Egypt Watch Market Overview

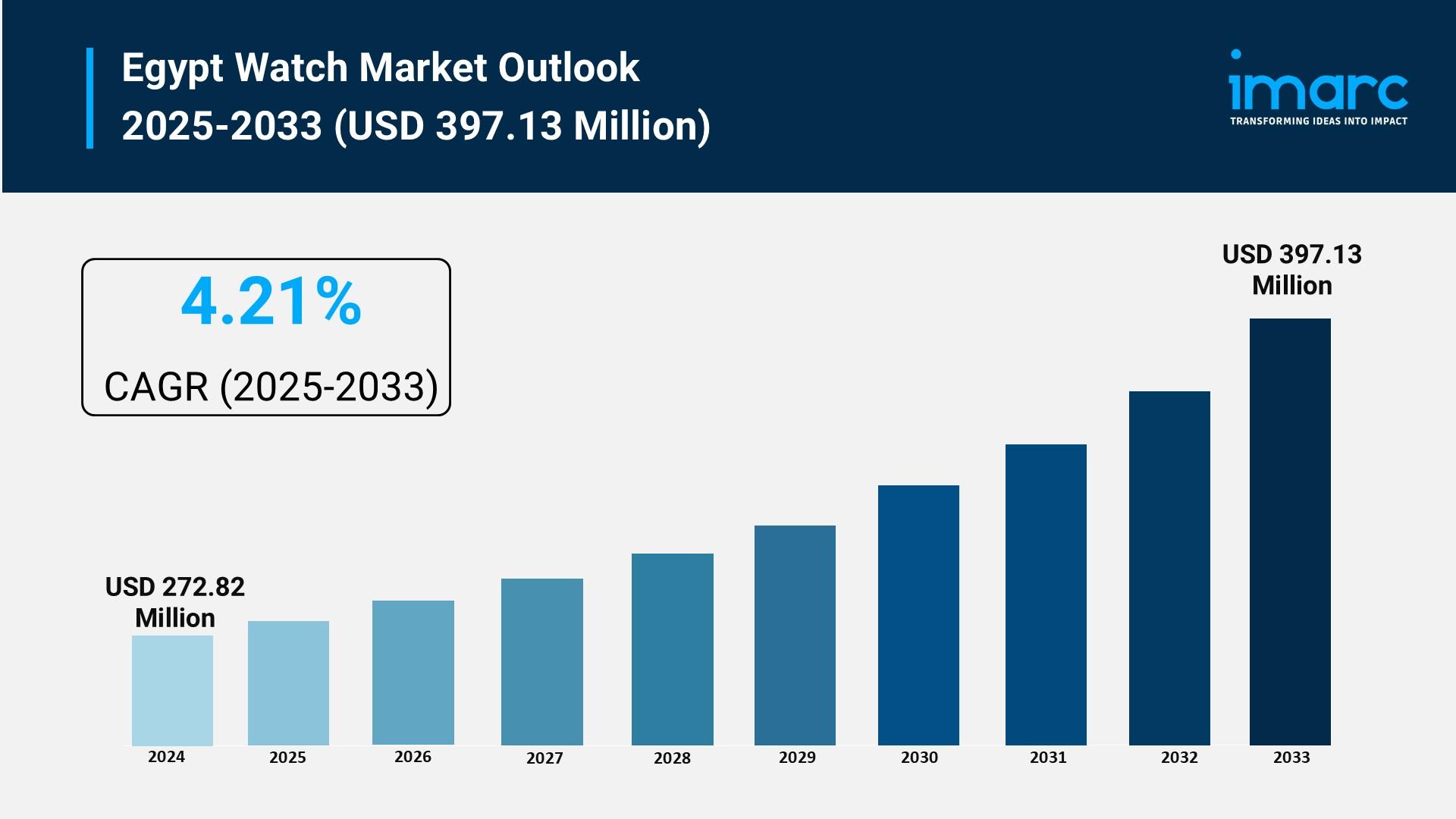

Market Size in 2024: USD 272.82 Million

Market Size in 2033: USD 397.13 Million

Market Growth Rate 2025-2033: 4.21%

According to IMARC Group's latest research publication, "Egypt Watch Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Egypt watch market size reached USD 272.82 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 397.13 Million by 2033, exhibiting a growth rate of 4.21% during 2025-2033.

How AI is Reshaping the Future of Egypt Watch Market

- Personalized Shopping Experiences: AI-powered recommendation engines are helping Egyptian watch retailers like BTC Trading and Azzam Watches analyze customer preferences and purchase history, offering tailored suggestions that match individual style and budget, driving conversions in both luxury and mid-range segments.

- Smart Inventory Management: Machine learning algorithms are optimizing stock levels for Egypt's watch retailers by predicting demand patterns across different price ranges—from affordable quartz watches to luxury mechanical timepieces—reducing overstock costs and ensuring popular models stay available.

- Enhanced Quality Control: AI-driven authentication systems are helping Egyptian retailers verify the authenticity of luxury watches and vintage timepieces, protecting consumers from counterfeits and building trust in a market where heritage pieces from historic Cairo shops dating back to the 1890s are experiencing renewed interest.

- Virtual Try-On Technology: Augmented reality powered by AI is enabling Egyptian consumers to virtually try on watches through mobile apps and websites, bridging the gap between online convenience and the in-store experience, particularly valuable as e-commerce grows in Greater Cairo and Alexandria.

- Predictive Maintenance for Smartwatches: AI algorithms embedded in locally-produced smartwatches like Oraimo's Watch Lite are providing Egyptian users with intelligent health monitoring, fitness tracking insights, and predictive battery management, enhancing the overall wearable technology experience.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-watch-market/requestsample

Egypt Watch Market Trends & Drivers:

In Egypt, the vintage and heritage watch market gains popularity with young people. Digital watches are becoming common. Mechanical watches have an appeal related to their craftsmanship and history. Social media has added to the trend. Collectors and fashion industry influencers show others vintage items pair well with more modern aesthetics. In Cairo, foot traffic is returning to older watch houses of the 1890s, including Nerses Papazian, which opened in 1903. Azzam Watches, founded in 1954, and others have been around since the 1930s and 1950s. Millennials and Gen Z want watches with stories and character. While these are not mass-produced timepieces, instead being high-end complex manual watches passed down between family members over generations, the desire to create a watch with lineage has combined with the modern trend. Vintage watches can be very expensive, and younger buyers are looking for stores with decades of experience with mechanical watches.

The retail market is also growing. BTC Trading, a subsidiary of the Baghdad Group, established in 1935, has historically dominated high-end watch sales in Egypt. BTC has been the sole distributor in Egypt for Rado, Tissot and other Swiss brands for the past 75 years. The retailer is looking to expand further in Egypt by opening more stores and having more retailers, as the middle class becomes more aware of what they want in terms of price and quality and has more purchasing power. Watches today are considered status symbols denoting craftsmanship, quality, durability, and sometimes, wealth. Available at every price point, from inexpensive to ultra-expensive, a lifestyle marketing strategy is being adopted by watch companies and retailers, to target both customary and new customers, by expanding into new segment markets. It's also establishing brick-and-mortar stores in prime spots like Cairo Festival City Mall and City Stars Heliopolis. With Egyptian consumers drawn to online shopping, there's a growing e-commerce presence too.

In its latest phase of local assembly, Oraimo launched its first smartwatch Watch Lite and its FreePods 3C earphones through its Silicon Wadi (SVEi) factory, which are the first smart devices locally produced in Egypt. It's not just manufacturing. It is about the action of bringing the latest high-quality wearable tech to consumers in Egypt at accessible prices. The smartwatches made locally support fitness tracking, heart rate monitoring, smart notifications and more for local needs. Expected benefits from the move include job creation and strengthening Egypt's technology sector. Egypt could become a center for smartwatch production because the smartwatch market is growing quickly, and Egyptian consumers want smartwatches that include the best features for the best price. Local manufacture means better service after sale, speed of provision and the ability to add features specific to the Egyptian market, giving local manufacturers an advantage over imports.

Egypt Watch Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Quartz

- Mechanical

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

Distribution Channel Insights:

- Online Retail Stores

- Offline Retail Stores

End User Insights:

- Men

- Women

- Unisex

Breakup by Region:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Egypt Watch Market

- October 2023: Oraimo launched Egypt's first locally-manufactured smartwatch, the Watch Lite, and FreePods 3C earphones through its Silicon Wadi factory. This milestone marks the first time smart wearable devices have been produced domestically in Egypt, offering consumers locally-certified, affordable, high-quality alternatives with features including fitness monitoring and heart rate tracking.

- March 2021: Historic Cairo watch shop Nerses Papazian, established in 1903 by an Armenian watchmaker who escaped Ottoman army service and eventually settled in Egypt, continues to serve collectors and heritage watch enthusiasts. The shop represents over 120 years of watchmaking tradition in Cairo, embodying the city's rich horological heritage.

- Ongoing 2024: BTC Trading continues its retail expansion strategy across Egypt, leveraging its 75-year legacy as the country's pioneer in luxury watches and sole distributor for prestigious Swiss brands including Rado and Tissot. The retailer maintains strategic locations in premium shopping destinations like Cairo Festival City Mall and City Stars Heliopolis.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302