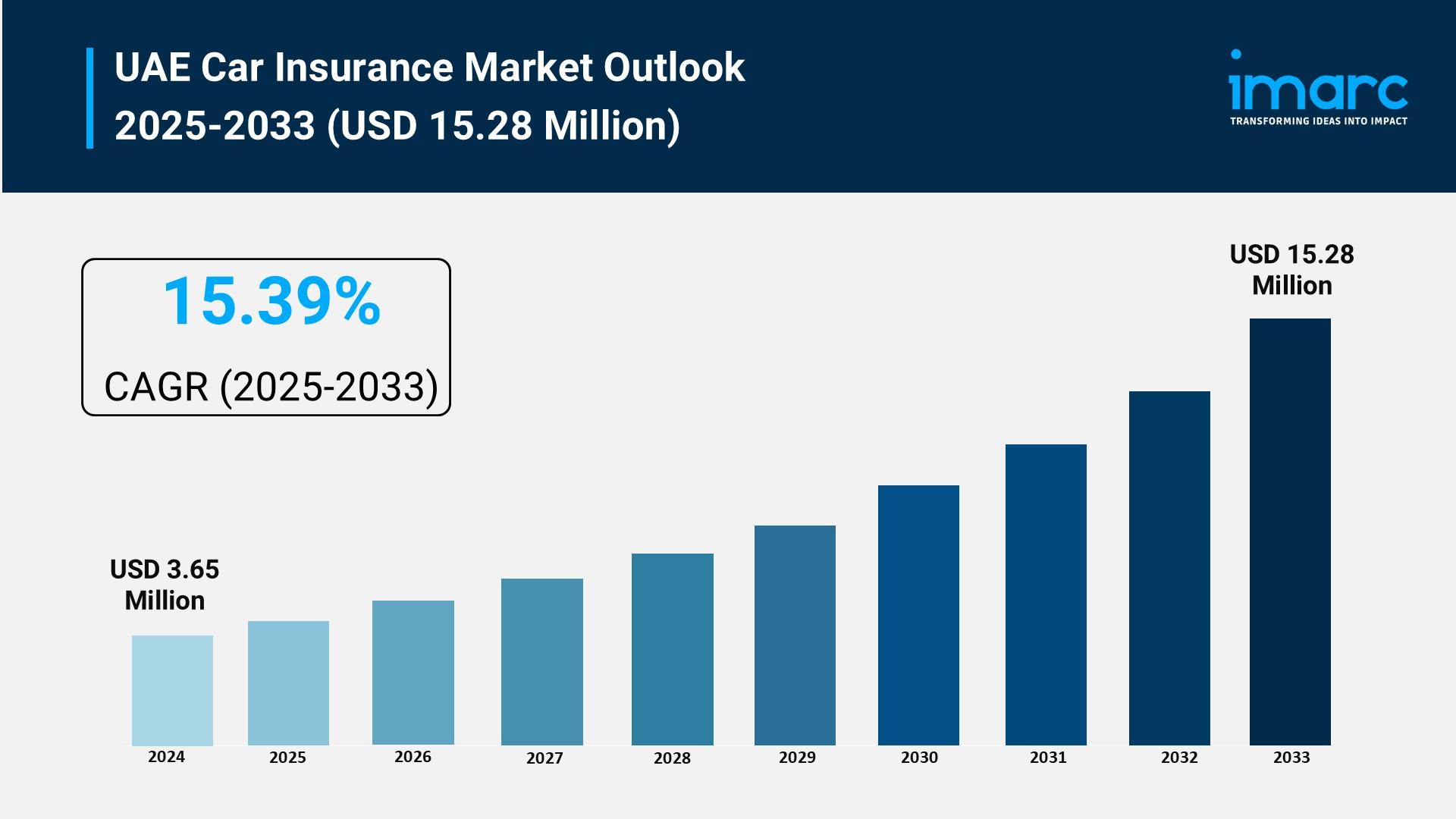

UAE Car Insurance Market Overview

Market Size in 2024: USD 3.65 Million

Market Size in 2033: USD 15.28 Million

Market Growth Rate 2025-2033: 15.39%

According to IMARC Group's latest research publication, "UAE Car Insurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE car insurance market size reached USD 3.65 Million in 2024. The market is projected to reach USD 15.28 Million by 2033, exhibiting a growth rate (CAGR) of 15.39% during 2025-2033.

How AI is Reshaping the Future of UAE Car Insurance Market

- Revolutionizing Claims Processing: Insurers like Tokio Marine UAE have implemented AI-based document processing that tripled daily claims capacity, with some companies reducing processing times by 90%, enabling settlements in days rather than weeks.

- Enabling Usage-Based Insurance Models: With telematics powered by AI analysis, 27% of UAE motorists would switch insurers for discounts greater than 15%, transforming the traditional flat-rate pricing approach into behavior-based premiums.

- Fighting Fraud with Machine Learning: AI systems cross-reference thousands of data points to detect suspicious claims, analyzing inconsistencies between GPS data and damage reports, reducing false claims significantly across the industry.

- Powering Digital-First Customer Experience: Platforms like Shory and PolicyBazaar leverage AI-driven chatbots providing 24/7 support, with online sales jumping from less than 1% five years ago to 5-7% of the motor insurance market currently.

- Optimizing Premium Calculations: Real-time telematics data from accelerometers, GPS, and gyro sensors enable insurers to calculate personalized premiums based on driving patterns like night-time kilometers and urban rush-hour ratios.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-car-insurance-market/requestsample

UAE Car Insurance Market Trends & Drivers:

Mandatory car insurance rules in the UAE form the basis of the car insurance market. Third-party liability cover is mandatory on all vehicles. Minimum lawfully mandated insurance coverage is AED 2 million property damage and AED 5 million bodily injury. There is a fine of AED 500 and four black points for driving an uninsured vehicle and the car is towed and impounded for seven to 15 days (UAE Insurance Authority Circular No. A regulatory framework was created by 06/2025 to allow usage-based insurance products, and on July 2025, the flood insurance requirement became effective. Since around 200000 vehicles are sold each year, this regulation creates a purchase funnel: a new purchase of a vehicle naturally requires the purchase of new insurance for that vehicle.

Telematics (or usage-based insurance) is expected to change the way people in the United Arab Emirates (UAE) pay for car insurance premiums. As the 5G Phase-2 is completed by Etisalat and Du, insurers will be able to track driving behavior, including spikes in accelerometer readings from harsh braking, GPS data logging average speed and images of mobile phone usage. Various firms offer cashback, for instance, "Beema SmartDriver" launched by Beema Insurance in January 2022 based on driving behavior. According to PwC Middle East behavior based insurance products appeal to cost-driven drivers. Safe drivers get the greatest benefit from personalized pricing. Regulatory approval in the UAE from the Insurance Authority and the fact that over 30% of the MENA fintech startup ecosystem is based there has seen increased adoption with greater telematics integration.

Sales of 24000 electric vehicles and hybrids in 2024 created a market for specialized EV insurance. Thorough EV insurance premiums in UAE average AED 4992 (US$1293) per year. The premiums are 20-35% higher than conventional cars, which have an average cost of AED 2,895 (US$788) to insure. This is mainly due to the cost of batteries and motors, which make up 40% of the vehicle's value, since they cost AED 60,000 to AED 80,000. Abu Dhabi National Insurance Company launched EV insurance policies in October 2024 to cover battery degradation and charging events. Despite higher premiums, the Central Bank of UAE encourages discounts of up to 25% on qualifying EVs. In 2025, some insurers reported stable or dropping premiums for claim-free EVs, due to steady premiums and repair expertise as the EV market matured.

UAE Car Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Coverage Insights:

- Third-Party Liability Coverage

- Collision/Comprehensive/Other Optional Coverage

Application Insights:

- Personal Vehicles

- Commercial Vehicles

Distribution Channel Insights:

- Direct Sales

- Individual Agents

- Brokers

- Banks

- Online

- Others

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Car Insurance Market

- January 2025: Sukoon Insurance launched a new comprehensive motor insurance policy with additional coverage options and enhanced customer protection features, expanding its reach across all emirates including operations in Oman and Qatar.

- January 2025: Motor insurance premiums in UAE increased by 15-20% for renewal policies compared to the previous year, driven by cautious pricing strategies following high claims from April 2024 flooding events.

- February 2025: The Insurance Brokers' Regulation 2024 took effect on 15 February 2025, requiring claim payments to be made directly from insurers to policyholders and prohibiting brokers from collecting premiums without specific authorization.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302