Market Overview:

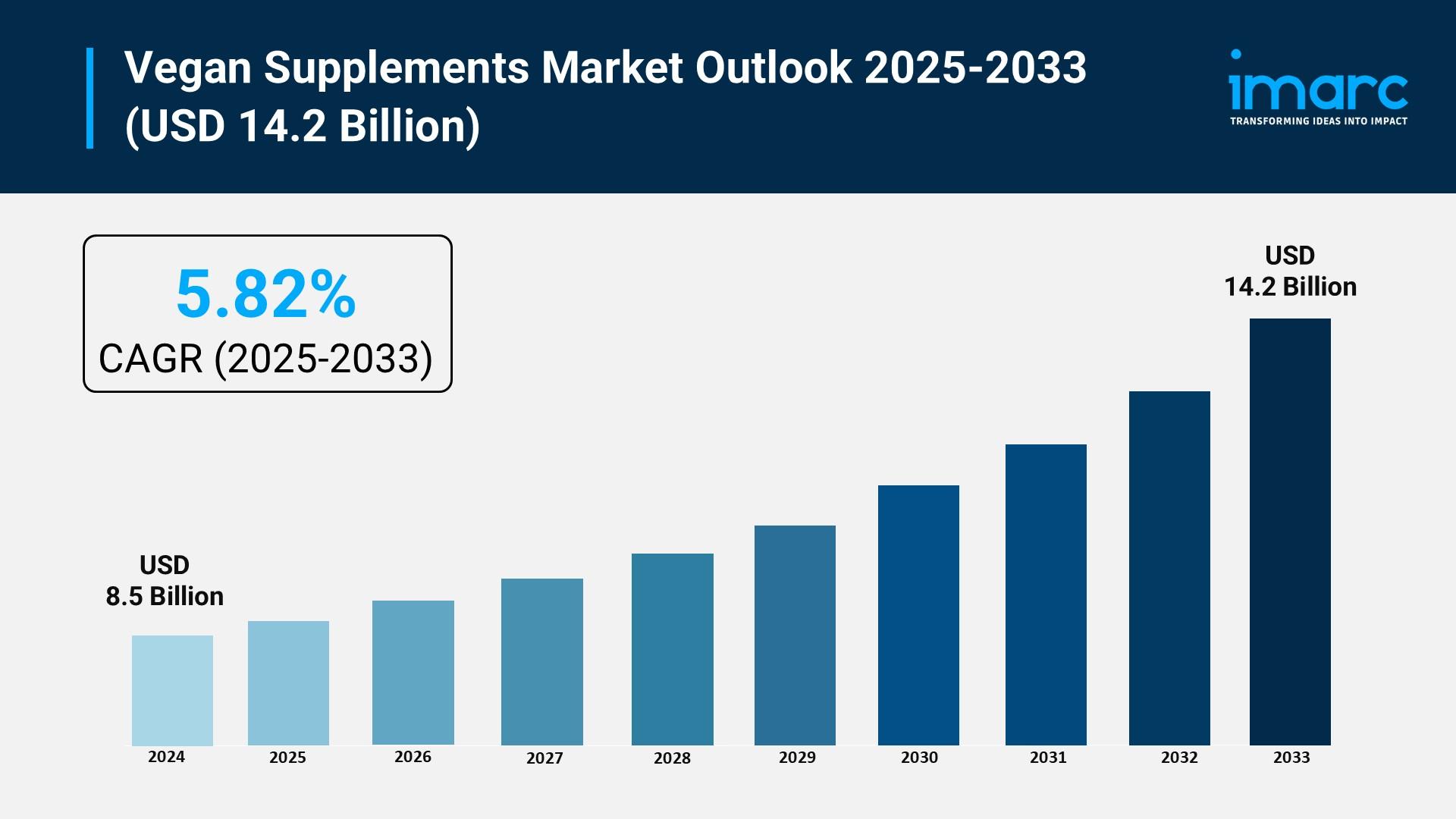

The vegan supplements market is experiencing rapid growth, driven by expanding global vegan and flexitarian populations, rising prevalence of dietary restrictions and food sensitivities, and government initiatives and regulatory support for food innovation. According to IMARC Group's latest research publication, "Vegan Supplements Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global vegan supplements market size reached USD 8.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.82% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/vegan-supplements-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Vegan Supplements Market

- Expanding Global Vegan and Flexitarian Populations

The primary driver for the vegan supplements market is the rapid expansion of the global vegan population and the rise of the flexitarian lifestyle. In the United Kingdom alone, the vegan population has surpassed 600,000 individuals, while nearly three-quarters of consumers in the United States aged 18 to 59 express openness to plant-based diets. This demographic shift is particularly strong among Millennials and Gen Z, who prioritize animal welfare and environmental sustainability. Consequently, these consumers are increasingly scrutinizing labels to avoid traditional ingredients like bovine-sourced gelatin or lanolin-based Vitamin D3. Major brands such as Cymbiotika and Vital Nutrients are responding by launching specialized plant-derived products. Furthermore, the global plant-based protein market reached 16.9 billion USD in 2024, reflecting a broader movement toward ethical consumption that directly fuels the demand for complementary vegan vitamins and minerals to prevent nutritional gaps in meat-free diets.

- Rising Prevalence of Dietary Restrictions and Food Sensitivities

Increased awareness regarding lactose intolerance, gluten sensitivity, and soy allergies is significantly pushing consumers toward vegan-certified supplements as safer alternatives. Since vegan products are inherently dairy-free, they serve as the primary solution for the millions of individuals who experience digestive discomfort from traditional whey or casein-based proteins. For instance, approximately 0.4% of infants in the United States are diagnosed with soy allergies, prompting a surge in demand for hypoallergenic sources like pea, rice, and hemp proteins. Pea protein, in particular, is gaining traction due to its high digestibility and complete amino acid profile, often reaching a market share of over 6% within its respective category. This shift is supported by government bodies like the European Food Safety Authority, which has validated various plant-based sources as essential nutrient carriers. The perception of vegan supplements as "cleaner" and "gentler" on the digestive system continues to attract non-vegans with sensitive health profiles.

- Government Initiatives and Regulatory Support for Food Innovation

Global governments are implementing strategic frameworks and financial incentives to bolster the plant-based and nutraceutical sectors. In India, the Ministry of Food Processing Industries and the FSSAI have introduced the "Eat Right India" initiative and the "Jaivik Bharat" logo to promote authentic organic and healthy food choices. Additionally, the FSSAI notified the Food Safety and Standards Regulations specifically for health supplements and functional foods, which streamlined the approval process for a vast range of plant-based products. Events like World Food India 2025 have been established to provide startups with access to domestic and international markets while aligning with net-zero emission targets. Similar supportive environments are found in North America and Europe, where regulatory bodies are encouraging investment in research and development for sustainable proteins. These initiatives reduce the barrier to entry for small and medium enterprises, fostering a competitive market landscape that offers diverse, high-quality, and science-backed vegan formulations to the public.

Key Trends in the Vegan Supplements Market

- Personalized and Functional Nutrition

One of the hottest trends sweeping the vegan supplements market is the shift towards personalized and functional nutrition. Consumers are no longer satisfied with generic, one-size-fits-all vitamins; instead, they want solutions tailored to individual health needs, lifestyles, and even genetic profiles. For instance, AI-powered quizzes and microbiome science allow brands like Persona Nutrition and Ritual to deliver custom supplement regimens, driving up subscription rates and customer loyalty. According to a 2024 consumer survey, more than half of millennials are willing to pay a premium for personalized nutrition products, which has motivated companies to roll out targeted vegan lines fortified with nutrients like vitamin B12, D3, and omega-3s. Real-time health monitoring is being integrated, too, with firms such as Elo Health offering protein powders that adjust blends according to users’ biomarker data.

- New Ingredient Sources and Technologies

Cutting-edge ingredient sourcing and innovative formulation are transforming what it means to be "vegan" in the supplement aisles. Instead of relying on traditional ingredients or production methods, companies are turning to fermentation, algae, and even fungi to create high-bioavailability plant vitamins, minerals, and proteins. For example, the use of algae for DHA/EPA omega-3s gives vegans access to nutrients previously only found in fish oil. Meanwhile, plant-sourced vitamin D3 from lichen, iron from quinoa, and fermented B12 set new industry standards for purity and sustainability. Brands like Naturelo and Future Kind have launched whole-food and ferment-based supplements to address recurring deficiencies in vegan diets, seeing strong repeat purchase rates and clear consumer enthusiasm.

- Clean Labeling and Transparency

Demand for transparency is another major trend—modern supplement shoppers want clean, easily understood labels and clear ingredient sourcing information. This has made clean labeling a must, with consumers especially keen on avoiding artificial additives and allergenic binders like gelatin. Companies have embraced alternatives such as cellulose, pectin, or pullulan for capsules, and prioritize non-GMO, organic certifications to strengthen consumer trust. For example, Berg's research highlights a growing preference for non-animal excipients and solvent-free sourcing, influencing brands to focus on clean, traceable supply chains. High-visibility certifications, such as vegan and organic seals, along with detailed sustainability credentials, are now displayed prominently on packaging and in digital marketing—making plant-based supplements a top pick for wellness-driven and eco-conscious shoppers alike.

Leading Companies Operating in the Global Vegan Supplements Industry:

- Aloha Inc.

- Amway Corp.

- Deva Nutrition LLC

- DuPont de Nemours Inc.

- Eversea Inc.

- HTC Health

- Jarrow Formulas Inc.

- Nestlé S.A.

- NOW Foods

- Nutrazee

- Ora Organic

- PepsiCo Inc.

Vegan Supplements Market Report Segmentation:

By Product Type:

- Protein

- Minerals

- Vitamins

- Others

Protein exhibits a clear dominance in the market attributed to the increasing demand for plant-based protein sources as a result of health and sustainability concerns.

By Form:

- Powder

- Capsules/Tablets

- Others

Powder holds the biggest market share as it offers convenience and versatility in terms of usage, making it a preferred choice among consumers.

By Distribution Channel:

- Pharmacies/Drug Stores

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

Pharmacies/drug stores lead the vegan supplement market, offering convenient access to trusted brands of vitamins, minerals, and protein powders.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market owing to the growing awareness about plant-based lifestyles, which is driving the demand for vegan supplements in this region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302