As digital transactions continue to rise, businesses are under increasing pressure to verify customer identities quickly, securely, and accurately. A robust KYC verification service combined with face match verification has become essential for preventing fraud, meeting regulatory compliance, and building customer trust. From fintech and banking to e-commerce and crypto platforms, identity verification technologies are transforming how organizations onboard users.

What Is a KYC Verification Service?

A Know Your Customer (KYC) verification service is a digital process used to confirm the identity of customers before allowing access to services. It typically involves document verification, biometric checks, and database validation. Businesses use KYC verification to comply with regulations such as AML (Anti-Money Laundering) and CFT (Counter-Financing of Terrorism) while reducing the risk of identity fraud.

Modern KYC verification services are fully automated, allowing businesses to verify customers in real time. By leveraging AI and machine learning, these systems can analyze identity documents, extract data, and validate authenticity within seconds, ensuring a smooth and secure onboarding experience.

Understanding Face Match Verification

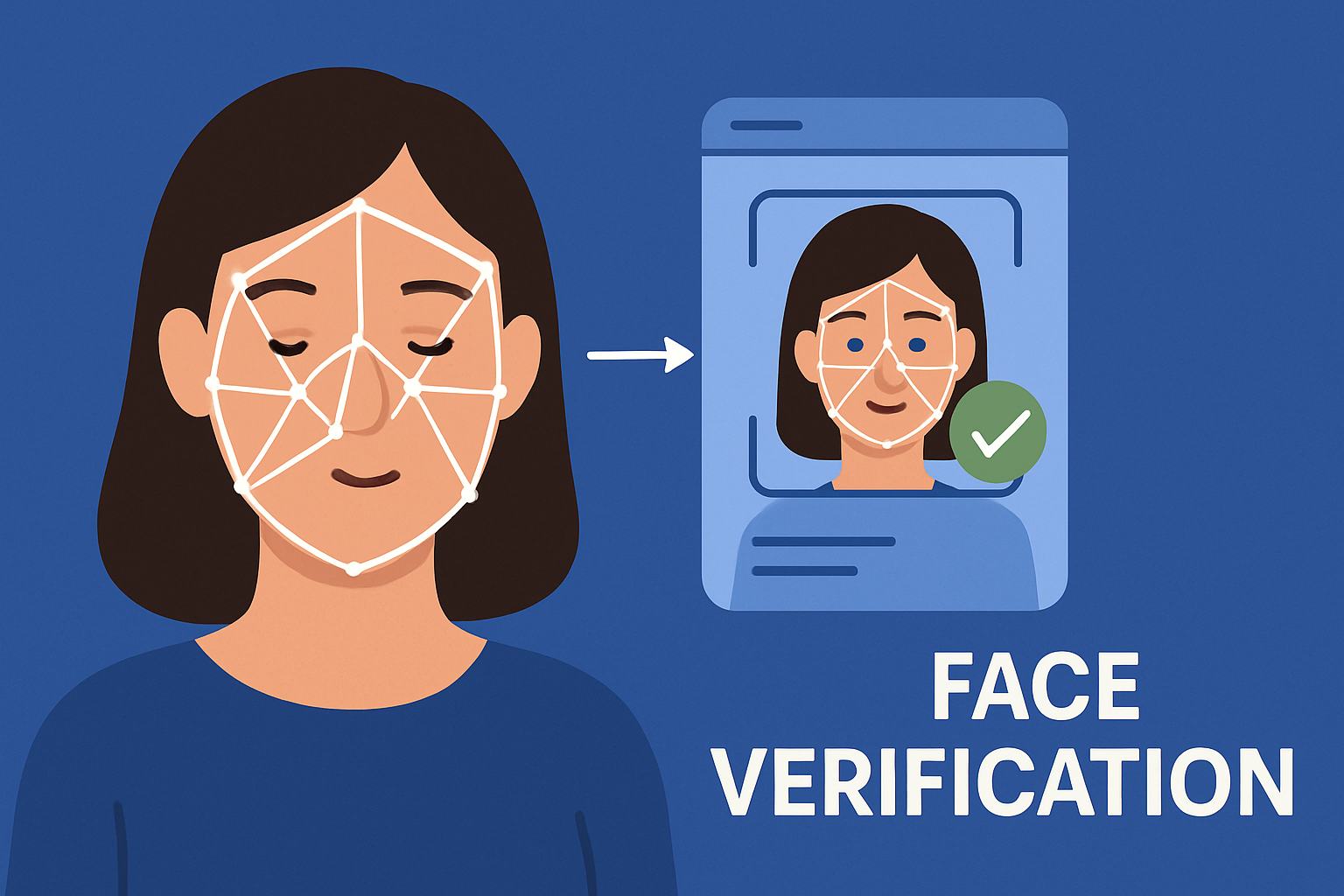

Face match verification is a biometric authentication method that compares a live selfie or captured facial image with the photo on an identity document, such as a passport or national ID. The goal is to confirm that the person presenting the document is the legitimate owner.

Advanced face match verification systems use facial recognition algorithms to detect unique facial features and ensure high accuracy. This technology helps prevent impersonation, identity theft, and document misuse. When combined with liveness detection, face match verification becomes even more effective in stopping spoofing attacks using photos or videos.

Why Combine KYC Verification Service with Face Match Verification?

Integrating a KYC verification service with face match verification provides a multi-layered security approach. While document verification confirms the authenticity of identity documents, face match verification ensures the physical presence of the real user. This combination significantly reduces fraud risks and improves compliance.

Key benefits include:

-

Faster and frictionless customer onboarding

-

Enhanced fraud prevention and identity assurance

-

Regulatory compliance across multiple industries

-

Improved user trust and brand credibility

Use Cases Across Industries

KYC verification services and face match verification are widely used in banking, fintech, crypto exchanges, insurance, healthcare, and online marketplaces. Any industry that deals with sensitive customer data or financial transactions can benefit from these technologies.

Conclusion

In an increasingly digital world, identity fraud is a growing challenge. Implementing a reliable KYC verification service with face match verification enables businesses to verify users securely, comply with regulations, and deliver a seamless customer experience. By adopting advanced biometric verification solutions, organizations can protect their platforms while building long-term trust with their customers.