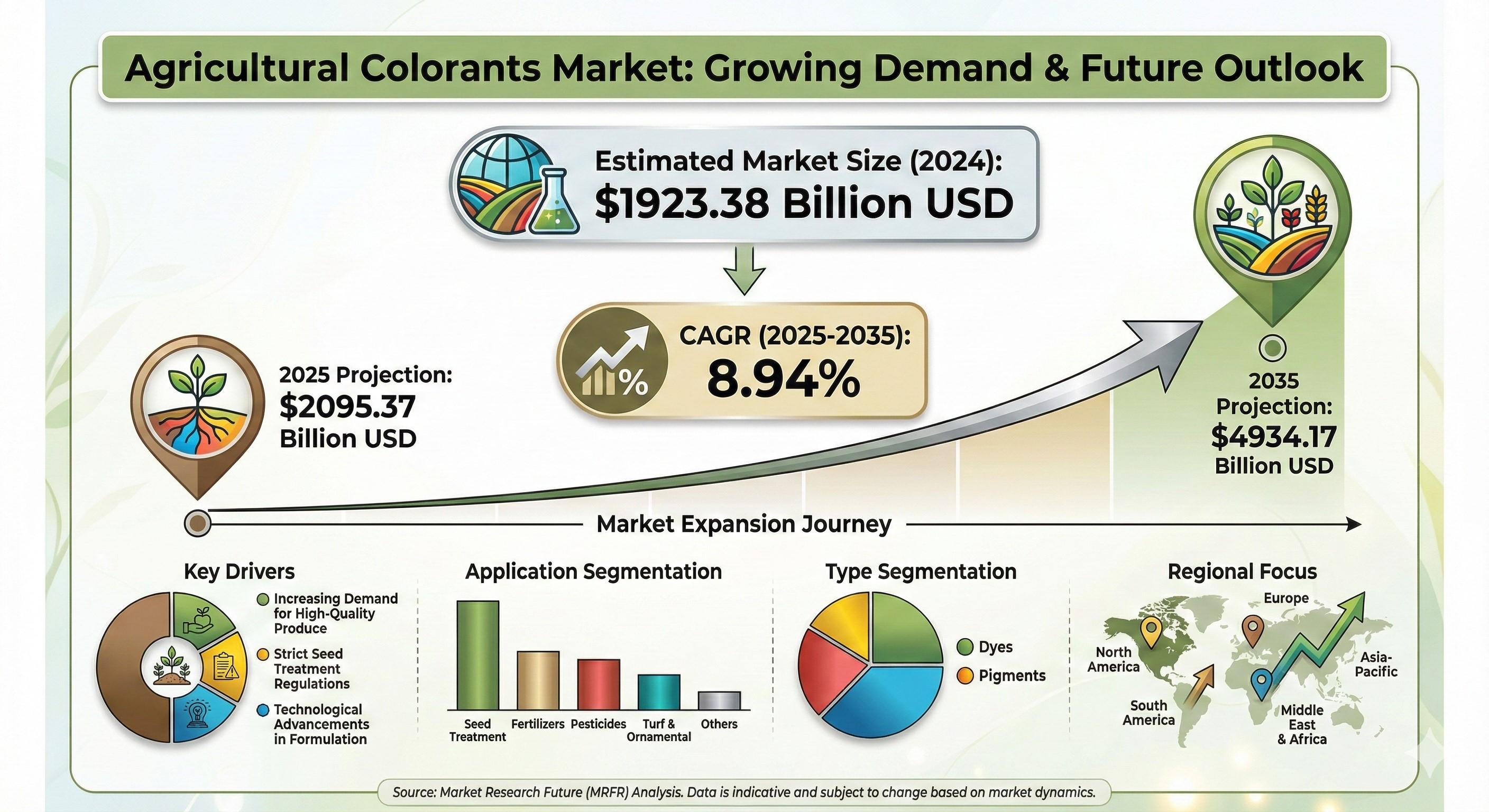

As per MRFR analysis, the Agricultural Colorants Market Size was estimated at 1923.38 USD Billion in 2024. The Agricultural Colorants industry is projected to grow from 2095.37 USD Billion in 2025 to 4934.17 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.94 during the forecast period 2025 - 2035. The backbone of the Agricultural Colorant Market is its complex supply chain. From raw material suppliers to local distributors, every link matters. The competitive landscape is equally intense. Major chemical giants fight for share against specialized niche players.

Market Growth Factors/Drivers

Strategic partnerships are driving market growth. Seed companies are partnering directly with colorant manufacturers. This ensures a steady supply of customized formulations. Moreover, the consolidation of the agrochemical industry is a major factor.

As big companies merge, they streamline their supply chains. They prefer global suppliers who can deliver consistent quality worldwide. In addition, raw material availability affects the market. Volatility in petrochemical prices impacts synthetic colorant costs. This drives the search for alternative, stable supply sources.

Segmentation Analysis

We can analyze the market by player type.

- Global Giants: Offer a wide portfolio but may lack flexibility.

- Niche Specialists: Focus solely on seed coatings and offer high customization.

- Regional Distributors: Critical for reaching small farmers in developing nations.

The distribution channel is also segmented. Direct sales to seed processors constitute the bulk of the volume. However, retail sales to farmers are significant in emerging economies.

Regional Analysis

The competitive intensity varies. In Europe and North America, the market is consolidated. A few large players dominate the scene. Barriers to entry are high due to regulations and R&D costs.

In Asia-Pacific, the landscape is fragmented. There are many local manufacturers in India and China. They compete aggressively on price. However, multinational companies are expanding their footprint here. They are acquiring local firms to gain market access. This trend is reshaping the regional competition.

Future Growth

Digitalization will transform the supply chain. Blockchain could be used to trace the origin of agricultural inputs. This ensures authenticity and quality. Furthermore, "Just-in-Time" delivery models will become popular.

Seed treatment often happens seasonally. Manufacturers need colorants exactly when the planting season starts. Efficient logistics will be a key differentiator. Companies that master the supply chain will win.

Read More Reports:

- germany hydroponics market

- germany pet food ingredients market

- europe pet food ingredients market

- china pet food ingredients market

- canada pet food ingredients market

FAQs

- Who are the main users of agricultural colorants?

The primary users are seed processing companies. Agrochemical manufacturers and individual farmers also use them.

- How does the supply chain affect prices?

Raw material costs and logistics heavily influence the final price. Disruptions in the supply chain can lead to price spikes.

- Is the market dominated by a few companies?

Globally, yes. A handful of large chemical companies hold significant market share, though local players exist in specific regions.