India Electric Vehicle Components Market Set for Exponential Growth as EV Adoption Accelerates

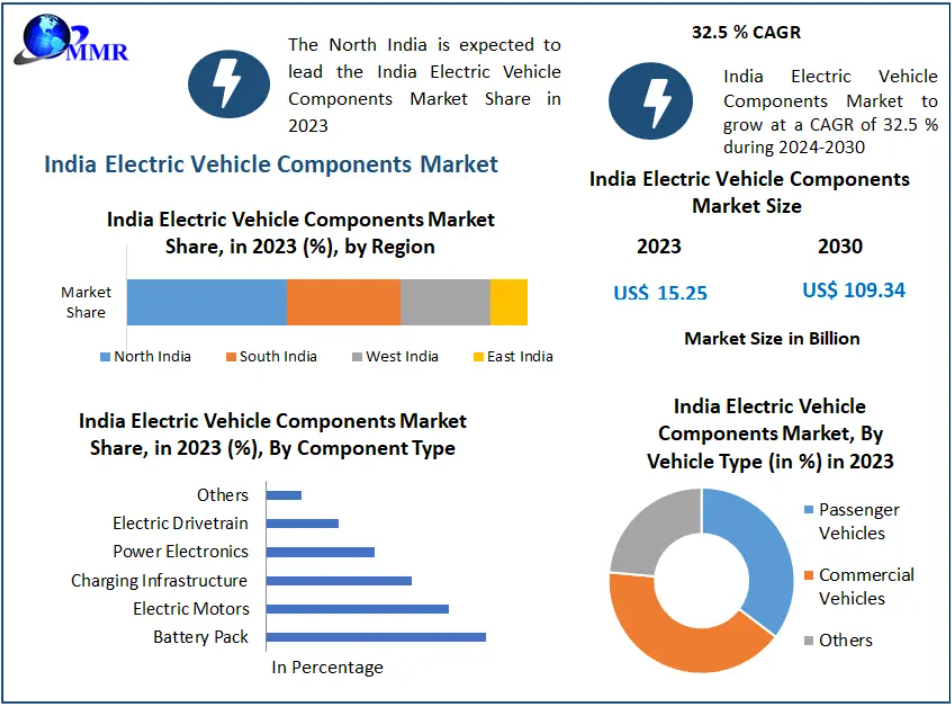

The India Electric Vehicle Components Market was valued at USD 15.25 billion in 2023 and is expected to soar to USD 109.34 billion by 2030, growing at an impressive CAGR of 32.5%. Driven by rising EV adoption, government initiatives, and advancements in battery technology, the market is poised to reshape the Indian automotive landscape.

Market Overview

Electric vehicles (EVs) are redefining transportation, powered by sophisticated components that enable efficient, sustainable mobility. At the core, the Traction Battery Pack (EV Battery) stores and delivers energy to the vehicle, accounting for 30-40% of EV costs. Supporting components such as DC-DC converters, electric motors, and power inverters manage energy distribution, propulsion, and regenerative braking systems, marking a significant shift from traditional internal combustion engines.

India is increasingly focusing on domestic EV component manufacturing, reducing reliance on imports from China, Japan, and Korea. Government-backed schemes, including the $5 billion PLI incentive and FAME initiatives, are fostering local production, R&D, and innovation in battery technology and electric motors.

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐓𝐨 𝐠𝐞𝐭 𝐰𝐞𝐥𝐥-𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/request-sample/63133/

Market Scope

| Report Coverage | Details |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Historical Data | 2018–2023 |

| Market Size 2023 | USD 15.25 Bn |

| Forecast 2030 | USD 109.34 Bn |

| CAGR | 32.5% |

| Segments Covered | By Vehicle Type: Passenger Vehicles, Commercial Vehicles, Others |

| Regions | North India, South India, West India, East India |

Market Drivers

- Environmental Sustainability and Carbon Reduction

Rising concerns over air pollution and climate change are driving India’s shift to EVs. EVs provide zero tailpipe emissions, lower operational costs, and reduced maintenance compared to traditional vehicles. Government incentives, tax benefits, and infrastructure support amplify the adoption of EVs and corresponding components.

- Government Policies and Incentives

Programs like FAME India and the National Electric Mobility Mission Plan (NEMMP) promote EV adoption, subsidize battery and vehicle costs, and support charging infrastructure development. These initiatives strengthen the EV ecosystem and accelerate the demand for locally manufactured components.

- Technological Advancements

Investments in battery energy density, charging efficiency, electric motors, and power electronics are reducing costs and enhancing performance. Collaborations between automakers, startups, and research institutions are fostering innovation, enabling India to develop indigenous EV technologies.

Market Trends

- Focus on Local Manufacturing: The ‘Make in India’ initiative encourages domestic EV component production, reducing import dependence and boosting self-reliance.

- Battery Innovation: Advanced lithium-ion and solid-state battery technologies are improving performance, lowering costs, and enabling longer EV ranges.

- Expansion of Charging Infrastructure: Rapid deployment of home and public charging stations is addressing range anxiety, further encouraging EV adoption.

- Collaborative Ecosystems: Strategic partnerships between automakers, technology firms, and startups accelerate research and innovation in EV components.

Market Segmentation

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Others

By Propulsion Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid EV (PHEV)

- Fuel Cell EV (FCEV)

- Hybrid EV (HEV)

- Others

By Component Type:

- Battery Pack

- Electric Motors

- Charging Infrastructure

- Power Electronics

- Electric Drivetrain

- Others

By End-User:

- Individual Consumers

- Fleet Operators

- Commercial Entities

- Government & Public Agencies

- Others

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐓𝐨 𝐠𝐞𝐭 𝐰𝐞𝐥𝐥-𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/request-sample/63133/

Key Insight: BEVs dominate the market, supported by government subsidies, emission regulations, and lower total cost of ownership, while plug-in hybrids and FCEVs are emerging segments.

Key Players

India Electric Vehicle Components Market Leaders (Vertical Listing):

- SEG Automotive India Private Limited (Bengaluru)

- Tata Motors Limited (Mumbai)

- Mahindra Electric Mobility Limited (Bengaluru)

- Avtec Limited (Delhi)

- Exide Industries Ltd. (Kolkata)

- Bosch Limited (Bengaluru)

- Ashok Leyland (Chennai)

- Maruti Suzuki (New Delhi)

- Okaya Power Pvt. Ltd. (New Delhi)

- Amara Raja Batteries Ltd. (Andhra Pradesh)

- Sparco Batteries Pvt. Ltd. (Pune)

- Eastman Auto & Power Ltd. (New Delhi)

- Exicom Tele-Systems Ltd. (Gurgaon)

- Delta Electronics India (Gurugram)

- Hero Electric Vehicles Pvt. Ltd. (New Delhi)

Regional Analysis

- North India: NCR, Delhi, Noida, and Gurugram lead EV adoption and innovation, driven by government policies and high urban population density.

- South India: Bengaluru, Chennai, and Hyderabad host EV startups, battery production, and research centers.

- West & East India: Key industrial hubs supporting EV component manufacturing, logistics, and distribution.

Key Questions Answered

- What is the current and projected size of India Electric Vehicle Components Market?

- Which component types are leading the market?

- How are government policies impacting EV adoption?

- What role does indigenous manufacturing play in market growth?

- Which regions in India present the highest growth opportunities?

Conclusion

The India Electric Vehicle Components Market is on a transformative growth trajectory, driven by environmental sustainability, government support, technological advancements, and domestic manufacturing initiatives. With BEVs leading adoption and significant investments in battery technology, electric motors, and charging infrastructure, India is positioned to emerge as a global hub for electric mobility.

The collaborative efforts of Tata Motors, Mahindra Electric, Bosch, and Exide are accelerating the market’s development, ensuring innovation, cost efficiency, and environmental impact reduction. As the country pushes toward a sustainable, emission-free transportation future, the EV components industry will continue to play a pivotal role in India’s automotive revolution.