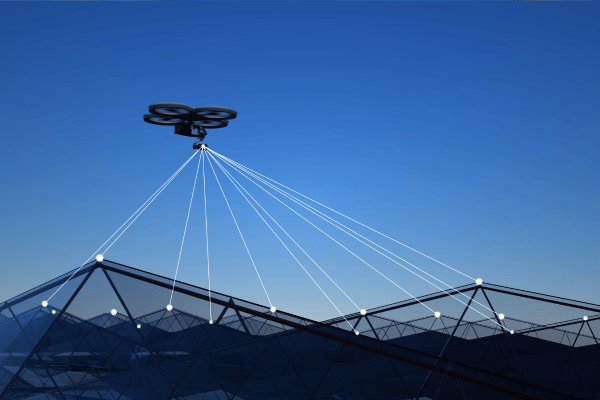

The rapid proliferation of unmanned aerial vehicles (UAVs), commonly known as drones, has transformed numerous industries, including defense, logistics, agriculture, media, and surveillance. While drones offer significant operational advantages, their widespread availability and ease of deployment have also introduced new security challenges. Unauthorized or malicious drone activities pose serious risks to critical infrastructure, military installations, airports, public events, and national borders. As a result, governments, defense organizations, and commercial entities are increasingly investing in anti-drone systems to detect, identify, track, and neutralize rogue drones.

Anti-drone technologies encompass a broad range of solutions, including radar systems, radio-frequency (RF) detectors, electro-optical sensors, jammers, and kinetic and non-kinetic countermeasures. The growing threat landscape, combined with increasing drone-related incidents, is accelerating the adoption of advanced counter-UAV solutions worldwide.

The global anti-drone market reached a value of approximately USD 2,565.08 Million in 2025. Driven by escalating security concerns and technological advancements, the market is projected to grow at an impressive CAGR of 31.00% between 2026 and 2035, reaching a value of around USD 38,178.06 Million by 2035. This article provides a comprehensive analysis of the anti-drone market, including key drivers, market segmentation, regional outlook, competitive landscape, challenges, and future growth prospects.

Overview of the Anti-Drone Market

Anti-drone systems, also known as counter-UAS or counter-drone solutions, are designed to protect airspace from unauthorized or hostile drones. These systems integrate multiple technologies to provide early detection, accurate identification, real-time tracking, and effective neutralization of UAV threats.

In 2025, the anti-drone market size stood at USD 2,565.08 Million, reflecting rising global awareness of drone-related security risks. The market’s rapid expansion is closely tied to increasing investments in defense modernization, homeland security, and critical infrastructure protection.

By 2035, the market is expected to reach USD 38,178.06 Million, underscoring the strategic importance of anti-drone technologies in maintaining airspace security across military and civilian domains.

Key Market Drivers

Rising Security Threats from Unauthorized Drones

The increasing use of drones for espionage, smuggling, sabotage, and terrorism is a primary driver of the anti-drone market. Incidents involving drones near airports, government buildings, and military bases have highlighted the urgent need for effective countermeasures.

Growing Defense and Homeland Security Investments

Governments worldwide are strengthening defense and homeland security capabilities in response to evolving aerial threats. Anti-drone systems are becoming essential components of modern defense strategies, driving significant procurement and deployment.

Expansion of Critical Infrastructure Protection

Critical infrastructure facilities such as airports, power plants, oil refineries, and data centers are increasingly vulnerable to drone incursions. The need to safeguard these assets is accelerating the adoption of anti-drone solutions in the commercial and industrial sectors.

Technological Advancements in Detection and Neutralization

Advances in radar, RF sensing, artificial intelligence, and sensor fusion are improving the accuracy and reliability of anti-drone systems. Integration of AI-powered analytics enables faster threat assessment and response, supporting market growth.

Increasing Adoption at Public Events and Commercial Sites

Large public gatherings, sports events, and commercial venues are increasingly deploying anti-drone systems to ensure safety and compliance with airspace regulations.

Market Segmentation

By Technology

Detection Systems

Detection technologies include radar, RF sensors, acoustic sensors, and electro-optical/infrared (EO/IR) cameras. These systems identify and track drones in real time, forming the first layer of defense.

Disruption Systems

Disruption technologies neutralize drones using non-kinetic methods such as RF jamming, GPS spoofing, and protocol manipulation. These systems are widely used due to their effectiveness and lower risk of collateral damage.

Kinetic Systems

Kinetic countermeasures physically disable drones using projectiles, nets, or interceptor drones. These systems are typically deployed in high-security environments.

By Platform

Ground-Based Systems

Ground-based anti-drone systems dominate the market due to ease of deployment and wide-area coverage. They are commonly used to protect fixed installations.

Handheld Systems

Handheld anti-drone devices offer mobility and are used by law enforcement and security personnel for short-range protection.

Naval and Airborne Systems

Naval and airborne platforms are gaining attention for protecting ships and airborne assets from drone threats.

By End User

Military and Defense

The military and defense sector represents the largest end-user segment, driven by border security, battlefield protection, and counter-terrorism operations.

Government and Law Enforcement

Government agencies and law enforcement bodies are increasingly adopting anti-drone solutions for public safety and surveillance.

Commercial and Industrial

Commercial applications include airports, energy facilities, and industrial complexes requiring airspace security.

Regional Analysis

North America

North America holds a significant share of the global anti-drone market, supported by high defense spending, advanced technological capabilities, and early adoption of counter-UAV solutions. The region has seen widespread deployment across military bases and critical infrastructure.

Europe

Europe represents a rapidly growing market, driven by increasing cross-border security concerns and investments in defense modernization. Regulatory initiatives and collaborative defense programs are supporting market growth.

Asia Pacific

Asia Pacific is expected to witness the fastest growth during the forecast period. Rising geopolitical tensions, border security challenges, and expanding defense budgets are driving demand for anti-drone technologies in the region.

Middle East and Africa

The Middle East and Africa region is experiencing strong demand for anti-drone systems due to ongoing security challenges and the need to protect strategic assets such as oil and gas infrastructure.

Latin America

Latin America shows emerging growth potential, particularly in protecting borders, prisons, and critical infrastructure from drone-based smuggling and surveillance activities.

Competitive Landscape

The global anti-drone market is highly competitive and innovation-driven. Market participants focus on developing integrated and scalable solutions capable of addressing diverse drone threats. Key competitive strategies include:

- Investment in research and development

- Integration of artificial intelligence and sensor fusion

- Strategic partnerships with defense agencies

- Expansion of product portfolios to address civilian and military needs

Companies are also emphasizing interoperability and compliance with evolving regulatory standards.

Regulatory and Legal Considerations

The deployment of anti-drone systems is subject to strict regulatory frameworks governing airspace management, spectrum usage, and public safety. Governments are developing policies to balance security requirements with civil liberties and aviation safety.

Challenges and Market Constraints

High Cost of Advanced Systems

Advanced anti-drone solutions can be expensive, limiting adoption among smaller organizations and developing regions.

Regulatory Restrictions

Restrictions on RF jamming and kinetic countermeasures in civilian airspace pose challenges for widespread deployment.

Rapid Evolution of Drone Technology

The fast pace of drone innovation requires continuous upgrades to anti-drone systems, increasing development and maintenance costs.

Future Outlook

The global anti-drone market is poised for exponential growth over the forecast period. With a projected CAGR of 31.00% from 2026 to 2035, the market is expected to expand from USD 2,565.08 Million in 2025 to approximately USD 38,178.06 Million by 2035.

Key trends shaping the future include:

- Increased use of AI-driven threat detection

- Development of layered and integrated defense systems

- Expansion of anti-drone solutions in commercial and civilian sectors

- Greater international collaboration on airspace security