In today’s fast-growing digital business environment, financial management has evolved far beyond spreadsheets and manual bookkeeping. Companies—small, medium, and enterprise-level—are shifting toward Cloud Accounting Software to manage their finances with greater accuracy, speed, and automation.

This transformation is driven by the need for real-time data, compliance with tax laws, cost-effective tools, and technology that enables business owners to manage their accounts from anywhere, at any time.

In this comprehensive guide, we explore what cloud accounting software is, why businesses are adopting it, its features, benefits, challenges, and how to choose the right solution for your organization.

What Is Cloud Accounting Software?

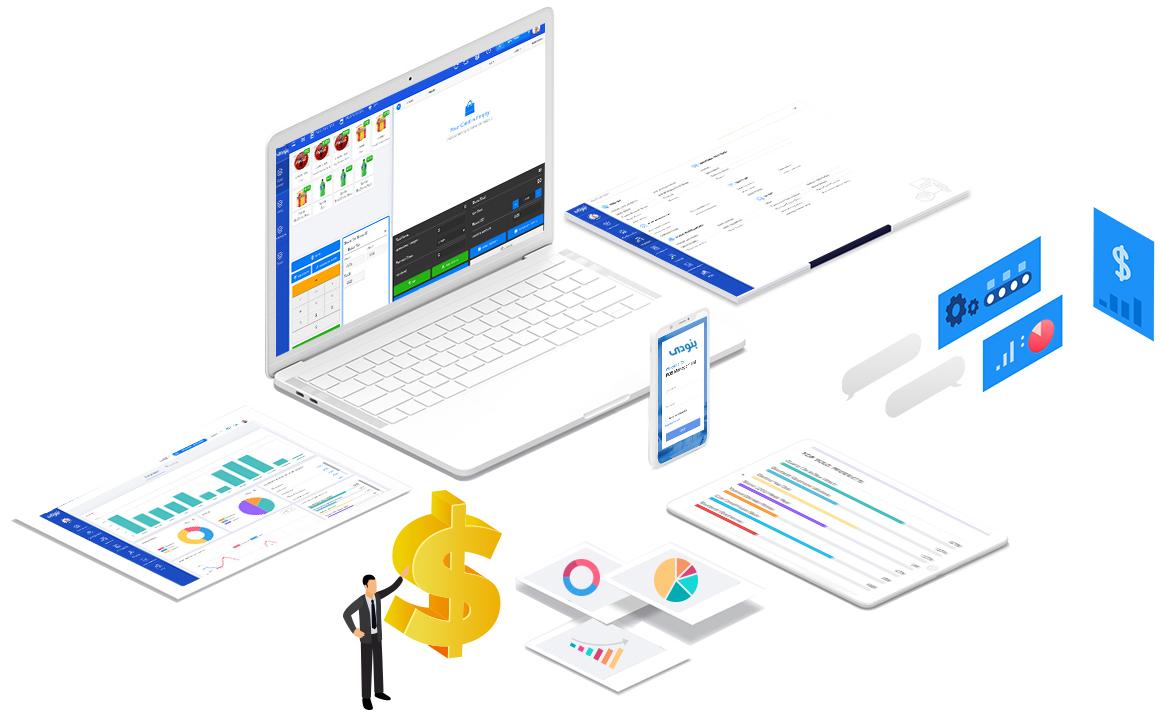

Cloud Accounting Software is an online financial management system that stores data on secure cloud servers instead of local computers. Users can access their financial information through the internet using computers, mobiles, or tablets.

Unlike traditional accounting systems, cloud accounting does not require installation, manual backups, or constant maintenance. Everything runs automatically in the cloud with real-time updates and data syncing.

Why Cloud Accounting Is Transforming Modern Businesses

Businesses today face intense competition, strict regulatory requirements, and increasing customer expectations. Cloud accounting solves many financial management challenges by offering:

-

Real-time financial visibility

-

Instant access from anywhere

-

Automated bookkeeping

-

Accurate reports

-

Fast invoicing and payments

-

Streamlined tax and compliance management

The shift to cloud-based systems has helped companies reduce manual work, avoid costly mistakes, and make better business decisions.

Key Features of Cloud Accounting Software

Cloud Accounting Software comes with a wide range of features that make financial management simpler and smarter.

. Real-Time Financial Dashboard

View cash flow, sales, expenses, profits, and outstanding invoices instantly. Business owners can track performance without waiting for monthly reports.

. Smart Invoicing

-

Create and send invoices instantly

-

Set automatic payment reminders

-

Accept online payments

-

Track overdue invoices

Faster invoicing means faster cash flow.

. Automated Expense Tracking

Upload receipts, categorize expenses automatically, and sync bank transactions without manual entry.

. Bank Reconciliation

Connect your bank accounts and credit cards directly to the software. The system automatically matches transactions, reducing errors and saving hours of manual work.

. VAT / Tax Compliance

Built-in features help calculate VAT, generate tax reports, and ensure compliance with local regulations.

. Inventory Management

Track stock levels, update quantities automatically, and avoid over- or under-stocking issues.

Multi-User Access

Business owners, accountants, and employees can access the system at different permission levels in real time.

. Financial Reporting

Generate:

-

Profit and loss statements

-

Balance sheets

-

Cash flow reports

-

Tax reports

-

Sales and inventory reports

The reports are available instantly and can be exported or shared easily.

. Data Security & Automatic Backups

Cloud accounting systems use advanced encryption, multi-factor authentication, and secure servers to protect financial data.

. Mobile App Access

Manage your business finances from your phone—create invoices, check reports, approve payments, and track expenses on the go.

Benefits of Cloud Accounting Software

. Work From Anywhere

With cloud systems, business owners can access their accounts anytime and from any device.

. Reduce Manual Work

Automation handles tasks like:

-

Expense categorization

-

Invoice reminders

-

Bank reconciliation

-

Report generation

This saves hours of manual effort.

. Real-Time Decision Making

Live reports help businesses evaluate:

-

Sales performance

-

Cash flow status

-

Inventory health

-

Profit margins

Better data leads to smarter decisions.

. Cost-Effective

No need for:

-

Server installations

-

Expensive hardware

-

IT maintenance

-

Manual backup systems

You only pay a subscription fee.

. Enhanced Security

Cloud accounting systems protect data with:

-

Encryption

-

Secure servers

-

Automatic backups

-

Role-based access

This reduces the risk of data loss or unauthorized access.

. Easy Collaboration

Accountants and team members can work together in real time, eliminating version conflicts and outdated files.

. Faster Compliance

Tax calculations, VAT filings, and government reporting become smoother, reducing errors and penalties.

Why Cloud Accounting Software Is Essential in 2026

The year 2026 marks a major shift in business technology. With digital transformation happening globally, cloud systems have become essential. Here’s why:

. Remote Work Is Normal

Teams need tools that are accessible from anywhere.

. Governments Are Moving to Digital Tax Systems

Online VAT filing, e-invoicing, and compliance are becoming standard.

. Businesses Need Automation

Manual accounting slows down operations and increases errors.

. AI & Machine Learning Enhancements

Modern cloud accounting uses AI to:

-

Predict cash flow

-

Categorize expenses

-

Detect anomalies

-

Improve financial accuracy

. Scalability

Cloud platforms grow with your business—new users, branches, and modules can be added effortlessly.

Common Industries Using Cloud Accounting Software

Cloud accounting is used across many industries, including:

-

Retail stores

-

Restaurants & cafés

-

E-commerce shops

-

Service providers

-

Real estate

-

Construction companies

-

Manufacturing

-

Freelancers & consultants

-

Healthcare facilities

-

Logistics companies

Any business that manages money can benefit from cloud accounting.

How to Choose the Right Cloud Accounting Software

Picking the right software depends on your business needs. Here are the top criteria:

. Features You Need

Look for invoicing, expense tracking, VAT, bank sync, inventory, payroll, and reporting.

. Ease of Use

Choose software with a clean, simple interface.

. Industry Fit

Restaurants, retailers, and service providers may need different features.

. Integration Compatibility

It should integrate with:

-

POS systems

-

Payroll software

-

E-commerce platforms

-

CRM tools

. Security Measures

Ensure the software uses:

-

Encryption

-

Automatic backups

-

Role-based access

. Customer Support

Quick support is essential when dealing with financial systems.

Cloud accounting clearly provides a more modern and efficient approach.

Future Trends in Cloud Accounting

. AI Automation

Automated bookkeeping, smart forecasts, and intelligent auditing.

. Blockchain Accounting

Enhanced transparency and secure transaction logs.

. Voice-Activated Commands

Users can generate reports or track payments using voice assistants.

. Predictive Financial Insights

AI predicts expenses, risk, and growth using historical data.

. Integrated Business Ecosystems

Accounting, HR, POS, and inventory systems all linked in one platform.

Conclusion

Cloud Accounting Software is no longer optional—it's essential for businesses that want to operate efficiently, reduce costs, stay compliant, and adapt to digital transformation. With automation, real-time insights, mobile access, and powerful security, cloud systems help businesses focus on growth instead of paperwork.

As we move into 2026 and beyond, companies that embrace cloud accounting will gain a strong competitive advantage and build smarter financial infrastructures for the future.

FAQs – Cloud Accounting Software

-

What is cloud accounting software?

It is an online financial system that stores accounting data in the cloud and allows access from any device using the internet. -

Is cloud accounting safe?

Yes. It uses encryption, secure servers, backups, and authentication to protect data. -

Can I access cloud accounting from my phone?

Absolutely. Most systems offer mobile apps for invoicing, reporting, and expense tracking. -

Do small businesses need cloud accounting?

Yes. Small businesses benefit from automation, lower costs, and fast invoicing. -

Does cloud accounting support VAT or tax?

Most solutions come with built-in VAT and tax compliance tools. -

Can multiple users access the system?

Yes. You can give access to accountants, managers, and employees with different permission levels. -

What happens if the internet goes down?

Some systems offer offline mode, which syncs when the connection restores. -

How much does cloud accounting cost?

Pricing varies by system but is usually subscription-based and more affordable than traditional software. -

What industries benefit the most?

Retail, restaurants, services, e-commerce, and SMEs benefit greatly. -

Can it integrate with POS or payroll systems?

Yes. Most cloud accounting tools support integration with POS, HR, payroll, and CRM systems.