Market Overview:

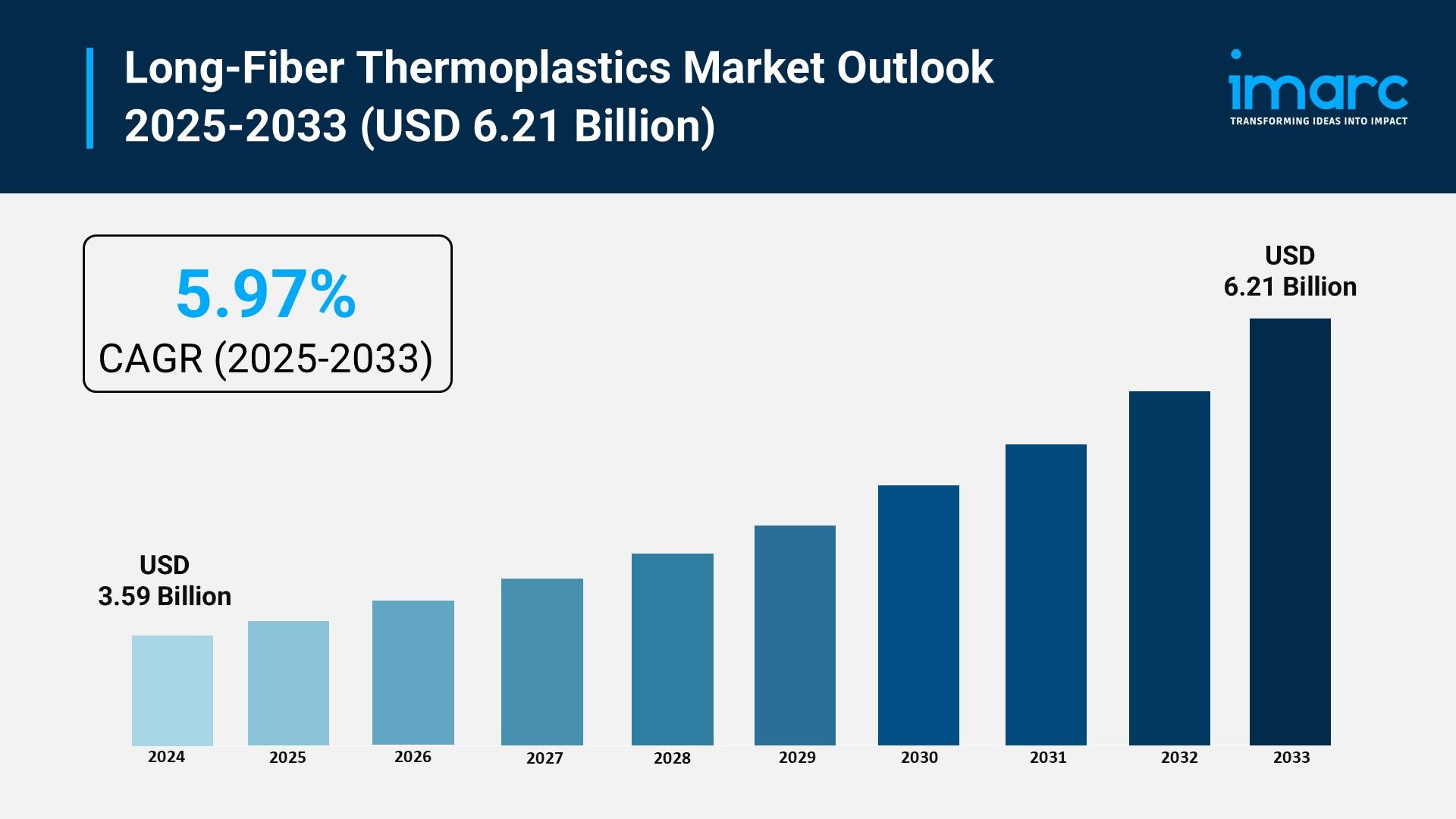

The long-fiber thermoplastics market is experiencing rapid growth, driven by accelerating automotive lightweighting and electrification, expanding infrastructure in electrical and electronics, and technological advancements in material formulations. According to IMARC Group's latest research publication, "Long-Fiber Thermoplastics Market Size, Share, Trends and Forecast by Resin Type, Fiber Type, Manufacturing Processing, Application, and Region, 2025-2033", The global long-fiber thermoplastics market size was valued at USD 3.59 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.21 Billion by 2033, exhibiting a CAGR of 5.97% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/long-fiber-thermoplastics-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Long-Fiber Thermoplastics Market

- Accelerating Automotive Lightweighting and Electrification

The automotive industry is the primary catalyst for the growth of long-fiber thermoplastics (LFT), as manufacturers strive to reduce vehicle weight to meet environmental standards. Replacing traditional steel components with LFT solutions can reduce the weight of specific parts by 30% to 50% while maintaining essential structural integrity. This weight reduction is particularly critical for electric vehicles, where every kilogram saved contributes directly to extending battery range and improving energy efficiency. Major original equipment manufacturers are increasingly integrating these materials into front-end modules, underbody shields, and seat structures. Government initiatives, such as the Corporate Average Fuel Economy standards in the United States and similar emissions mandates in Europe, incentivize this shift. Furthermore, companies like SABIC and Celanese are actively developing advanced polypropylene and polyamide matrices to provide the stiffness and impact resistance required for high-performance automotive applications.

- Expanding Infrastructure in Electrical and Electronics

The rapid expansion of the electrical and electronics sector is significantly fueling the demand for long-fiber thermoplastics due to their excellent dimensional stability and heat resistance. These materials are essential for 5G infrastructure components, server racks, and high-performance consumer electronics housings that require precise molding tolerances and electromagnetic shielding. As devices become more compact, LFTs offer a superior alternative to traditional composites by providing high thermal conductivity and mechanical strength. In regions like Asia-Pacific, government programs such as India’s Production Linked Incentive scheme have realized investments of approximately ₹1.76 lakh crore to boost domestic manufacturing of electronics and telecommunications equipment. This industrial push encourages the adoption of reinforced thermoplastics to ensure product durability. Additionally, the inherent recyclability of thermoplastic matrices aligns with global circular economy initiatives, making them a preferred choice for manufacturers looking to reduce their environmental footprint.

- Technological Advancements in Material Formulations

Continuous innovation in polymer chemistry and fiber-coupling technologies is broadening the functional range of long-fiber thermoplastics. Recent breakthroughs enable the use of high-temperature resins, such as Polyether Ether Ketone and Polyphthalamide, in demanding underhood and aerospace environments that were previously dominated by metals. These advanced formulations allow for 15% to 20% higher mechanical properties compared to conventional short-fiber composites. Leading industry players are investing heavily in research and development to create bio-based LFTs and hybrid molding techniques that improve production efficiency. For instance, the development of direct-LFT processes allows manufacturers to combine roving and resin in a single step, reducing material wastage and lowering overall system costs. These technological improvements make LFTs more accessible for industrial machinery and consumer goods, where high-performance benefits like corrosion resistance and long-term durability are critical for maintaining a competitive edge in the global market.

Key Trends in the Long-Fiber Thermoplastics Market

- Integration of Recycled and Bio-Based Materials

A prominent trend in the long-fiber thermoplastics market is the shift toward sustainable sourcing through the use of recycled fibers and bio-based resin matrices. Manufacturers are increasingly incorporating reclaimed carbon fibers from aerospace production into new thermoplastic pellets to create high-value, eco-friendly composites. For example, Toray Industries has successfully utilized recycled carbon fiber from aircraft structures to reinforce thermoplastic components for premium laptop casings, such as the Lenovo ThinkPad series. This approach not only reduces the carbon footprint of the manufacturing process but also addresses the growing demand from environmentally conscious consumers. Many companies are also experimenting with high-performance polyamides derived from renewable resources like castor oil. By moving away from purely virgin, petroleum-based materials, the industry is aligning with global sustainability goals and creating a more circular supply chain for high-performance engineering plastics.

- Adoption of Hybrid Molding and Multi-Material Design

The market is witnessing a transition toward hybrid molding techniques that combine the benefits of different material forms in a single production cycle. Designers are now frequently over-molding long-fiber injection compounds onto continuous-fiber reinforced thermoplastic sheets to create complex, multi-functional parts. This trend is highly visible in the consumer electronics and sporting goods sectors, where brands use these hybrid structures to produce slimmer, lightweight laptop lids and high-strength bicycle frames. In electronics, these hybrid lids can lower skin temperatures by 2 to 3 °C during heavy-load processing due to improved thermal diffusion properties. This "design-for-performance" approach allows for the optimization of specific part areas—placing strength exactly where it is needed—while maintaining the fast cycle times and cost-effectiveness of injection molding. This versatility is unlocking new opportunities in the medical and marine industries.

- Digitalization and Industry 4.0 in LFT Production

The integration of digital twins, predictive analytics, and real-time process monitoring is transforming the manufacturing landscape for long-fiber thermoplastics. Maintaining fiber length during the injection molding process is critical for performance, and smart facility systems now allow operators to precisely control barrel temperatures and screw speeds to minimize fiber breakage. These Industry 4.0 solutions help reduce material wastage and optimize operational efficiency, making high-performance LFTs more accessible to small and medium-sized enterprises. Companies are adopting automated quality control systems that provide paperless documentation and certified material solutions for highly regulated sectors like aerospace and defense. This digital shift ensures high repeatability and reliability in production, which is essential for structural applications. As manufacturing becomes more data-driven, the ability to simulate material behavior in real-time is accelerating the transition from traditional metals to advanced thermoplastic composites.

Leading Companies Operating in the Global Long-Fiber Thermoplastics Industry:

- Avient Corporation

- BASF SE

- Celanese Corporation

- Coperion GmbH (Hillenbrand Inc.)

- Lanxess AG

- Mitsubishi Chemical Holdings Corporation

- Owens Corning

- SGL Carbon SE

- Solvay S.A.

- Toray Industries Inc.

Long-Fiber Thermoplastics Market Report Segmentation:

By Resin Type:

- Polypropylene (PP)

- Polyethylene (PE)

- Polyamide (PA)

- Others

Polypropylene dominates the market due to excellent chemical resistance, processability, and cost-effectiveness in automotive applications.

By Fiber Type:

- Glass Fiber

- Carbon Fiber

Glass fiber accounts for the majority share due to optimal balance of mechanical properties, cost, and processing characteristics.

By Manufacturing Processing:

- Injection Molding

- Pultrusion

- D-LFT

- Others

Injection molding holds the largest share due to high-volume production capabilities and design flexibility.

By Application:

- Automotive

- Electrical and Electronics

- Consumer Goods

- Sporting Goo

Automotive dominates the market due to lightweighting requirements and performance demands in structural applications.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe holds a 40% share in the long-fiber thermoplastics market, driven by its advanced industrial base, focus on sustainable innovation, and strong regulatory support.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302