Introduction

The smart-lock market in Latin America refers to electronic and IoT-enabled locking systems — smart deadbolts, lever-handle locks, keypad locks, biometric or app-controlled locks — designed for residential, commercial, and hospitality use. These locks replace or supplement traditional mechanical locks, offering keyless entry, remote access control, logging, and integration with smart-home or building-automation ecosystems. As urbanization, smartphone penetration, connectivity and security awareness rise across Latin America, smart locks are emerging as a significant component of the broader smart-home and security infrastructure.

Source - https://www.databridgemarketresearch.com/reports/latin-america-smart-lock-market

Market Size & Growth Outlook

-

As of 2024, the Latin America smart lock market was estimated to be over US$ 75–80 million. Grand View Research+2Emergen Research+2

-

Forecasts indicate the market could reach roughly US$ 280 million by 2030, representing a strong compound annual growth rate (CAGR) of around 24–25% over 2025–2030. Grand View Research

-

In major markets like Brazil, smart-lock demand is expected to grow rapidly: one estimation projects Brazil’s market to grow from about US$ 32 million in 2024 to over US$ 100 million by 2030. Grand View Research

-

The overall smart-home and security ecosystem in Latin America is also expanding: the broader smart home security market in the region was valued at several billion USD in 2024 and is projected to grow at a robust rate through 2030. Grand View Research+1

Summary: The market is in an early-to-middle growth phase, with potential for rapid expansion as awareness, affordability, and smart-home adoption increase.

Key Drivers

-

Rising Urbanization & Security Concerns

As more people move into urban apartments, gated communities, and multi-unit housing, demand for security solutions increases. Smart locks provide a more secure and flexible solution compared to traditional locks, offering remote access, digital logs, and easier key management. -

Smart-Home Trend & Growing Technology Penetration

Increasing numbers of smartphone users, improved internet connectivity, and the spread of IoT devices are supporting adoption of smart locks. Integration with home-automation systems (lighting, cameras, alarms) makes smart locks a natural fit for tech-savvy households. -

Decreasing Costs and Improved Affordability

As production scales and technology becomes more widely available, smart-lock hardware and installation costs are dropping. Lower prices make smart locks more accessible to a broader middle-class segment, especially in larger markets such as Brazil, Mexico, Argentina, and Colombia. -

Adoption in Commercial, Hospitality, and Multi-unit Properties

Beyond residential use, smart locks are increasingly used by hotels, offices, co-working spaces, and apartment buildings. The convenience of mobile or code-based entry, easier access management, and audit trails appeal to property managers and owners. -

Rising Awareness and Consumer Preferences for Convenience

Consumers are beginning to value convenience—keyless entry, remote access, sharing temporary passes, auto-locking, and integration with smartphone apps. For younger, urban homeowners, these features outweigh the comfort and simplicity of traditional locks.

Market Segmentation

By Product Type

-

Deadbolt smart locks

-

Lever-handle / lever-type smart locks

-

Smart padlocks and portable locks

-

Biometric locks (fingerprint / facial recognition)

-

Keypad / electronic cipher locks

By Connectivity / Technology

-

Wi-Fi enabled smart locks

-

Bluetooth-based smart locks

-

Zigbee / Z-Wave / other smart-home protocol locks

-

Offline-enabled electronic locks with RFID or keypad

By End User / Application

-

Residential (apartments, houses)

-

Commercial buildings (offices, retail, co-working spaces)

-

Hospitality (hotels, hostels, short-term rentals)

-

Multi-unit housing / gated communities

Regional & Country-Level Patterns

-

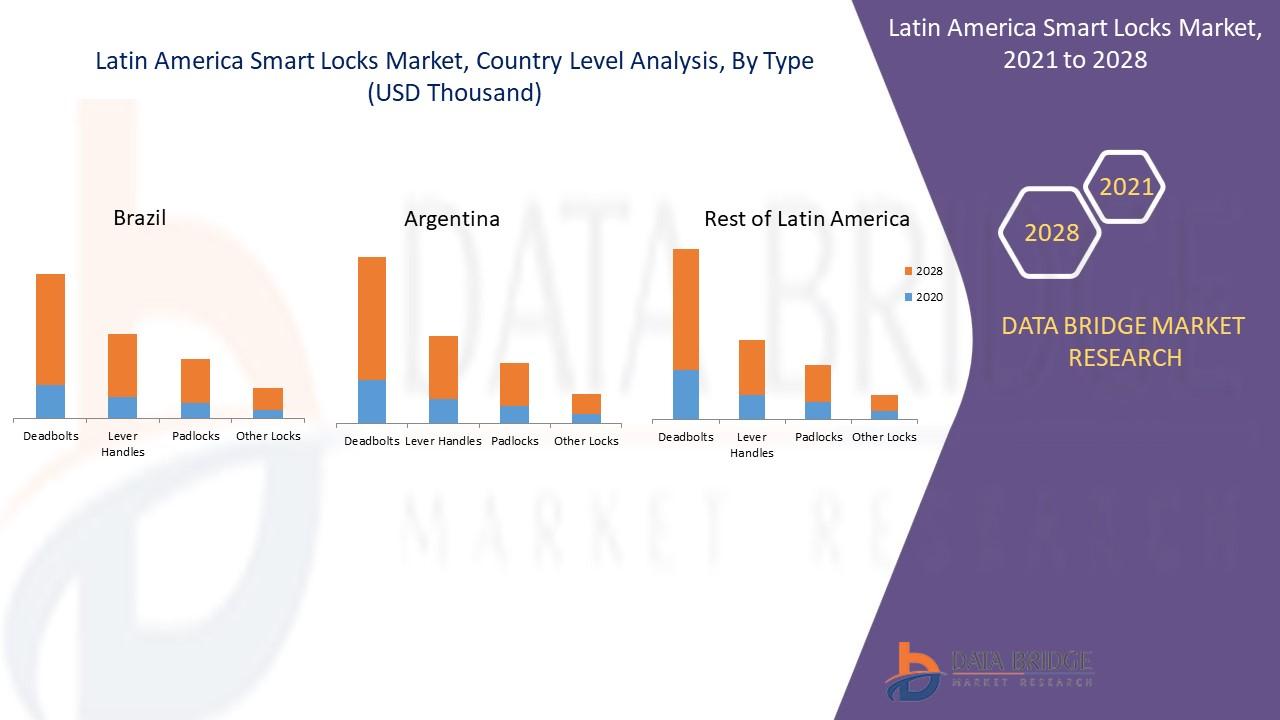

Brazil stands out as the largest and fastest-growing market in Latin America for smart locks. Urbanization, rising middle class, and strong adoption of smart-home technologies drive demand. Grand View Research+2Emergen Research+2

-

Argentina, Colombia, Mexico, Chile, Peru and other countries also contribute to growth, with consumers gradually shifting to smarter security solutions. Cognitive Market Research+2Business Market Insights+2

-

Urban centers — large cities with rising crime or security concerns — show higher adoption rates, particularly among young professionals, apartment dwellers, and rental-market participants.

-

Hospitality and rental property segment shows growing adoption as hotels and short-stay accommodations look for cost-efficient keyless lock solutions to manage access and security for guests.

Challenges & Restraints

-

Affordability for Lower-Income Segments

Despite falling costs, smart locks remain more expensive than traditional locks, which limits adoption among price-sensitive consumers and low-income households. -

Awareness and Trust Issues

Many potential buyers remain unfamiliar with smart-lock benefits or sceptical about reliability, security and battery / power issues. There is also concern over technical complexity and durability. -

Infrastructure and Network Limitations

Stable Wi-Fi or Internet connectivity is essential for many smart locks. In regions with unreliable connectivity or frequent power outages, performance may suffer, limiting adoption. -

Compatibility, Standardization and After-Sales Support

Smart locks must integrate with other smart-home devices or security systems; lack of standardization or inadequate support and maintenance could deter some buyers. -

Security & Cyber Risks

As locks become networked, risks increase of hacking, unauthorized access, or data vulnerabilities. Ensuring encryption, secure mobile apps and firmware updates is critical for consumer trust.

Emerging Trends

-

Increasing use of biometric and mobile-app-based authentication, replacing traditional keys or passcodes.

-

Growing interest in smart-home ecosystem integration — locks working in tandem with cameras, alarms, door sensors, and home automation hubs.

-

Rising demand from multi-unit residential developments and gated communities, where shared or rental properties use smart locks for access management.

-

Adoption in hospitality and vacation rental sectors, where owners seek easier guest management and remote access control.

-

Advancement in wireless connectivity technologies and battery life — making locks more reliable even in regions with intermittent power or network.

-

Expansion of aftermarket and retrofit solutions, enabling owners of older homes or apartments to install smart locks without major renovation.

Future Outlook

The Latin America smart lock market is poised for strong growth over the next 5 to 10 years, driven by urbanization, rising security concerns, expanding smart-home adoption, and increasing digital literacy. As hardware costs fall and connectivity improves, smart locks are likely to become mainstream for mid-income households—not just early adopters or luxury buyers.

By 2030, market revenues are expected to grow several times from current levels. Growth will be led by Brazil, followed by Argentina, Mexico, Colombia and other fast-urbanizing countries. Demand will come not only from residential apartments and houses but also from hospitality, rentals, co-working spaces, and commercial properties.

Manufacturers and distributors that focus on affordable models, easy installation, local support, and integration with popular smart-home ecosystems will have the best chance of capturing this growing market. In parallel, strengthening cybersecurity, ensuring product durability, and investing in consumer education will be critical to broader adoption.