PM Jan Dhan Yojana is one of the most important financial inclusion schemes launched by the Government of India. Officially known as Pradhan Mantri Jan Dhan Yojana, this initiative aims to provide every Indian household access to basic banking services. The scheme focuses on bringing the unbanked population into the formal financial system through zero balance savings accounts, insurance cover, and direct benefit transfers.

Since its launch, PM Jan Dhan Yojana has transformed the way government welfare schemes reach citizens. By linking bank accounts with Aadhaar and mobile numbers, the scheme ensures transparency, reduces corruption, and empowers citizens financially.

What is PM Jan Dhan Yojana?

PM Jan Dhan Yojana is a national mission for financial inclusion that ensures affordable access to financial services such as savings accounts, remittance facilities, credit, insurance, and pension. The biggest attraction of the scheme is that beneficiaries can open a zero balance bank account without any minimum deposit requirement.

The objective of PM Jan Dhan Yojana is not just opening bank accounts but also encouraging savings, digital payments, and financial literacy among citizens, especially those from economically weaker sections.

Objectives of PM Jan Dhan Yojana

The core objectives of PM Jan Dhan Yojana include:

-

Universal access to banking facilities

-

Financial literacy and awareness

-

Direct transfer of subsidies and benefits

-

Promotion of savings habits

-

Reduction of cash-based transactions

This scheme plays a crucial role in connecting citizens with other government programs such as PM Jan Arogya Yojana, Pradhan Mantri Fasal Bima Yojana, and PM Pradhan Mantri Awas Yojana.

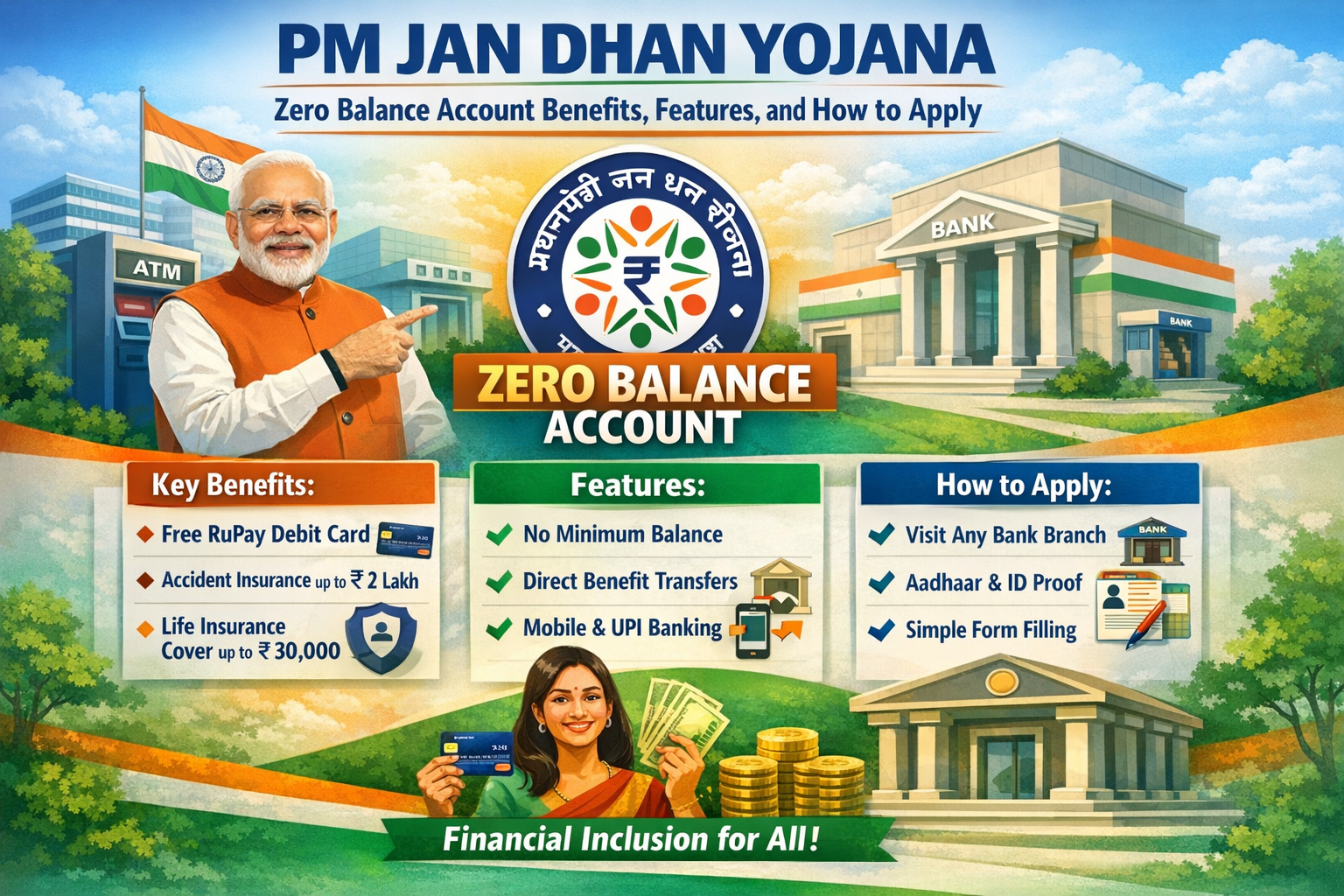

Key Features of PM Jan Dhan Yojana

PM Jan Dhan Yojana offers multiple features that make it attractive and beneficial:

-

Zero balance savings account

-

Free RuPay debit card

-

Accidental insurance cover

-

Life insurance cover

-

Overdraft facility

-

Direct Benefit Transfer (DBT) eligibility

These features make PM Jan Dhan Yojana a foundation for financial stability and inclusion.

Benefits of Zero Balance Account under PM Jan Dhan Yojana

One of the biggest advantages of PM Jan Dhan Yojana is the zero balance facility. Account holders are not required to maintain a minimum balance, which is especially helpful for low-income families.

Major Benefits Include:

-

Easy account opening

-

Safe savings option

-

Access to government subsidies

-

Digital banking support

-

Financial security through insurance

The scheme has helped millions receive benefits under PM Jan Arogya Yojana, PM Sukanya Samriddhi Yojana, and Pradhan Mantri Mudra Yojana directly into their accounts.

Eligibility Criteria for PM Jan Dhan Yojana

Any Indian citizen above the age of 10 years can open an account under PM Jan Dhan Yojana. Even individuals without proper KYC documents can open a small account with basic identification.

Documents Required to Open PM Jan Dhan Yojana Account

To open a PM Jan Dhan Yojana account, applicants need any one of the following documents:

-

Aadhaar Card

-

Voter ID

-

PAN Card

-

Driving License

-

NREGA Job Card

How to Apply for PM Jan Dhan Yojana

Opening an account under PM Jan Dhan Yojana is simple and free. Applicants can visit any public or private sector bank or regional rural bank.

Application Process:

-

Visit the nearest bank branch

-

Ask for PM Jan Dhan Yojana account form

-

Fill in personal details

-

Submit required documents

-

Receive passbook and RuPay card

Bullet Point: Why PM Jan Dhan Yojana is Important

-

It acts as the backbone for all major government welfare schemes and ensures financial inclusion at the grassroots level.

PM Jan Dhan Yojana and Direct Benefit Transfer

PM Jan Dhan Yojana enables the government to directly transfer subsidies such as LPG subsidy, pension payments, crop insurance claims, and health benefits. This eliminates middlemen and ensures transparency.

Schemes like Pradhan Mantri Fasal Bima Yojana and PM Jan Arogya Yojana heavily rely on Jan Dhan accounts for benefit disbursement.

Jan Arogya Yojana (Ayushman Bharat)

Jan Arogya Yojana, also known as Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY), is a flagship health insurance scheme launched by the Government of India to provide quality healthcare to economically weaker families. Under this scheme, eligible beneficiaries receive health insurance coverage of up to ₹5 lakh per family per year for secondary and tertiary hospitalization. Jan Arogya Yojana ensures cashless treatment at empaneled public and private hospitals across India, promoting accessible and affordable healthcare for all.

Integration with Other Government Schemes

PM Jan Dhan Yojana and Pradhan Mantri Mudra Yojana

Accounts opened under PM Jan Dhan Yojana help small entrepreneurs access loans under Pradhan Mantri Mudra Yojana, supporting startups and self-employment.

PM Jan Dhan Yojana and PM Jan Arogya Yojana

Under PM Jan Arogya Yojana, health insurance benefits are directly credited or processed using Jan Dhan-linked accounts.

PM Jan Dhan Yojana and PM Sukanya Samriddhi Yojana

Parents can easily open PM Sukanya Samriddhi Yojana accounts for their daughters using their Jan Dhan account as the base banking facility.

PM Jan Dhan Yojana and PM Pradhan Mantri Awas Yojana

Housing subsidies under PM Pradhan Mantri Awas Yojana are transferred directly to beneficiaries’ Jan Dhan accounts.

Table: Comparison of PM Jan Dhan Yojana with Regular Savings Account

| Feature | PM Jan Dhan Yojana | Regular Savings Account |

| Minimum Balance | Zero | Required |

| Debit Card | Free RuPay Card | Often Paid |

| Insurance | Yes | Limited |

| Overdraft Facility | Available | Limited |

| DBT Eligibility | Yes | Not Always |

Challenges and Limitations of PM Jan Dhan Yojana

Despite its success, PM Jan Dhan Yojana faces challenges such as inactive accounts, lack of financial literacy, and limited banking infrastructure in rural areas. However, continuous digital awareness programs are helping overcome these issues.

Impact of PM Jan Dhan Yojana on Indian Economy

PM Jan Dhan Yojana has strengthened India’s financial ecosystem by increasing bank penetration, encouraging digital payments, and improving transparency. The scheme has also reduced dependency on informal lending sources.

Role of Digital Banking in PM Jan Dhan Yojana

Digital banking has played a crucial role in strengthening PM Jan Dhan Yojana. Mobile banking, UPI, and Aadhaar-enabled payment systems allow beneficiaries to access funds easily. This reduces travel costs and saves time for rural citizens.

Financial Literacy and Awareness Programs

The government regularly conducts awareness campaigns to educate Jan Dhan account holders about savings, insurance, and responsible borrowing. Financial literacy ensures long-term success of PM Jan Dhan Yojana.

Women Empowerment through PM Jan Dhan Yojana

A significant number of Jan Dhan accounts are held by women. This has improved women’s control over finances and increased participation in schemes like PM Sukanya Samriddhi Yojana.

Future Scope of PM Jan Dhan Yojana

With continuous technological advancements, PM Jan Dhan Yojana is expected to integrate more fintech services, micro-investments, and pension schemes, making it a complete financial solution for all citizens.

Frequently Asked Questions

1. What is PM Jan Dhan Yojana?

PM Jan Dhan Yojana is a government scheme that provides zero balance bank accounts with insurance and direct benefit transfer facilities.

2. Can I open a PM Jan Dhan Yojana account online?

Currently, the account opening process requires visiting a bank branch, though some banks offer partial online registration.

3. Is Aadhaar mandatory for PM Jan Dhan Yojana?

Aadhaar is preferred but not mandatory. Other valid ID documents are accepted.

4. What insurance benefits are provided under PM Jan Dhan Yojana?

The scheme offers accidental and life insurance coverage subject to terms and conditions.

5. Can I get a loan through PM Jan Dhan Yojana?

Yes, eligible account holders can access overdraft facilities and loans under Pradhan Mantri Mudra Yojana.

Conclusion

PM Jan Dhan Yojana is a landmark initiative that has revolutionized financial inclusion in India. By offering zero balance accounts, insurance benefits, and seamless integration with schemes like Pradhan Mantri Mudra Yojana, PM Jan Arogya Yojana, Pradhan Mantri Fasal Bima Yojana, PM Sukanya Samriddhi Yojana, and PM Pradhan Mantri Awas Yojana, the scheme empowers millions.

PM Jan Dhan Yojana is not just a banking program; it is a foundation for economic growth, social security, and digital India.