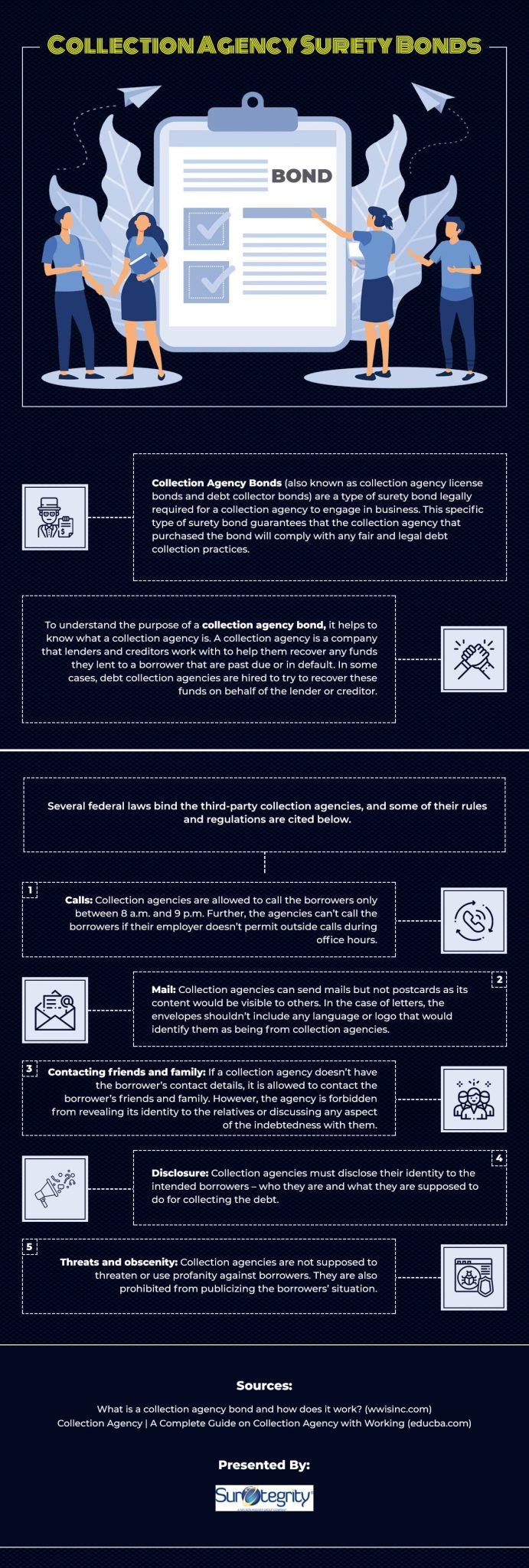

This educational infographic from Suretegrity provides a clear and concise overview of collection agency surety bonds, breaking down their purpose, function, and significance within the debt collection industry. Designed for agency owners, financial professionals, and legal compliance teams, the infographic simplifies complex regulatory concepts using accessible visuals and straightforward explanations.

The infographic begins by defining a collection agency surety bond—a legal requirement in many states that ensures agencies operate ethically and in compliance with state laws. It outlines the three key parties involved in the bond: the principal (collection agency), the obligee (government authority), and the surety (insurance company providing the bond). It continues by detailing the main purposes of the bond, such as protecting consumers from misconduct, ensuring legal compliance, and building trust with clients.

The infographic also explains how claims work, what happens in cases of bond violations, and the consequences for agencies. Additional sections cover state-specific requirements, renewal timelines, and how to apply for a bond online through Suretegrity’s streamlined platform. With its clean layout and informative icons, this infographic is an excellent starting point for understanding the regulatory obligations tied to collection agency operations.