Egypt Private Equity Market Overview

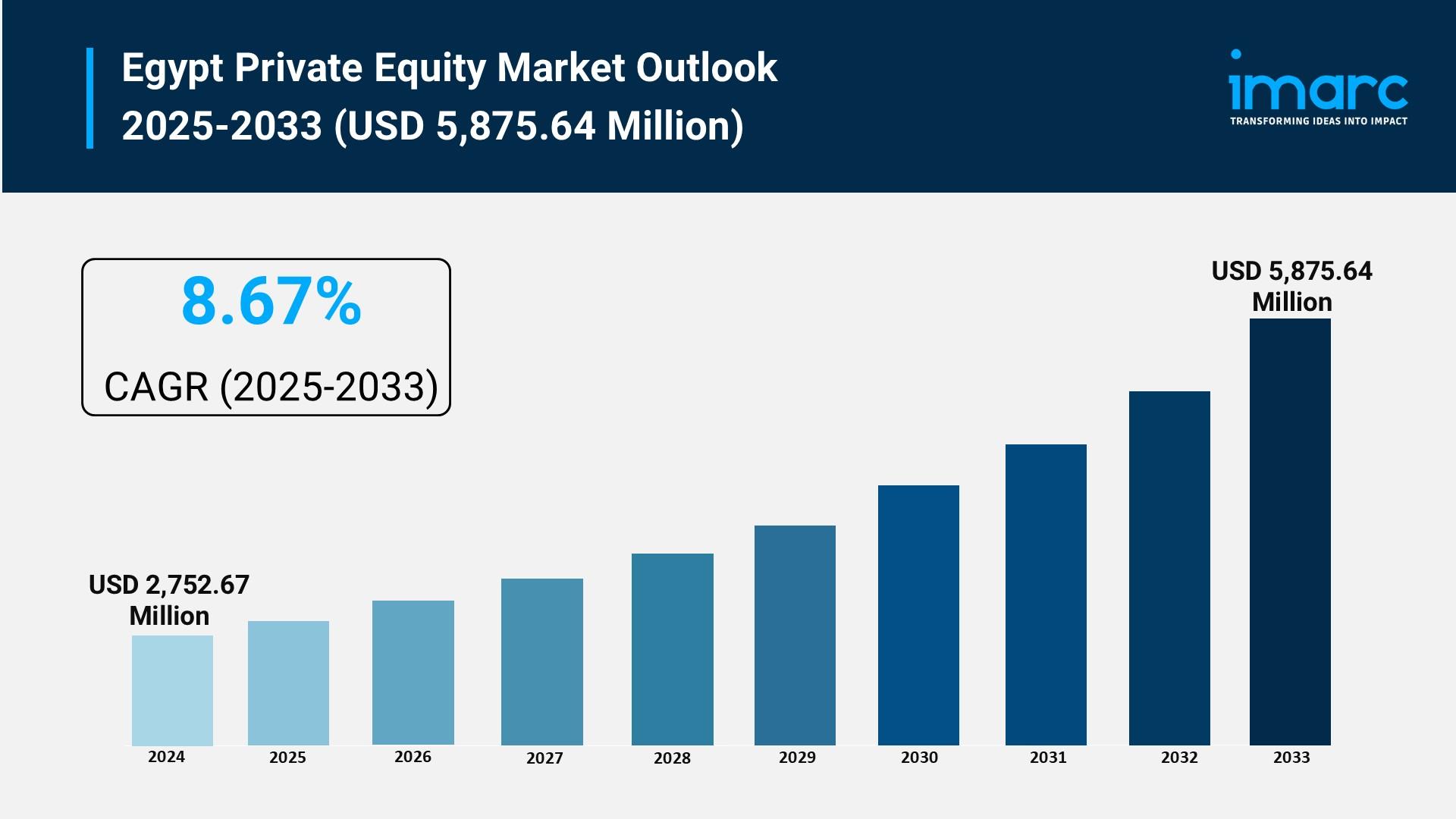

Market Size in 2024: USD 2,752.67 Million

Market Size in 2033: USD 5,875.64 Million

Market Growth Rate 2025-2033: 8.67%

According to IMARC Group's latest research publication, "Egypt Private Equity Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Egypt private equity market size reached USD 2,752.67 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,875.64 Million by 2033, exhibiting a growth rate of 8.67% during 2025-2033.

How AI is Reshaping the Future of Egypt Private Equity Market

- Enhanced Deal Sourcing: AI-powered analytics platforms are helping Egyptian PE firms identify high-potential investment targets across 61 active funds, processing vast amounts of financial data to uncover opportunities in fintech, consumer goods, and export-oriented businesses that traditional methods might miss.

- Smarter Due Diligence: Machine learning algorithms are streamlining the due diligence process for Egypt's PE investors, analyzing financial statements, market trends, and risk factors in record time, enabling faster decision-making in a market that saw 77 transactions in recent periods.

- Portfolio Optimization: AI-driven performance monitoring tools are giving Egyptian fund managers real-time insights into their portfolio companies' operations, helping them identify operational inefficiencies and growth opportunities across sectors like higher education, retail, and IT services.

- Predictive Market Intelligence: Advanced AI models are forecasting sector performance and market trends, particularly valuable for Egypt's fintech sector which captured 18% of total venture capital investments and secured 35% of Africa's fintech funding, helping investors time their entry and exit strategies.

- Automated Valuation Models: AI-powered valuation platforms are providing more accurate company assessments by analyzing comparable transactions, market multiples, and financial projections, reducing valuation discrepancies and supporting the 21% year-on-year increase in M&A activity.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-private-equity-market/requestsample

Egypt Private Equity Market Trends & Drivers:

The Egypt private equity market is recovering from misallocation of investments. The largest private equity fund manager in Egypt, Ezdehar, has signaled that in 2011 it will invest between $50 million and $100 million in high education, retail, information technology service and consumer goods sectors. In April 2007, the company paid US$70 million to acquire an 80% stake in Indian textiles company Seta Textiles. The company felt that it was preferable to buy out influential minority stakes so as to drive value on operational issues rather than purely financial engineering towards a capital gains play. In 2021, private equity and venture capital investment into Egyptian fintech reached $437.7 million and $358.8 million, respectively, a 28.7-fold increase from three years prior, concentrating 35% of total African fintech investment and ranking Egypt third on the continent for such investment. The shift to tech and, subsequently, consumption and export (or growth) stocks seems to have paid off for inflation hedging and export momentum investors.

This is changing however, with 77 M&A transactions recorded in 2022, up 21% YoY after two years of decreases. B Investments' largest deal was a 70% acquisition of Orascom Financial Holding. The other prominent deals were a USD 157.5 mn investment in fintech company MNT Halan (where the USD 40 mn lead component was provided by the IFC) and specific measures such as the granting of Golden Licenses, the fast-tracking of merger filings, and the provision of incentives for technology, green energy and manufacturing investments. In addition to foreign sovereign funds, the government initiated a privatization program to divest from state-owned enterprises. There are currently 61 private equity funds in Egypt. They invested 253 billion dollars across 4,342 investment rounds in more than 970 Egyptian companies. The Sovereign Fund of Egypt was also created for investment purposes.

Venture capital (VC) has become more accessible. Under regulatory decision 194, retail users can subscribe for and redeem VC fund shares on fintech platforms via apps and websites. Unlike the past where only HNWIs capitalized the entire venture economy, over the last 5 years, Egyptian PE funds have invested in 334 seed/startup deals, 540 early stage, and 362 late stage deals, totaling USD 1.02 billion, USD 12.7 billion, and USD 37.7 billion respectively. The ecosystem is maturing as the number of funds, exits, and the secondary market activities have increased. Egypt is mentioned more than any other country in Africa. Egypt, Nigeria, Kenya, and South Africa account for 55% of all transactions and 64% of all capital invested in Africa. Regulatory reform, sector focus and improved market infrastructure present attractive private equity investment opportunities in Africa to domestic and international investors.

Egypt Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Breakup by Region:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Egypt Private Equity Market

- October 2025: Egypt's Financial Regulatory Authority issued decision number 194, allowing the establishment of fintech platforms for public subscription and redemption of venture capital fund stakes. This groundbreaking regulation democratizes access to VC investments, enabling retail investors to participate through digital platforms rather than limiting opportunities to high-net-worth individuals only.

- July 2024: MNT-Halan, Egypt's first unicorn and fastest-growing fintech leader, raised 157.5 million dollars in funding, with 40 million dollars contributed by the International Finance Corporation. The round included participation from Development Partners International, Lorax Capital Partners, and Apis Partners, marking one of the largest fintech investments in the region.

- April 2024: B Investments successfully completed its mandatory tender offer to acquire a 70% majority stake in Orascom Financial Holding, representing one of the most significant financial services transactions in Egypt's recent M&A landscape and demonstrating renewed confidence in the country's investment climate.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302