Application Performance Monitoring Market: Global Outlook, Trends, and Growth Forecast (2024–2030)

Market Overview

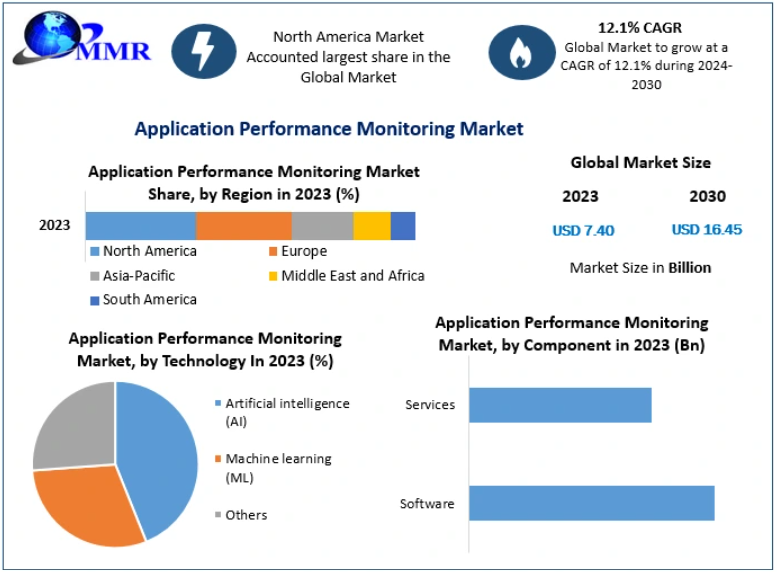

The Application Performance Monitoring (APM) Market was valued at USD 7.40 billion in 2023 and is projected to reach USD 16.45 billion by 2030, registering a CAGR of 12.1% during the forecast period. APM solutions track, measure, and optimize software application performance, availability, and user experience, helping organizations detect bottlenecks, anomalies, and errors in real time.

By offering diagnostic insights and performance analytics, APM tools allow businesses to maintain smooth operations, minimize downtime, and deliver seamless digital experiences. The rise of cloud computing, big data analytics, and the growing demand for improved user experience are key drivers propelling the market forward. However, limited awareness about APM benefits and the complexity of deployment remain notable challenges.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/200134/

Market Drivers

Cloud Computing Adoption

The surge in cloud computing is fueling the APM market. Distributed cloud applications require robust monitoring to ensure optimal performance across multiple servers and regions. Statistics indicate that 75% of businesses experienced cloud performance issues last year, with an average cost of $100,000 per incident. APM solutions enable organizations to detect and resolve these issues proactively, enhancing user satisfaction and minimizing financial risk.

Big Data Analytics Integration

As enterprises generate increasing volumes of data, leveraging application insights for performance optimization has become critical. APM platforms utilize big data analytics to identify trends, predict performance bottlenecks, and enhance operational efficiency. The global big data analytics market is expected to grow from $182 billion in 2021 to $331 billion by 2025, highlighting the increasing reliance on data-driven decision-making to support APM adoption.

AI and Machine Learning Enhancements

Modern APM solutions integrate Artificial Intelligence (AI) and Machine Learning (ML) to enhance root-cause analysis, anomaly detection, and predictive performance monitoring. These technologies enable real-time decision-making and automated problem resolution, improving overall application reliability and user experience.

Market Restraints

Limited End-User Awareness

A significant portion of potential customers remains unaware of APM benefits. Research by Dynatrace indicates that only 25% of organizations fully understand APM solutions, and just 15% have mature APM programs. This lack of awareness hampers adoption, particularly among small and medium-sized enterprises (SMEs). Educating businesses through webinars, white papers, and training can help overcome this barrier.

Complexity of Implementation

APM solutions often require specialized skills for deployment and management, which may deter organizations with limited technical resources. Simplifying APM interfaces and offering comprehensive vendor support can mitigate this challenge.

Regional Insights

- North America: The largest APM market due to high cloud adoption, a strong focus on customer experience, and widespread awareness of APM benefits.

- Europe: The second-largest market, driven by cloud adoption and growing enterprise emphasis on application performance.

- Asia-Pacific: Expected to grow at a CAGR of 13.8%, fueled by rapid digital transformation, expanding cloud infrastructure, and increasing awareness of APM solutions.

- South America and MEA: Emerging markets experiencing gradual growth, supported by cloud adoption and regional digital initiatives.

Market Segmentation

By Deployment

- On-Premises: Installed locally within an organization; suitable for enterprises requiring full control over infrastructure.

- Cloud-Based: Hosted by vendors; offers scalability, cost-effectiveness, and easy maintenance. The cloud-based segment is expected to witness faster growth due to widespread cloud adoption.

By Enterprise Size

- SMEs: Limited deployment due to cost and technical requirements.

- Large Enterprises: Leading adoption due to complex applications and need for high-performance solutions.

By Industry

- BFSI: Dominates the market, driven by mission-critical applications and stringent performance requirements.

- IT & Telecom, Retail & E-Commerce, Healthcare, Education, Media & Entertainment, Manufacturing, Others: Growing adoption as organizations seek to enhance operational efficiency and customer satisfaction.

By Component

- Software: Core APM platforms; expected to hold the largest market share.

- Services: Includes installation, configuration, maintenance, and consulting.

By Monitoring Type

- Infrastructure Monitoring: Tracks performance of underlying servers, networks, and cloud resources.

- Application Monitoring: Monitors application performance, response times, and error rates.

- User Experience Monitoring: Focuses on end-user interactions and satisfaction.

By Technology

- Artificial Intelligence (AI)

- Machine Learning (ML)

- Others (Big Data Analytics, Automation Tools, etc.)

AI and ML segments are growing rapidly due to their capabilities in predictive analytics and anomaly detection.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/200134/

Competitive Landscape

The APM market is highly competitive, with leading players offering diverse solutions:

- AppDynamics (Santa Clara, CA)

- Datadog (New York, NY)

- Dynatrace (Boston, MA)

- IBM (Armonk, NY)

- Micro Focus (Newbury, UK)

- New Relic (Burlington, MA)

- Oracle (Redwood Shores, CA)

- SolarWinds (Austin, TX)

- Splunk (San Francisco, CA)

- AppNeta (Burlington, MA)

- Aternity (Mountain View, CA)

- Coralogix (Tel Aviv, Israel)

- Elastic (Mountain View, CA)

- Fiddler (San Francisco, CA)

- Honeycomb (San Francisco, CA)

Key strategies include partnerships (e.g., New Relic and Microsoft Azure alliance), cloud-based solution adoption, AI/ML integration, and compliance with regional data regulations such as GDPR. These initiatives enhance scalability, security, and operational efficiency, enabling APM vendors to maintain a competitive edge.

Market Outlook

The Application Performance Monitoring Market is poised for robust growth through 2030, driven by cloud computing adoption, big data analytics, AI and ML integration, and the growing emphasis on superior customer experience. While awareness and implementation challenges exist, strategic vendor initiatives and technological advancements will continue to propel the market. North America will maintain leadership, while Asia-Pacific and emerging regions offer significant growth opportunities.