to wealth management and risk assessment.

As the demand for automation and real-time analytics increases, AI and ML-powered fintech apps are becoming a powerful tool for businesses aiming to deliver seamless digital services. Developing such applications, however, requires deep technological expertise, advanced financial system knowledge, and a thorough understanding of global compliance protocols. That is why selecting the right fintech app development company is essential to build intelligent, secure, and scalable fintech platforms that unlock new revenue opportunities and future-proof your business.

The Role of AI & ML in Fintech App Development

Artificial Intelligence and Machine Learning are transforming financial operations through automation, data-driven decision-making, predictive modeling, and fraud elimination. They allow financial institutions and digital payment platforms to optimize operations while enhancing customer experience.

Major benefits of integrating AI & ML into fintech applications include:

-

Real-time decision making and faster service processing

-

Increased accuracy through automated calculations

-

Personalization based on customer behavior analytics

-

Fraud prevention using pattern identification

-

Cost savings by reducing manual intervention

-

Compliance support through automated monitoring

-

Improved financial risk assessment

AI enables fintech platforms to think and respond intelligently, while ML improves continuously by learning from transaction history and user data.

Why AI & ML Are Critical for the Future of Finance

The fintech world is moving toward hyper-digitalization, where customers expect instant responses, automatic approvals, and secure transaction experiences. AI and ML play a vital role in:

1. Fraud Detection & Cybersecurity

AI algorithms identify suspicious patterns and prevent unauthorized transactions instantly.

2. Risk Management

ML-based predictive analytics helps financial institutions evaluate credit scores, loan eligibility, and repayment probability more accurately.

3. Robo-Advisory Services

Automated investment platforms analyze financial markets and recommend customized portfolios for users.

4. Intelligent Customer Support

AI-powered chatbots provide 24/7 personalized support for banking, insurance, and investment services.

5. Automated KYC & AML

Smart verification processes reduce onboarding time and ensure compliance.

6. Loan & Insurance Automation

AI speeds up approval decisions and reduces documentation workloads.

7. Real-Time Fraud Alerts & Behavioral Scoring

Security models continuously analyze user activity to detect potential threats.

These technologies offer powerful competitive advantages, increasing performance, security, and user trust.

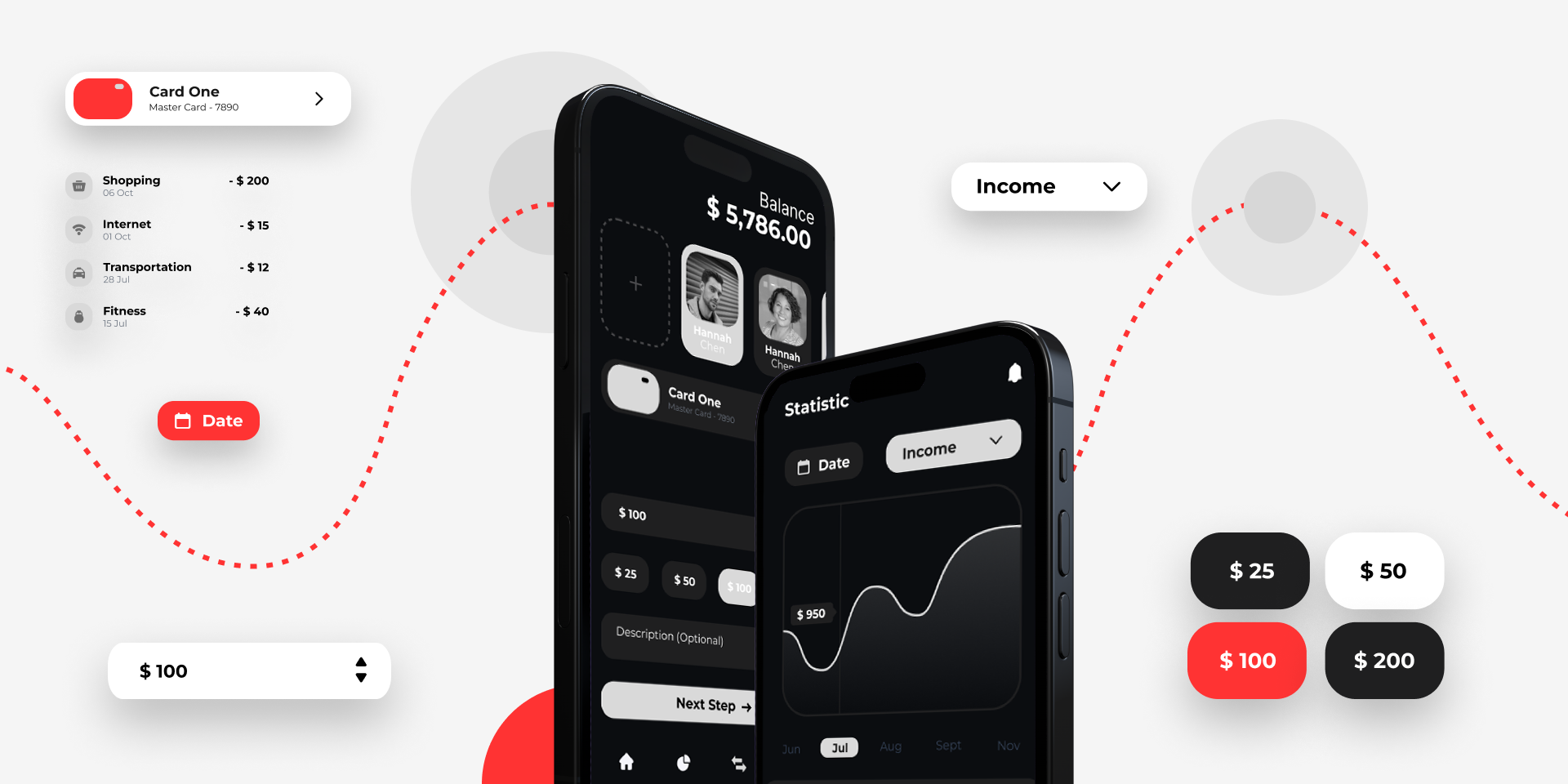

Key Features of AI & ML-Based Fintech Applications

A high-performing fintech application integrated with AI & ML typically includes:

-

Biometric authentication (face/fingerprint recognition)

-

Real-time payment processing

-

Automated risk and financial scoring models

-

Personalized dashboards and investment recommendations

-

Speech and text analytics for virtual financial assistants

-

AML/KYC automation

-

Intelligent transaction categorization

-

Automated settlements and reconciliation

-

AI-based portfolio & wealth management

These smart features enhance user experience and increase operational efficiency.

Types of AI & ML-Powered Fintech Apps

A modern fintech app development services provider can build complete digital products across diverse financial segments such as:

-

Digital Banking Applications

-

Investment & Trading Platforms

-

Wealth & Asset Management Apps

-

Personal Finance Management (PFM) Apps

-

Digital Wallet & Payment Gateway Platforms

-

Crypto Wallet & Blockchain Payment Apps

-

Insurance & InsurTech Solutions

-

Loan & Credit Scoring Platforms

-

BNPL (Buy Now Pay Later) Applications

-

Neobanking & Virtual Banking Apps

-

Fraud Detection & Financial Risk Monitoring Systems

Each solution is designed to support secure, scalable, and technology-driven financial operations.

Advanced Technologies Used

To build reliable digital finance products, leading fintech developers integrate multiple technologies, including:

| Technology | Usage |

| Artificial Intelligence | Decision automation, underwriting, robo-advisory |

| Machine Learning | Predictive models for loan approval & risk assessment |

| Blockchain | Secure payments, crypto trading & smart contracts |

| Cloud Computing | Scalable infrastructure for high-volume financial apps |

| Big Data Analytics | Intelligent customer insights and financial reporting |

| IoT & Wearables | Smart digital payment experiences |

| Biometric Security | Fast and safe identity verification |

| NLP (Natural Language Processing) | Chatbots & virtual financial agents |

The combination of AI + ML + Blockchain is shaping the future of financial technology.

Industries Utilizing AI & ML Fintech Technologies

AI-powered financial applications are being widely adopted across:

-

Banking & Financial Institutions

-

Retail & eCommerce

-

Healthcare & Insurance

-

Real Estate

-

Government Financial Systems

-

Travel & Hospitality

-

Manufacturing & Logistics

-

Education institutions

-

Investment & Brokerage Firms

Any sector processing financial transactions can benefit from intelligent automation.

Benefits of Choosing a Professional Fintech App Development Partner

Working with an expert fintech application development company provides advantages like:

-

Secure and scalable app architecture

-

High-level encryption & compliance adherence

-

Custom solution integration based on business needs

-

AI/ML enablement for exceptional user experiences

-

Reduced development time and cost

-

End-to-end support from planning to deployment

-

Increased business agility and competitive advantage

A specialized fintech team understands both technology and regulatory requirements, delivering stable and future-ready financial platforms.

Fintech App Development Process

-

Project discovery & requirement analysis

-

Market research & competitor evaluation

-

UX/UI design for app user journey

-

Core AI/ML architecture development

-

Security layer and compliance integration

-

API development and third-party service integration

-

Testing & QA across performance standards

-

Deployment to app stores and cloud servers

-

Continuous monitoring, updates & maintenance

This systematic approach ensures stability, quality, and high performance.

Conclusion

The integration of AI and ML into fintech applications is reshaping the digital financial ecosystem and creating smarter, faster, and more secure online transaction experiences. For businesses looking to adapt to next-generation technology and streamline financial operations, investing in intelligent fintech solutions is no longer optional—it is essential for growth. By partnering with an experienced development team, organizations can build reliable financial platforms that enhance customer trust, reduce operational costs, and maximize digital efficiency.

Frequently Asked Questions (FAQs)

1. What is AI-based fintech app development?

AI-based fintech development involves building financial applications with artificial intelligence that automate tasks, improve security, and offer personalized user experiences.

2. How are AI & ML used in fintech platforms?

They support fraud detection, risk assessment, smart investment guidance, customer service automation, and identity verification.

3. How long does it take to build a fintech app?

Typically 3–6 months, depending on complexity, integrations, and security requirements.

4. What is the cost of developing a fintech application?

Costs vary based on features, AI/ML requirements, compliance needs, and platform type.

5. Why should I choose a specialized fintech development company?

Because they ensure secure development, compliance support, scalable architecture, and advanced AI-driven features.

6. Do you provide maintenance and support after app launch?

Yes, including updates, bug fixes, performance improvements, and security updates.