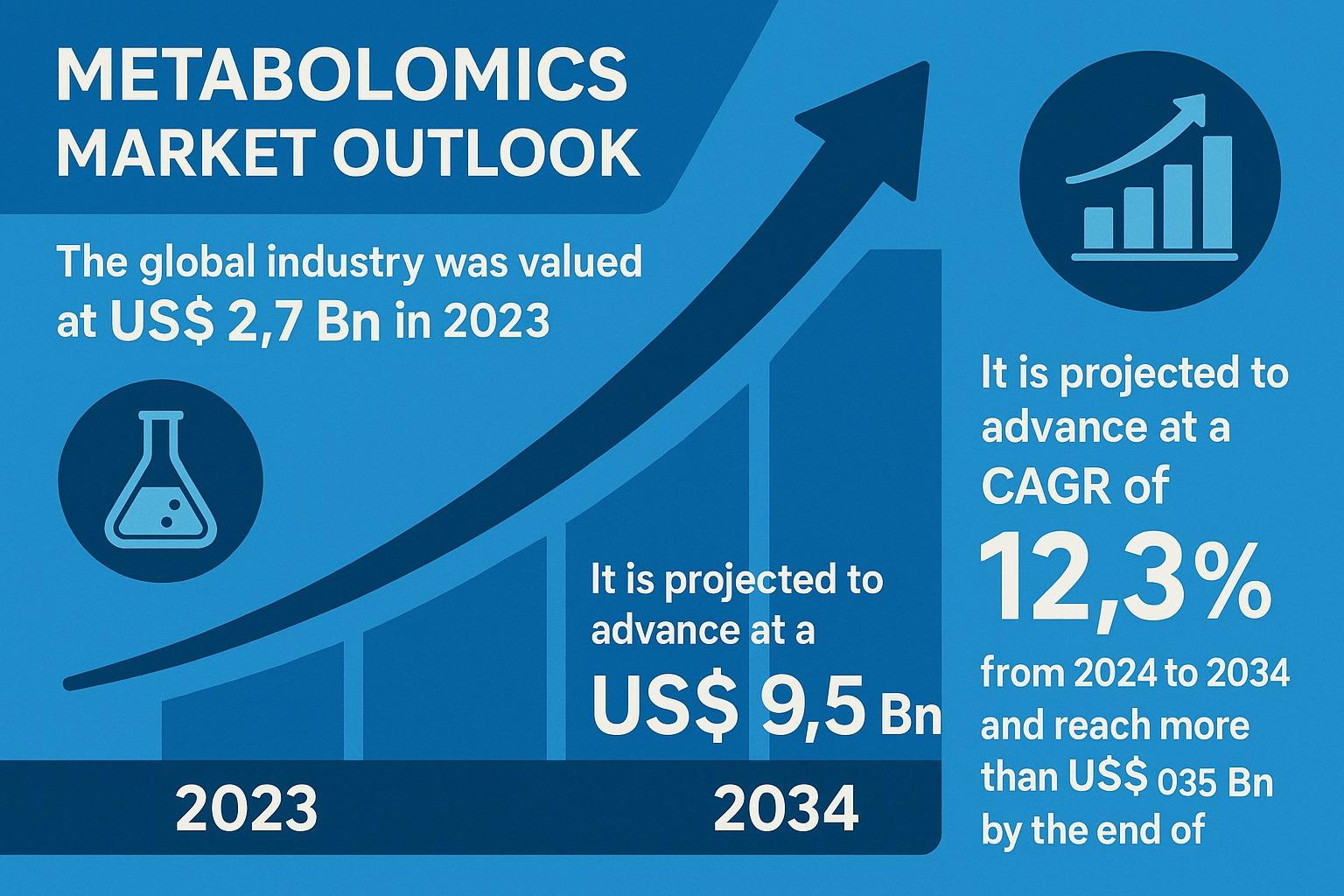

The global metabolomics market is entering a transformative decade marked by accelerated research, widespread adoption of precision medicine, and rapid advancements in analytical technologies. Valued at US$ 2.7 billion in 2023, the market is projected to rise at a CAGR of 12.3% from 2024 to 2034, ultimately surpassing US$ 9.5 billion by the end of 2034. This impressive growth trajectory is underpinned by increasing demand for metabolomics in drug discovery, disease diagnosis, biomarker identification, and personalized therapeutic strategies.

Analyst Viewpoint: A Market Shaped by Precision Medicine, R&D Investments, and Technological Innovation

The momentum behind the metabolomics industry stems from several key forces. The surge in personalized medicine—where treatment decisions are guided by an individual’s unique biological profile—has significantly expanded the use of metabolomics-based tools. As chronic diseases such as cancer, diabetes, and cardiovascular disorders rise worldwide, metabolomics platforms help uncover disease-specific metabolic pathways critical for effective diagnosis and therapy.

This field revolves around the extensive study of small molecules called metabolites, found in cells, tissues, and biofluids. Because these molecules reflect real-time physiological changes, metabolomics offers unprecedented insight into biological processes and disease progression.

Growing investments from governments, private equity firms, and research institutions continue to support metabolomics innovations. New analytical instruments, advanced spectrometry systems, AI-enhanced software tools, and integrated platforms are making metabolomics more scalable and accessible across research and clinical settings. Furthermore, collaborations between pharmaceutical companies and universities are accelerating breakthroughs while minimizing R&D risks.

Market Outlook: Evolving Technologies and Data Complexity Shape Industry Progress

Metabolomics is inherently complex due to the structural diversity of metabolites—each with distinct physical and chemical characteristics. In contrast to genomics or proteomics, metabolomics requires sophisticated analytical platforms capable of handling wide molecular variability. As a result, companies adopt multi-step workflows involving sample separation, optimized extraction, and advanced detection techniques.

To simplify this complexity, metabolic profiling often segments the metabolome based on structural similarities, functional groups, or molecular polarity. Customized protocols are then applied to enhance accuracy and reproducibility across diverse sample types.

Companies in this market often follow dual business models, offering both high-performance analytical instruments and complementary software tools. Analytical equipment is commonly installed in academic laboratories, biotechnology companies, and pharmaceutical facilities where metabolomics-driven discoveries support translational research, biomarker validation, toxicology testing, and therapeutic innovation.

One of the fastest-growing applications is drug discovery, where metabolomics enables in-depth characterization of cellular behavior, tumor heterogeneity, and disease biomarkers. These technologies are helping pharmaceutical developers accelerate drug pipelines and clinical success rates.

Key Market Drivers Boosting Global Demand

1. Technological Advancements in Personalized Medicine

The shift toward personalized healthcare is one of the strongest catalysts for market expansion. Genotyping and DNA sequencing help clinicians understand a patient’s genetic risk factors; however, metabolomics goes a step further by analyzing molecular interactions in real time. This makes it particularly effective in identifying:

- Cancer biomarkers

- Metabolic signatures associated with disease

- Drivers of tumorigenesis and progression

- Therapeutic response indicators

Since more than 95% of the clinical laboratory workload involves metabolic analysis, adoption of metabolomics technologies is closely tied to improving diagnostic precision and treatment personalization.

2. Rising Investments from Public and Private Sectors

The metabolomics field has attracted substantial funding due to its promising commercial and clinical applications. Programs such as the U.S. Metabolomics Program, supported by the Common Fund, are building national capacities in biomedical metabolomics. Private investors are also entering the space, supporting early-stage companies developing breakthrough technologies.

For example, Atavistik Bio secured US$ 40 million to advance its AMPS technology for precision oncology. Such investments speed up innovation cycles and broaden access to advanced metabolomics tools, expanding the market across regions.

3. High Demand for Metabolomics Instruments

Metabolomics instruments—including mass spectrometers, NMR systems, chromatography platforms, and electrophoresis tools—account for a large share of market revenue. Researchers increasingly prefer conducting their own metabolomics screening to ensure alignment between analytical outputs and experimental goals. This trend is boosting instrument sales across academia, industry, and contract research organizations.

Expanding Use of Metabolomics for Biomarker Discovery

Biomarker discovery remains the dominant application area for metabolomics. The ability to identify previously unknown metabolites has revolutionized diagnostic science. The Human Metabolome Database now catalogs more than 25,000 metabolites, reflecting the exponential growth of biological knowledge enabled by metabolomics.

These discoveries support new diagnostic assays, prognostic tools, and therapeutic targets across oncology, neurology, metabolic disorders, and cardiovascular diseases.

Regional Outlook: North America Leads, Asia Pacific Rises Fast

North America accounted for the largest share of the metabolomics market in 2023, supported by strong healthcare infrastructure, high R&D expenditure, and significant adoption of innovative technologies. The U.S. hosts several leading companies advancing spectrometry and analytical systems. For instance, Danaher launched the SCIEX 7500+ system in June 2024, offering superior sensitivity and contaminant-filtering capabilities.

Europe also features major metabolomics providers and is experiencing rising adoption in precision medicine and drug discovery.

The Asia Pacific region is projected to grow at the highest CAGR throughout the forecast period. Factors contributing to this rapid expansion include:

- A surge in aging populations

- Increased commercialization of advanced instruments

- Expanding biotech and pharmaceutical R&D ecosystems

- Growing demand for improved diagnostic and prognostic techniques

Competitive Landscape: Innovation at the Core

Leading players in the metabolomics market include Waters Corporation, Agilent Technologies, Thermo Fisher Scientific, Danaher Corporation, Bruker Corporation, PerkinElmer, Merck KGaA, Metabolon, Afekta Technologies, and Shimadzu Corporation. Companies are continuously launching new products to enhance workflow efficiency, throughput, and data accuracy.

Recent innovations include:

- Waters Corporation (2024): Alliance iS Bio HPLC System for advanced bio-separation

- Bruker (2023): Enhancements in 4D-metabolomics and spatial tissue proteomics

- Agilent Technologies (2022): AI-powered non-targeted metabolomics workflow through partnership with Bright Giant

These strategic developments underscore industry commitment to enhancing capabilities and expanding the application scope of metabolomics.

Conclusion

With the global market expected to exceed US$ 9.5 billion by 2034, metabolomics is poised to become a central pillar of biomedical research and personalized medicine. Increasing adoption across clinical diagnostics, drug discovery, biomarker validation, and translational research ensures that the next decade will witness unprecedented innovations, deeper biological insights, and transformative healthcare solutions driven by metabolomics.